The dollar received a dope at the end of the week in the form of optimistic data on the labor market. This means that traders will return to buying the US currency again, and the recovery of the euro and the pound will end there.

So far, the markets have shown only the first reaction to the release of key statistics, which is a kind of barometer for a further decision on the Federal Reserve's rates. Investors will be closely scrutinizing the new numbers indicating the good health of the US economy. However, it is already clear that NFP will set the tone for trading next week and completely neutralize the mood at the beginning of the outgoing week about the possible dovish mood of the US central bank.

"Those who had hoped for a Fed turnaround were greatly disappointed by the employment data, which confirmed that the economy continues to develop quite well. The latest bear market bounce has now begun to fade as investors wearily return to expectations of at least 125 bps of tightening by the end of the year, and even more is expected in 2023," IG comments on the situation.

The Fed has received a clear signal to continue its policy of aggressive rate hikes, and investors will have to reckon with this. Those who began to doubt the continuation of the dollar rally and its strength received a reminder of why the greenback remains and, apparently, will remain the master of the situation.

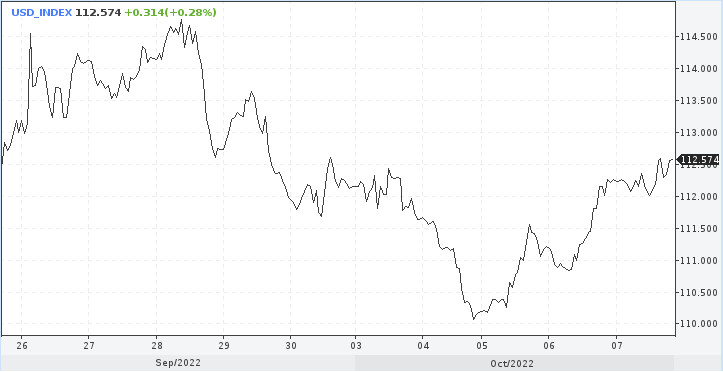

Credit Suisse remains bullish on the dollar in the fourth quarter despite some trend fatigue.

The latest move to a new cycle high, as noted, was not confirmed by the weekly momentum. After the consolidation phase, another jump to 118.37 is possible, and then to the 2001 high at 121.00.

Support is noted at 109.29 and 107.68. In case of a downward correction, these marks should become a reliable bottom. With the strengthening of weakness, the support will be moved to the area of 105.00 and 104.60 marks.

NFP without fireworks

The growth in the number of people employed in the non-agricultural sector of the economy slowed down compared to 315,000 in August. Nevertheless, the new figure turned out to be higher than the forecasted 250,000, amounting to 263,000.

Job growth averaged 420,000 per month this year, compared to a monthly average of 562,000 a year earlier.

We were pleasantly surprised by the unemployment rate, which fell to 3.5% from 3.7%, contrary to consensus expectations that the rate would remain unchanged.

In general, this all points to a tight labor market. Going forward, the Fed has a lot to do to achieve its goal of "curbing the overheated economy," according to CIBC Bank.

"The labor market is not just moving forward, it is a virtual steamroller doing nothing to slow economic demand and help the Fed fight inflation," the economists wrote.

Wage growth amounted to 0.3% in monthly terms. Over the past year, an increase of 5% has been recorded. This is too much to match 2% inflation. The fall in unemployment and growth in wages are consistent with the strengthening of domestic inflation, which the central bank is doing its best to reduce by raising rates.

The hawkish bias is adamant

High rates are negative for world markets while the dollar is gaining support. In November, the Fed is expected to raise rates again by 75 bps, which will aggravate the situation in the securities markets and further spur the dollar up.

US central bank members who spoke this week almost unanimously insisted that the rate increase would continue until "the job is done." New Fed members Lisa Cook and Philip Jefferson also showed themselves hawkish.

The head of the Cleveland Fed, Loretta Mester, spoke convincingly that there is no need to hope for a rate cut in 2023. Meanwhile, investors, in between the release of important data, periodically dream about the dovish bias of the central bank. Meanwhile, Charles Evans of the Chicago Fed suggested that rates could rise another 150 bps by next spring.

Softer data on the labor market, perhaps, would make the members of the central bank think, but this does not apply to their actions. Since the statistics turned out to be stronger than expected, the determination to raise rates will only grow.

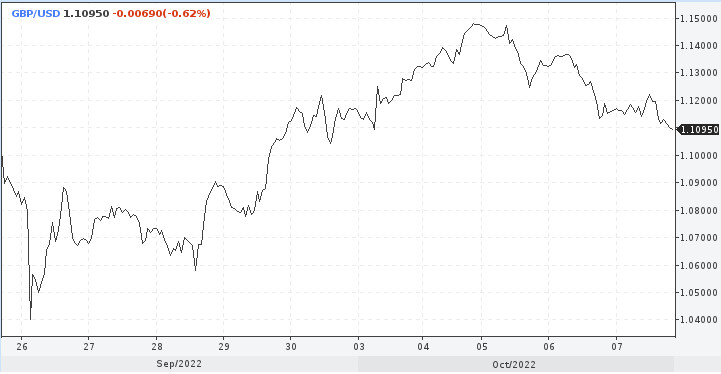

This state of affairs reinforces the forecast for further strengthening of the dollar. Consequently, higher beta currencies such as the British pound will start to weaken.

The GBP/USD pair sank on Friday to the 1.1111 area and risks returning to last week's lows.

With further tightening of financial conditions, the pound remains vulnerable. The real test of strength will be after the Bank of England ceases to support the securities market next week, according to MUFG Bank.

ING believes that the return of the pound below 1.1000 is a matter of time.

As for EUR/USD, this pair will also not resist the onslaught of the dollar. Moreover, market players are not sure that the European Central Bank will fulfill the median expectations of a rate hike.

The weakness of the world economy and the energy crisis in the eurozone remain a subject of concern.

Meanwhile, the EUR/USD pair may end the week without visible changes. The quote fluctuates around the 0.9800 zone. If buying interest does resume, then traders will encounter a hard barrier at recent peaks near the parity zone.

The downward trend remains in force, an attempt to decline to the 0.9500 area should be repeated.