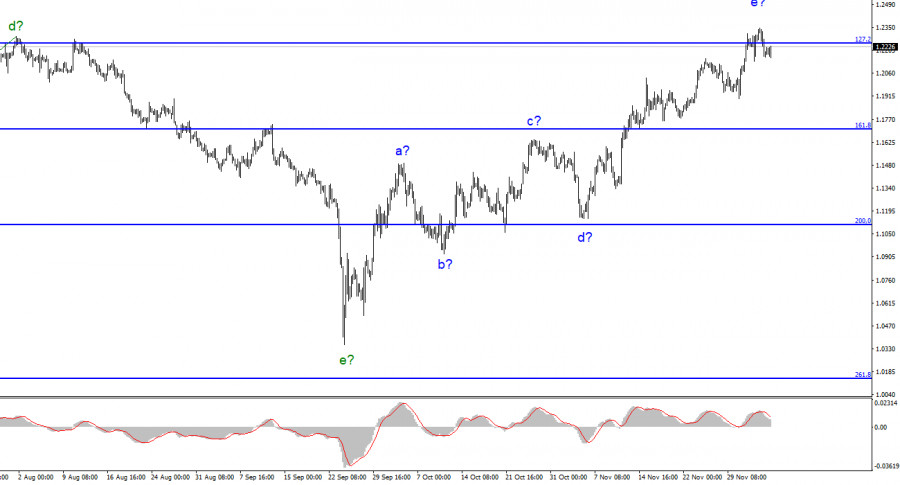

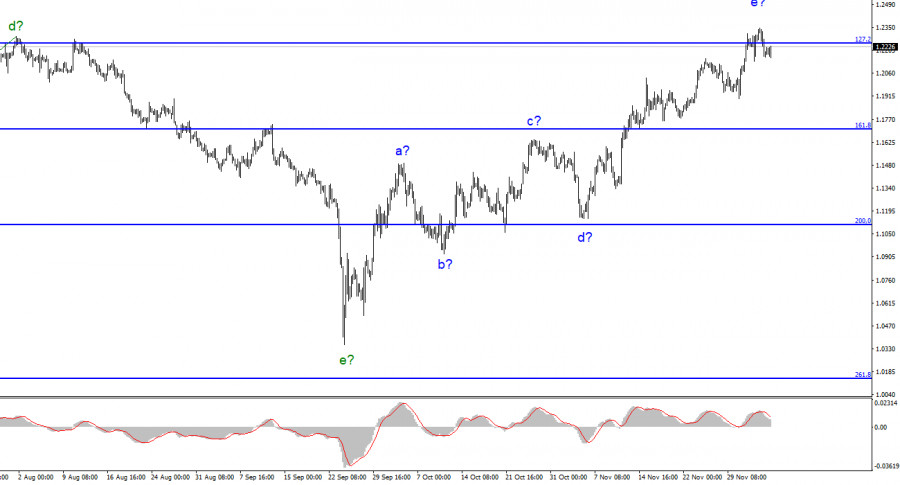

The wave marking for the pound/dollar instrument currently appears quite confusing, but it still needs to be clarified. We have a five-wave upward trend section, which has taken the form a-b-c-d-e and may already be complete. As a result, the instrument's price increase may last for a while. Therefore, both instruments are still in the process of developing an upward trend segment, which will be followed by the start of a mutual decline. Recently, the British pound's news background has been so varied that it is challenging to sum it up in one word. The British pound had more than enough reasons to rise and fall. As you can see, it primarily chose the first option and still does so today. The internal wave structure of wave e became more complicated due to the rise in quotes the week before last, and it became even more complicated the following week. However, as of this week's first day, the British pound still feels great and has no desire to create a corrective wave. I am currently waiting for the decline of both instruments. Still, these trend sections may take an even longer form because the wave marking on both instruments allows the ascending section to be built up to completion at any time.

It is intended for quotes to end at their highest points.

On Tuesday, the pound/dollar exchange rate decreased by 25 basis points. Of course, even considering yesterday's 80-point decline, such a decline cannot be regarded as the start of a new downward wave or a new downward trend segment. The British and American news backgrounds from yesterday were both quite interesting, which increased demand for US currency. Even though there was no news to speak of today, we can still anticipate the creation of a new downward trend section due to the instrument's declining quotes.

The market's driving forces that led to an increase in pound demand for several weeks have already been exhausted. If the news environment is unfavorable, the British pound cannot rise for several weeks. Few people can now predict how the Bank of England and Fed meetings will end because they are "on the nose." The Fed will increase rates by 50 basis points with a 95% probability, and the Bank of England may decide to tighten monetary policy by either 75 or 50 basis points, so from the perspective of rates, everything is more or less crystal clear. I believed the increase would be 75 points a few weeks ago, but now the Bank of England will also start to slow the increase. Since the British consumer price index is still rising quickly, there are no inflationary causes for this. From this vantage point, the Bank of England has no choice but to raise rates by 75 points until inflation, at the very least, starts to decline. But Britain should remember the economy too. Additionally, the Fed frequently serves as an example for the Bank of England and the ECB.

Conclusions in general

The construction of a new downward trend segment is predicated on the wave pattern of the pound/dollar instrument. Since the wave marking permits the construction of a downward trend section, I cannot advise purchasing the instrument. With targets around the 1.1707 mark, or 161.8% Fibonacci, sales are now more accurate. The wave e, however, can evolve into an even longer form.

The euro/dollar instrument and the picture look very similar at the larger wave scale, which is good because both instruments should move similarly. The upward correction portion of the trend is currently almost finished. If this is the case, a new downward trend will soon develop.