The EUR/USD currency pair resumed falling on Monday, as we had expected recently. Every day the situation in the world is becoming more interesting, although, of course, in the current circumstances, "more interesting" is a little bit of the wrong word. Better to say, more dangerous or more intense. Recently, almost all market participants have been closely following the words and actions of the Fed. The situation has been developing and at the moment 7% inflation forces many participants to talk not even about 3-4 rate increases in 2022, but about 5-7 increases. Naturally, this is "hawkish" rhetoric, although not coming from the Fed itself. Nevertheless, this is in any case a "bullish" factor for the US currency. However, recently, there have been new factors that lead to the growth of the US currency. We'll talk about them a little bit below. In the meantime, it should be noted: fast or slow, one way or another, and the US dollar continues to grow against the euro and the pound, as well as against many other currencies. If the pound sterling has at least shown significant growth in recent months, then nothing can be said about the euro currency. It continues to trade near its annual lows. Even the probability of a flat is now decreasing day by day. But it seems that the pair just took overclocking before another attempt to overcome the level of 1.1230. Accordingly, we continue to believe that the European currency will continue to fall. First to the level of 1.1230, and then much lower. There are no fundamental or technical grounds for a different scenario now.

The world is on the verge of another chaos and crisis.

Humanity has just recovered from the next "wave" of the pandemic, has just learned to live with the "coronavirus", and has just come to terms with the fact that 2022 will be the year of tightening monetary policy when a new attack comes. The year began with a political crisis in Kazakhstan, where the population reacts very violently to the authorities' desire to raise gas prices. However, as it turned out a little later, these were flowers. First, the riskiest markets began their decline. That is, cryptocurrency and stock. Moreover, this applies not only to the US stock market but also to other stock markets. The probability of an increase in the Fed's key rate due to high inflation is growing by leaps and bounds. If just a couple of weeks ago many people thought that there would be a correction in the stock market, but it seems to be "sometime later", and not now, then at this time quotes are flying down at the speed of light. The cryptocurrency market is collapsing before our eyes. The dollar is growing moderately and, if a couple of weeks ago its growth was justified in the form of tightening of the Fed's monetary policy, now it can safely grow due to the deterioration of the geopolitical situation in the world.

As for a single euro/dollar pair, the prospects for the euro currency are further aggravated by the fact that the ECB still does not give any signals about its readiness to tighten monetary policy. Simply put, the European Union is already a "catching up party", but now the gap between the ECB and the Fed will only increase, as the Fed intends to raise the key rate 3-4 times this year and begin gradually unloading its balance sheet. But many experts at the same time believe that the Fed can raise the rate even 6 or 7 times, that is, at almost all subsequent meetings. Naturally, such an imbalance in the approaches of the ECB and the Fed can have a long-term negative impact on the euro currency.

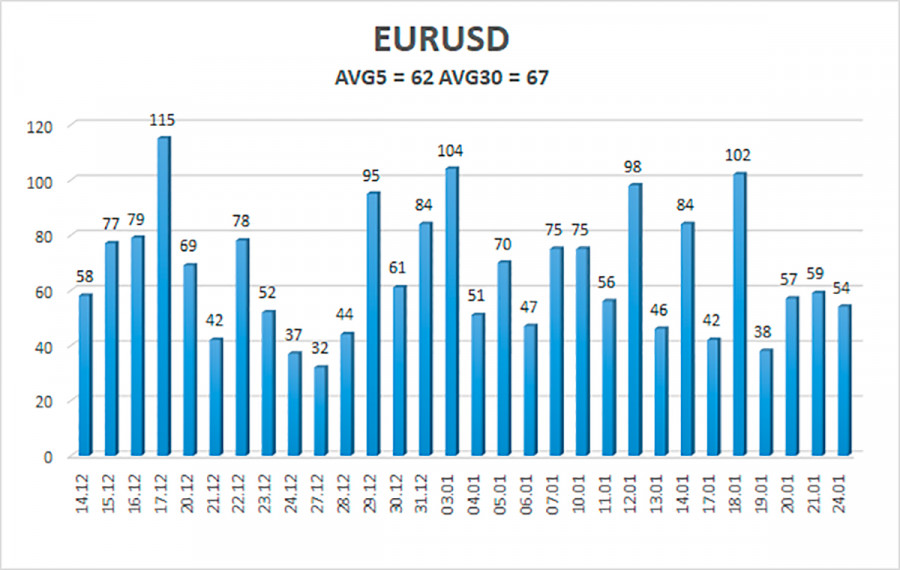

The volatility of the euro/dollar currency pair as of January 25 is 62 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1259 and 1.1383. A reversal of the Heiken Ashi indicator upwards will signal a new round of corrective movement.

Nearest support levels:

S1 – 1.1322

S2 – 1.1292

S3 – 1.1261

Nearest resistance levels:

R1 – 1.1353

R2 – 1.1383

R3 – 1.1414

Trading recommendations:

The EUR/USD pair continues to be located below the moving average line. Thus, now you should stay in short positions with targets of 1.1292 and 1.1261 until the Heiken Ashi indicator turns up. Long positions should be opened no earlier than the price-fixing above the moving average line with targets of 1.1383 and 1.1414.

Explanations to the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.