The current wave markup is quite clear, and the news background is complex. The US dollar is rising right now. However, the market is unwilling to increase demand for it in any way, so even if one downward correction wave is constructed, there are still significant issues. Recalling the numerous FOMC members who have spoken on the state of the economy in recent weeks, their rhetoric has become even more strident. Although the market is anticipating a slowdown in the PEPP's rate of tightening, Fed officials' rhetoric indicates that it is still getting tighter, so this is a good time for the US dollar to resume its upward trend. But as I've already mentioned, the market is unimpressed with the dollar and is unwilling to purchase it for some reason.

What exactly is causing the market's fear? The rate will increase in the US for at least a few more meetings. After that, it will stay high for at least 1.5 years. How many more shocks to the world economy can there be in the next 1.5 years? How many more geopolitical conflicts and escalations will we witness during this period? And the US dollar continues to be a reserve currency, with rising demand in challenging times. Therefore, I wouldn't conclude that the market has lost faith in the dollar and is now disillusioned with it. Market players are watching for a significant event to restart its increasing demand. What incidents can be called iconic?

First, Fed President Jerome Powell will deliver today's speech. Although Mary Daly's and James Bullard's opinions are undoubtedly noteworthy and carry significant weight, Powell's rhetoric is still far more significant. The market may not take Daly or Bullard at their word, but it is much more likely to listen to what the FOMC chairman says. Additionally, Powell's rhetoric no longer raises any concerns. Powell is also expected to discuss the necessity of maintaining the rate above 5% for a considerable time. What additional "hawkish" elements does the market require?

A new nonfarm payroll report for the US will be made public on Friday. Although this indicator's value has been declining in recent years, it is still at levels that cannot be considered weak. Please remind me that the Federal Reserve and Congress think the labor market is still in excellent shape and that it is inappropriate to discuss a recession in the American economy. The market may increase demand for US currency if Friday's payrolls again show a respectable value. The fact that the rate is rising and the labor market is holding steady is just a fantastic alignment for the American economy.

A new report on US inflation will be released in mid-December, and that report will serve as the foundation for the decisions made at the FOMC meeting that same month. If inflation resumes its insignificant slowdown, the FOMC members' rhetoric may become more constrictive. Any of this will not harm the US dollar. The market itself is still the problem.

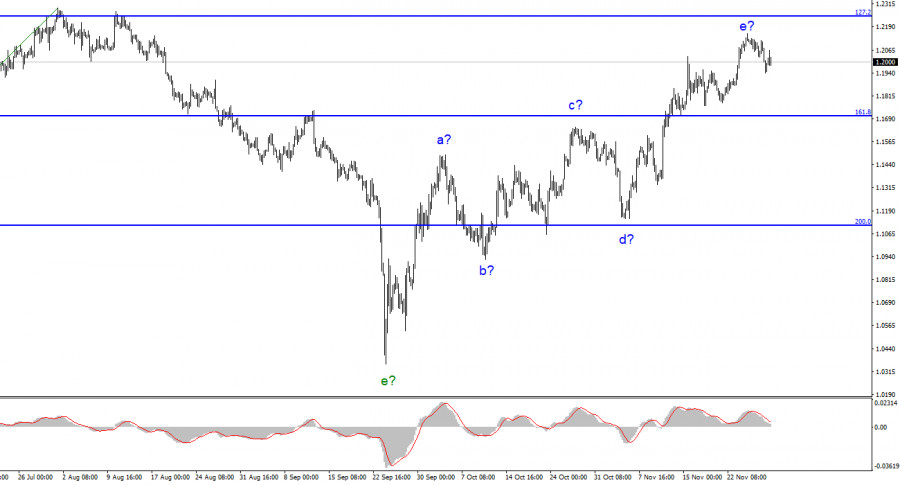

I conclude that the upward trend section's construction is complete and has increased complexity to five waves. As a result, I suggest making sales with targets close to the estimated 0.9994 level, or 323.6% Fibonacci. There is a chance that the upward section of the trend will become more complicated and take on an extended form, but this chance is currently at most 10%.

The construction of a new downward trend segment is predicated on the wave pattern of the pound/dollar instrument. Since the wave marking permits the construction of a downward trend section, I cannot advise purchasing the instrument. With targets around the 1.1707 mark, or 161.8% Fibonacci, sales are now more accurate. The wave e, however, can evolve into an even longer shape.