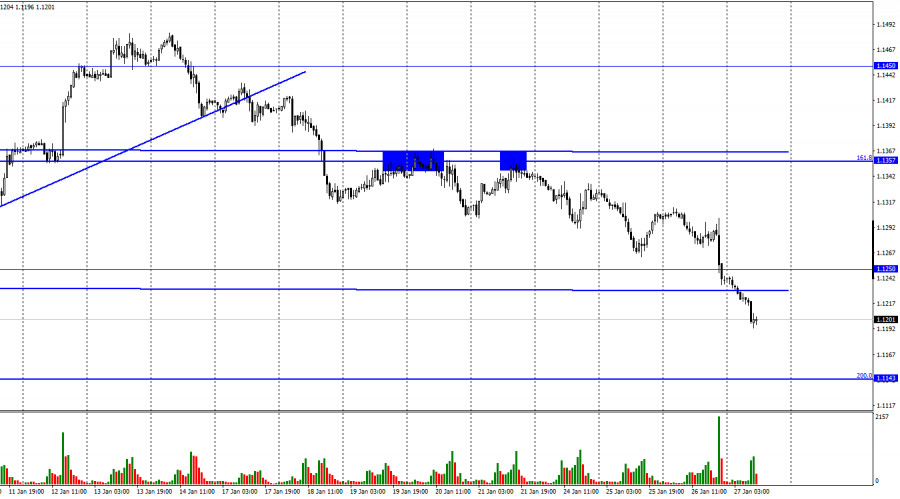

The EUR/USD pair continued the process of falling on Wednesday and was below the level of 1.1250 by the end of the day. And at the beginning of today – also under the side trend corridor. Thus, the process of falling can now be continued in the direction of the next corrective level of 200.0% (1.1143). The information background of yesterday was very strong, but there was not a single important economic event during the day. There was only one event and it was planned for the very evening. Therefore, traders were in no hurry with trading operations in the morning and afternoon. In the evening, it became known that the Fed left the interest rate unchanged at 0.25%, but at the same time reduced the QE program to $ 30 billion per month. However, that wasn't even the most important thing. Already in March, the QE program will be fully completed (30 billion worth of bond purchases will be made in February), and the interest rate will be raised for the first time since 2015.

In addition, Jerome Powell said at a press conference that he does not rule out raising the interest rate at each meeting until inflation begins to slow down and strives for the target level of 2%. Thus, there may be much more than 3 or 4 increases during 2022. Such results of the meeting can be called much more "hawkish" than traders expected. Therefore, from my point of view, the strong growth of the US dollar yesterday was completely logical, and it can also continue throughout today. The Fed clearly stated that now inflation is in the first place in terms of importance and all necessary measures will be taken to reduce it. Thus, now traders should closely monitor the inflation indicators. The higher it rises in February and March, the more likely it is that the Fed may go for a 0.5% rate hike at the next meeting. And the higher and faster the interest rate rises, the stronger the dollar can grow, since this is positive news for it. In general, the Fed provided strong support to bear traders yesterday. Now we need to continue working out the results of the Fed meeting.

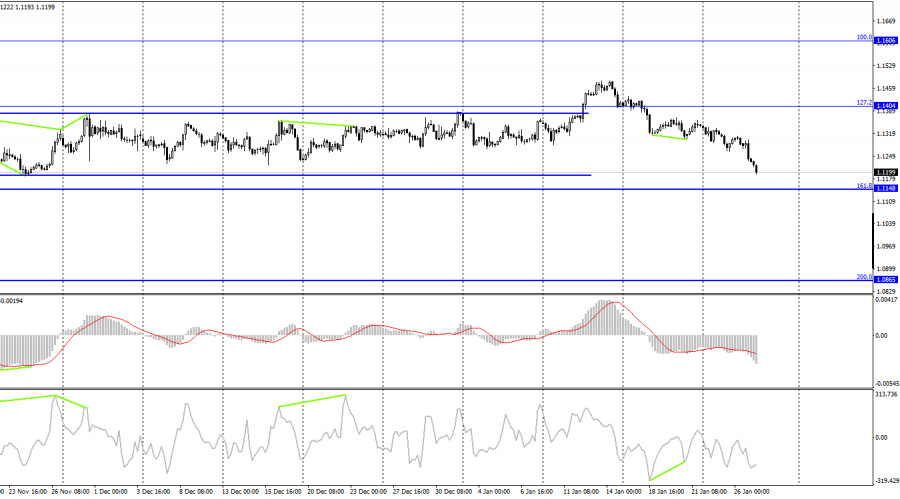

On the 4-hour chart, the process of falling quotes continues in the direction of the corrective level of 161.8% (1.1148). The rebound of the pair's exchange rate from this level will allow traders to count on a reversal in favor of the EU currency and some growth in the direction of the Fibo level of 127.2% (1.1404). Closing the pair's rate at the level of 161.8% (1.1148) will increase the probability of a further decline in the direction of the corrective level of 200.0% (1.1148). Emerging divergences are not observed in any indicator today.

News calendar for the USA and the European Union:

US - change in GDP volume for the quarter (13:30 UTC).

US - change in the volume of orders for long-term goods (13:30 UTC).

US - number of initial applications for unemployment benefits (13:30 UTC).

On January 27, the calendar of economic events of the European Union is empty again, and new important information about the economy will be released in America. The most important is the GDP report for the fourth quarter, but the other two reports may also affect the mood of traders today.

EUR/USD forecast and recommendations to traders:

I recommended selling the pair with targets of 1.1357 and 1.1250. Since these levels have been passed, it is now possible to stay in sales with a target of 1.1143 on the hourly chart. I recommend buying a pair if there is a rebound from the 1.1143 level on the hourly chart. You can count on 50-60 points of growth.