Despite the optimistic report of the IHS Markit on the German economy, released at the beginning of today's European session, the euro and the EUR/USD pair failed to develop an upward momentum.

According to the mentioned IHS Markit report, Germany's Composite Purchasing Managers' Index (PMI) rose to 54.3 in January from 49.9 in December. This is better than the forecast of 49.2. At the same time, the PMI in the German manufacturing sector also turned out to be significantly better than the forecast and the previous December value (60.5 vs. 57.0 and 57.4, respectively).

The German economy is the engine of the entire European economy, and its manufacturing sector forms a significant part of the final GDP indicator. In addition, the manufacturing PMI is an important indicator of the business environment and the general state of both the German and European economies as a whole.

Meanwhile, the Eurozone-wide Markit Composite PMI, also released today, fell short of its forecast value of 52.6, falling short of the previous December reading of 53.3 to 52.4. A reading above 50 is positive for the EUR and indicates an acceleration in business activity. However, its relative decline and a worse-than-expected indicator usually have a negative impact on the quotes of the European currency.

Similar indicators published earlier for France, whose economy is the second most important and largest in the eurozone after Germany, also slightly spoiled the overall picture. According to the data provided by IHS Markit, the composite purchasing managers' index (PMI) of France in January fell to 52.7 from 55.8 in December (the forecast was 54.5).

The IHS Markit report shows a slowdown in the growth rate of activity in the French economy at the beginning of 2022 to a 9-month low, which is also reflected in pan-European indicators. IHS Markit says supply shortages continue to weigh on activity, especially in the manufacturing sector, and the effects of mounting inflationary pressures, reinforced by rising labor costs and energy prices, are only exacerbating the overall negative situation.

Restrictive measures and consumer caution are also reflected in the weakening PMI for the Eurozone services sector. This indicator, published today, was 51.2 against the forecast of 52.2 and 53.1 in December.

Thus, the IHS Markit report presented earlier today shows that the overall situation in the Eurozone is still far from a stable recovery and growth of its economy.

Later this week, preliminary data on German GDP for the 4th quarter will be published, which is expected to fall to -0.2% from a +1.7% increase in the 3rd quarter of 2021. It is likely that this will also have a negative impact on the euro and the EUR/USD pair.

However, traders' and market participants' attention this week is set on the Fed meeting. The interest rate is widely expected to remain at 0.25% at this meeting, which ends on Wednesday. Nevertheless, during the publication of the rate decision, volatility may rise sharply throughout the financial market, primarily in the U.S. stock market and in dollar quotes, especially if the rate decision differs from the forecast or unexpected statements are received from the Fed management.

Investors want to hear Fed Chairman Jerome Powell's opinion on the further actions of the U.S. central bank this year. If everything goes according to plan, the first increase in the Fed's interest rate may occur as early as in the spring, when the quantitative easing program is completed.

Powell's comments could affect both short-term and long-term USD trading. A more hawkish stance on the Fed's monetary policy is seen as positive and strengthens the U.S. dollar, while a more cautious stance is seen as negative for the USD. If he says that in order to curb accelerating inflation, a tougher decision than a 3-time rate hike this year is possible, then the strengthening of the dollar could accelerate.

Most market participants are counting on this, as evidenced by the renewed growth of the DXY dollar index, while major U.S. stock indices continue to decline. At the time of writing, DXY futures are trading near 95.77, 116 points above the local 10-week low of 94.61, reached at the end of the week before last after the publication of inflation indicators that indicated a strong increase in U.S. consumer inflation (according to published data, U.S. consumer prices rose 7.0% in December over the same period the previous year, the highest since June 1982).

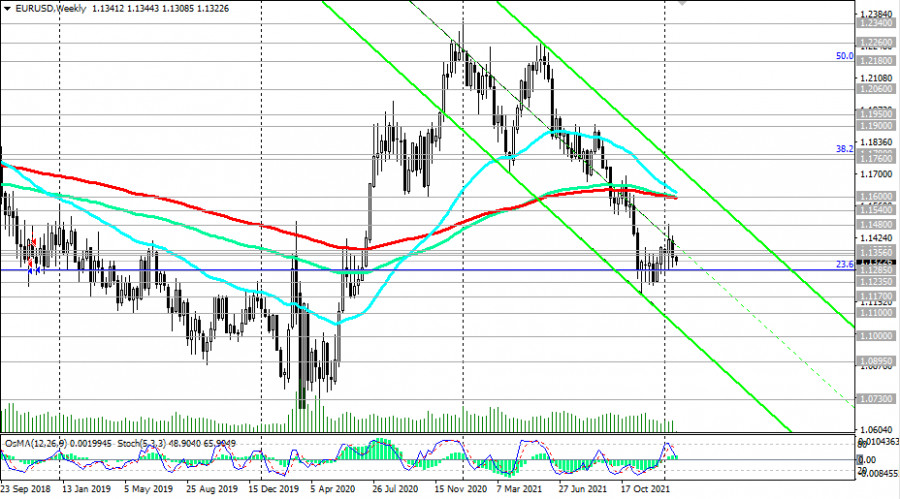

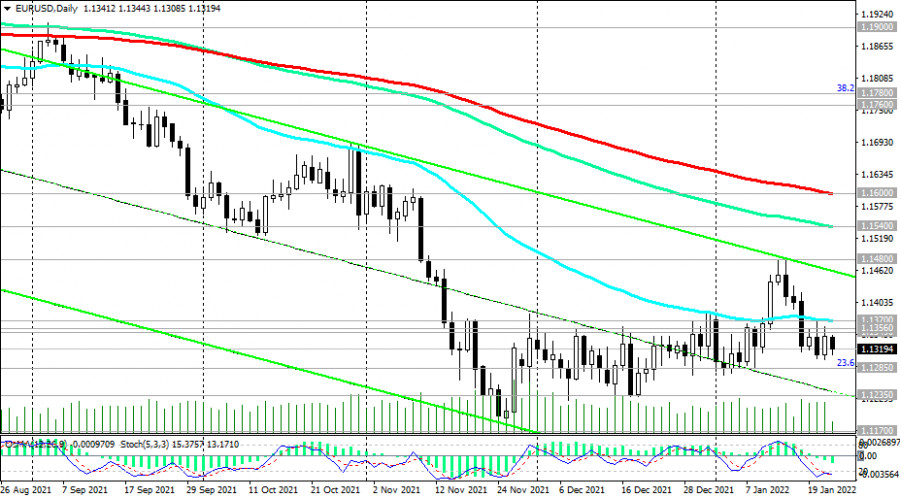

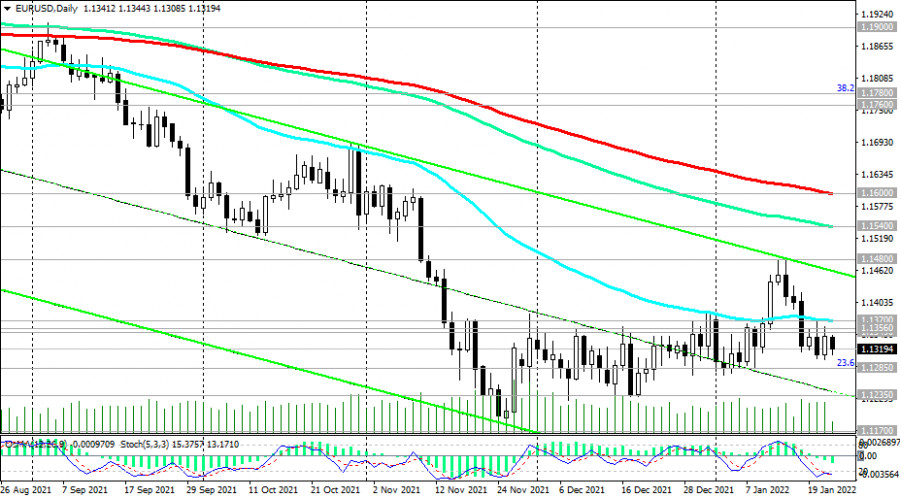

Returning to the dynamics of the euro and the EUR/USD pair, as we said above, it failed to develop an upward correction after the publication of the IHS Markit report, and continues to decline, remaining within the descending channels on the daily and weekly charts. Their lower borders are currently passing near the 1.1100 and 1.1000 marks, respectively. A break of support at 1.1285 (23.6% Fibonacci of the upward correction in the pair's decline from 1.3870, which began in May 2014, to 1.0500) will take EUR/USD out of the range between 1.1285 and 1.1370 (50 EMA on the daily chart) and send it to the lower border of a wider range formed between the levels of 1.1235 and 1.1370. After its breakdown, the road will be open towards the 1.1100 and 1.1000 marks.

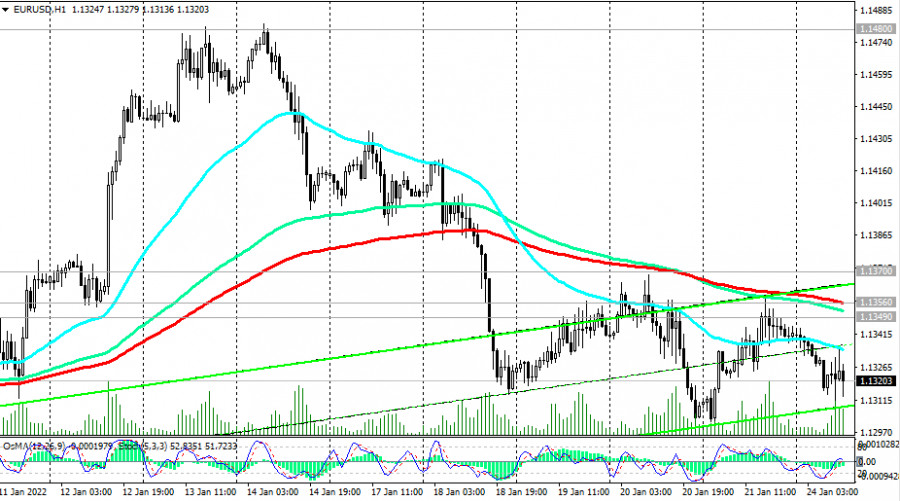

In an alternative scenario, the first signal for longs will be a breakdown of the important short-term resistance levels 1.1349 (200 EMA on the 1-hour chart), 1.1356 (200 EMA on the 4-hour chart), and the confirmation signal will be the breakdown of the resistance level 1.1370.

However, in the current situation, at least until 16:00 UTC on Wednesday, when the Fed's decision on interest rates will be published, short positions remain preferable.

Support levels: 1.1300, 1.1285, 1.1235, 1.1200, 1.1170, 1.1100, 1.1000, 1.0900, 1.0730

Resistance levels: 1.1349, 1.1356, 1.1370, 1.1480, 1.1500, 1.1540, 1.1600, 1.1700, 1.1760, 1.1780

Trading Recommendations

Sell Stop 1.1295. Stop-Loss 1.1375. Take-Profit 1.1285, 1.1235, 1.1200, 1.1170, 1.1100, 1.1000, 1.0900, 1.0730

Buy Stop 1.1375. Stop-Loss 1.1295. Take-Profit 1.1400, 1.1480, 1.1500, 1.1540, 1.1600, 1.1700, 1.1760, 1.1780