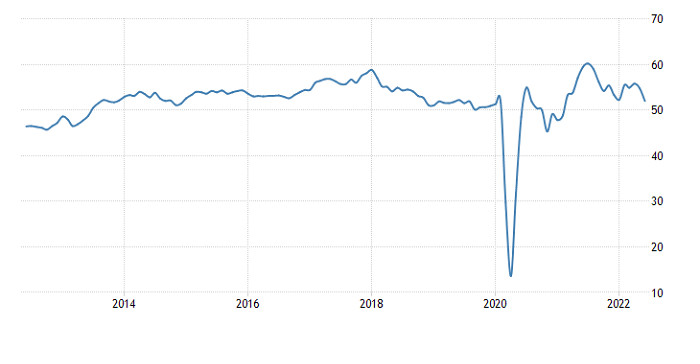

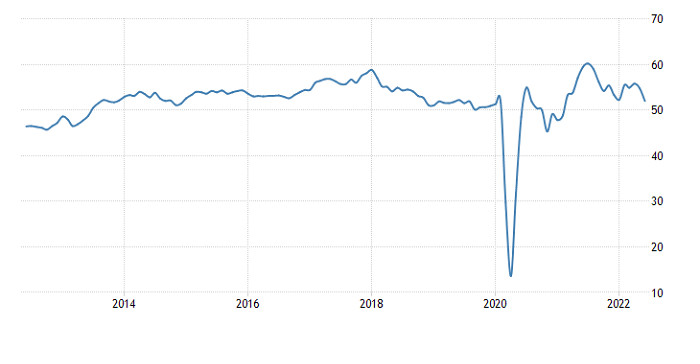

The first full-fledged trading day of the current week began with a strong fall in the single European currency. To the lowest values since 2002. Of course, one can try to explain this by the fears of investors about the inevitability of a recession around the world, but it looks like a farce. After all, they have been talking about the possibility of a recession for more than a day. So this is nothing new. Moreover, the final data on business activity indices turned out to be somewhat better than preliminary estimates. In particular, the index of business activity in the service sector fell from 56.1 points to 53.0 points, while the forecast was 52.8 points. The composite index, which was supposed to fall from 54.8 points to 51.9 points, fell to 52.0 points. However, even the final data on the index of business activity in the manufacturing sector showed that investors now, in principle, do not look at these data.

Composite PMI (Europe):

Therefore, the reasons for such a noticeable drop must be sought in somewhat different ways. It's all about the European Central Bank. As early as Monday, the head of the Bundesbank, Joachim Nagel, urged the ECB to be extremely cautious in terms of tightening monetary policy, as higher interest rates would increase the cost of borrowing for the weakest economies in the euro area. Thus, putting them on the brink of bankruptcy. In principle, this statement intersects with the words of the representatives of the ECB themselves that one must be careful when tightening monetary policy, otherwise the result will be completely opposite. And instead of improving the economic situation, it may worsen. Immediately there were rumors that the central bank would very slowly raise the refinancing rate, which would not be enough to slow down inflation. This is what caused the sharp weakening of the euro. And the fact that this happened on Tuesday, and not on Monday, is explained by a non-working day in the United States.

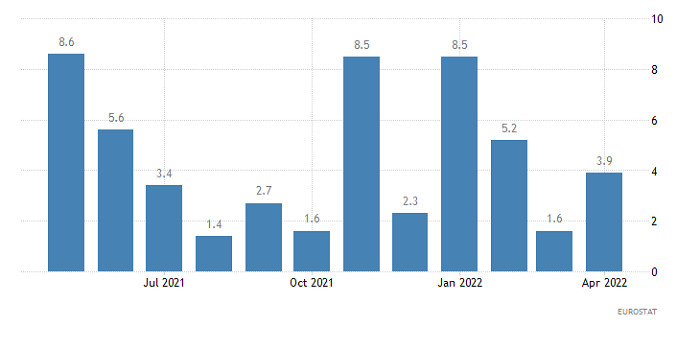

So the market confidently returned to the long-lasting trend for the strengthening of the dollar. But after such an impressive fall, a correction is inevitable. That's just the European macroeconomic statistics somehow does not favor any growth of the single European currency. After all, the growth rate of retail sales in Europe should slow down from 3.9% to 3.1%. A decrease in consumer activity only confirms fears about the inevitability of a recession.

Retail sales (Europe):

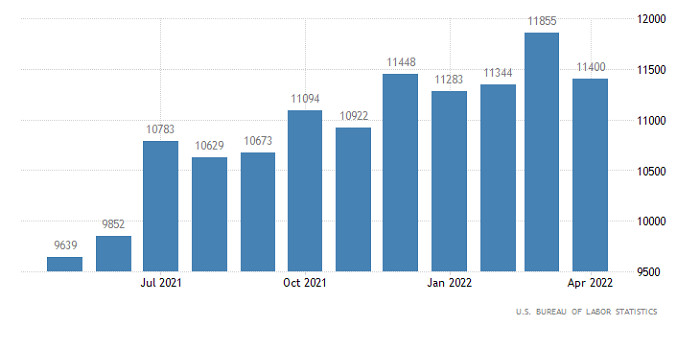

Apparently, the reason for the rebound will be the data on open vacancies in the United States, the number of which should decrease from 11.4 million to 11.3 million, which indicates a slight deterioration in the situation in the labor market. But after such an impressive movement as yesterday, even this is enough for a local rebound. The final data on business activity indices, as shown by the experience of recent publications of similar data, will be left without attention, and will not affect investor sentiment in any way.

Number of open vacancies (United States):

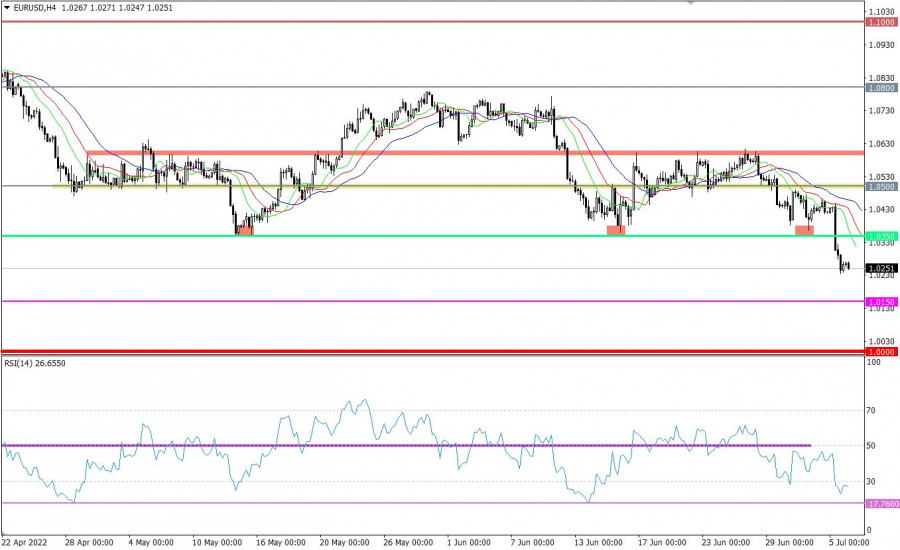

During the inertial movement, the EURUSD currency pair updated the local low of the medium-term downward trend, as a result of which the quote turned out to be at the level of 2002.

Due to such a rapid descent, the RSI H4 technical instrument entered the oversold zone, which indicates that short positions are overheated. RSI D1 is still moving in the lower area of the 30/50 indicator, indicating continued downward interest among traders.

The moving MA lines on the Alligator H4 and D1 indicators are directed downwards, this is a sell signal.

Expectations and prospects

In this situation, the speculative hype is going through the roof on the market, which can lead to ignoring the signal about the euro being oversold. As a result, the downward move may accelerate towards the value of 1.0150-1.0000.

It should be noted that sooner or later short positions will be consolidated, which will lead to a technical correction.

Complex indicator analysis has a sell signal in the short, intraday and medium term due to the downward cycle.