The focus of investors' attention today is the Fed meeting. It started yesterday, and will end today with the publication of the interest rate decision at 16:00 UTC. It is widely expected that Fed leaders will refrain from raising interest rates at this meeting for the time being. As Fed Chairman Jerome Powell has repeatedly stated before, before the start of the interest rate hike cycle, the quantitative easing program will first be completed.

However, the Fed is in a difficult situation. On the one hand, it needs to take measures to curb accelerating inflation (this is one of the main tasks of the central bank of any country): as reported earlier this month by the U.S. Department of Labor, consumer prices rose in December by 7.0% compared to the same period of the previous year, which was the highest since June 1982 (annual price growth in November was 6.8%). If inflation continues to grow at the same pace, the Fed may not keep up with it, steadily raising interest rates, which creates a threat of hyperinflation, and this will directly affect the value of the dollar.

On the other hand, according to some economists, a further decline in U.S. stocks and stock indices may lead to an outflow of capital from U.S. assets, and this will negatively affect the dollar. It is worth taking a look at the dynamics of the main U.S. stock indices, which declined sharply this month, returning to the levels of 7 months ago. The sharp downward correction in the U.S. stock market is also partly due to expectations of the imminent start of the Fed's monetary policy tightening cycle.

In short, we are waiting for an interesting development of events in the financial market, and the situation may develop in an entirely unpredictable scenario.

The Fed's press conference will begin at 16:30 UTC, half an hour after the publication of the interest rate decision. Perhaps unnecessarily, but still we recall that during this period of time, a sharp increase in volatility in the financial market is expected, especially in dollar quotes and U.S. stock indices.

At the same time, today's economic calendar is not limited only to this important event. At 12:00 UTC, the Bank of Canada will publish its decision on the interest rate.

The negative effects of the coronavirus on the Canadian economy and the country's labor market, as well as the weakness of the housing market, put pressure on the Bank of Canada towards either further easing of monetary policy or a wait-and-see position. It is expected that at today's meeting, the Bank of Canada will keep the interest rate at 0.25%.

If the Bank of Canada signals the need for a soft monetary policy, the Canadian currency will decline. During the press conference, which will begin at 13:15 UTC, Bank of Canada Governor Tiff Macklem will explain the bank's position and assess the current economic situation in the country. During his speech, volatility in CAD quotes may also increase if he makes unexpected statements.

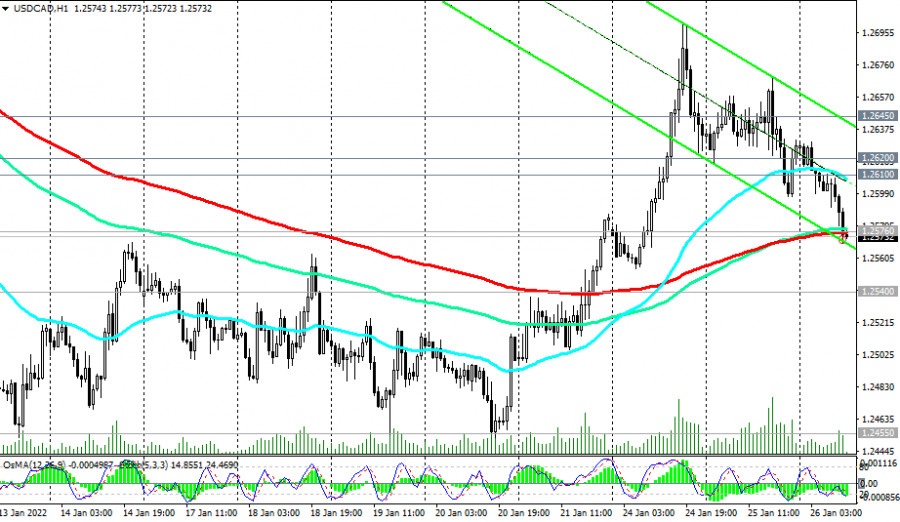

In the meantime, USD/CAD is declining, and the Canadian dollar is strengthening, also receiving support from rising oil prices. At the time of writing, the USD/CAD pair is trading near the 1.2576 mark, testing an important short-term support level (200-day MA on 1-hour chart) for a breakdown.

Trading recommendations and market expectations

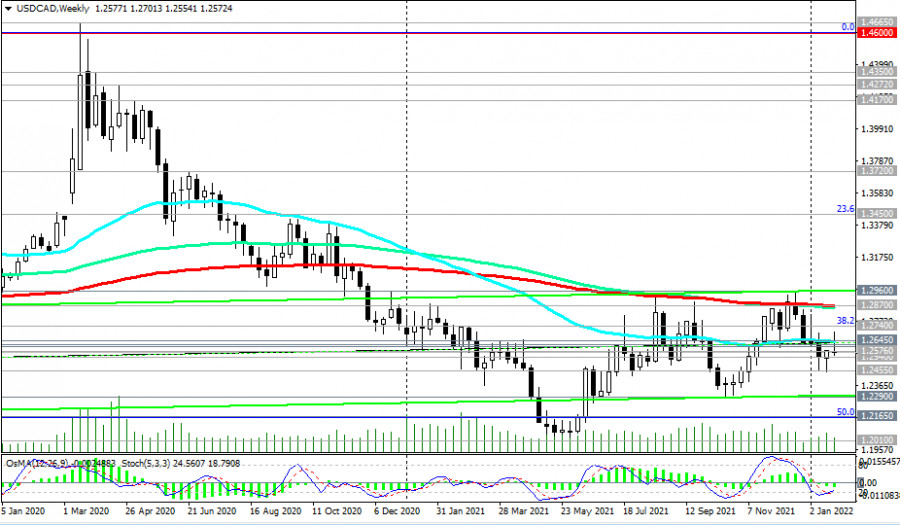

Given the current downward trend, a further decline is most likely.

In case of breakdown of the long-term support level 1.2540 (200 EMA on the monthly chart), USD/CAD will head towards the local support level 1.2455. Its breakdown will cause further decline to the local support level of 1.2290. In case of further decline, the targets are support levels 1.2165 (50% Fibonacci level of downward correction in the USD/CAD growth wave from 0.9700 to 1.4600), 1.2010 (2021 lows).

An alternative scenario suggests a rebound from the support level of 1.2576 and a reversal.

A consecutive breakdown of the resistance levels 1.2610, 1.2620, 1.2645 will return USD/CAD to the bull market zone.

Support levels: 1.2576, 1.2540, 1.2455, 1.2290, 1.2165, 1.2010

Resistance levels: 1.2610, 1.2620, 1.2645, 1.2740, 1.2870, 1.2900, 1.2960

Trading recommendations:

Sell Stop 1.2550. Stop-Loss 1.2635. Take-Profit 1.2540, 1.2455, 1.2290, 1.2165, 1.2010

Buy Stop 1.2635. Stop-Loss 1.2550. Take-Profit 1.2645, 1.2740, 1.2870, 1.2900, 1.2960