Ethereum is getting closer to the key resistance level of $2,000 every day. It is important to reach this psychological level during the ongoing uptrend. Institutional investors add fuel to the growth. Their inflow has increased significantly amid the transition of ETH to the Proof-of-Stake algorithm and the recent news.

The ETH/USD pair has fixed above $1,800 and formed a strong support area near that level. After forming the bullish engulfing pattern on August 10, the asset dashed to the level of $1,950 but rolled back because of the bearish activity. As a result, bulls were forced to retreat and the candlestick acquired a long upper shadow. Nevertheless, ETH is holding above $1,850, and as long as this level is not broken through, the asset may reach the area of $1,900-$2,000.

Eventually, ETH formed a bullish large-scale cup-and-handle pattern. This pattern may drag the price to the area of $2,700-$2,800. Taking into account the presence of the fundamental positive background and the successful mergers of the test ether networks, it is likely that the cup and handle pattern will be worked out by the middle of September. With this in mind, we can conclude that it is Ethereum that will be the main driving force of the crypto market during the next few months.

As for the technical picture, the asset started a consolidation after failing to touch the area of $1,950-$2,000. The RSI is moving near 70, indicating high buying activity. However, after testing 70, the metric has flattened. The stochastic oscillator managed to break through the level of 70 and enter the overbought zone. This means the asset is overbought and this state will increase with the positive sentiment in the market. The MACD indicator has gained an upward direction after a long flat period. As a whole, from the technical point of view, ether demonstrates the demand but prepares for a correction.

Most likely, this is where the market will face the first full-fledged correction due to the long upward movement. On the weekly chart, the ETH/USD pair is likely to close the sixth bullish week. If we compare it to the cryptocurrency's recent uptrends, we see that for the most part, the altcoin goes for a correction after forming six or seven green candlesticks in a row. Ethereum is close to the sixth one and we are likely to see a correction already next week.

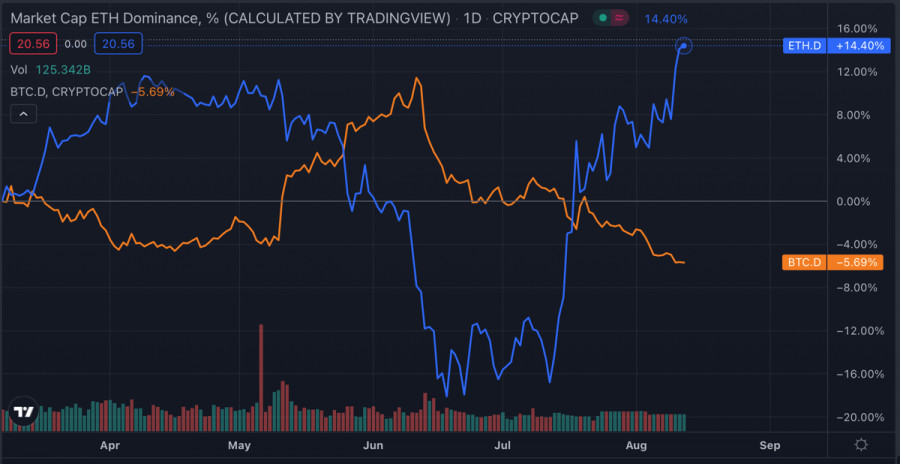

Dependence on Bitcoin may hamper the cryptocurrency's uptrend. In recent months, the level of BTC dominance was falling, while ETH, on the contrary, was growing. Mostly, it was due to the Fed policy and the presence of fundamental reasons for the growth of ether. It is likely that soon the situation will change since the rate of inflation began to fall.

Investments in BTC will gradually begin to increase, which will be a deterrent to the growth of ETH. Among the latest news related to these processes is the announcement of the BlackRock Capital fund. The largest $10 trillion asset management company has launched a new BTC fund for its clients. In the medium to long term, this bodes well for a significant increase in institutional investments in Bitcoin.

All of these factors can negatively contribute to the future growth of Ethereum, but they have no fundamental effect. With this in mind, Ethereum is very likely to remain the main cryptocurrency in the coming months. However, in the short term, we should expect a correction, which the altcoin needs after a prolonged six-week rally.