Trading in 2022 has started. The USD/JPY pair is showing a strong bullish mood. As part of a series of rallies, it has crossed the 116.00 level for the first time in its five-year history. Moreover, analysts predict a further upward trend in the pair towards 118.00. what it's all about?

The yen, as well as the dollar, acts as a safe haven and therefore does not react with a fall in case of weak US data which triggers risk aversion. As a defensive asset, the yen reacts most strongly to geopolitical tensions and can rise stronger than the dollar. This happens for example during North Korean or Russia-Ukraine tensions. The yen involved in such events usually does not react to US government bond yields.

The situation is now exactly the opposite. The yen is moving in tandem with the yields of the Treasuries. This rally has triggered a series of collapses of the yen against the dollar.

Rising US Treasury yields, however, are due to expectations of an interest rate hike by the Fed. As far as the yield of the dollar is concerned, the expected policy tightening will mean an increased attractiveness of the greenback.

The Fed's policy stands in stark contrast to that of the Bank of Japan, which is determined to keep policy unchanged amid low inflation.

On the 4-hour timeframe, the USD/JPY pair remains overbought in the short term, which implies a correction. It is unlikely that the rise in the pair ended at this point. The bullish sentiment persists and the quote could be aiming for new highs. However, before the dollar resumes gains, there will be a temporary slide in the exchange rate.

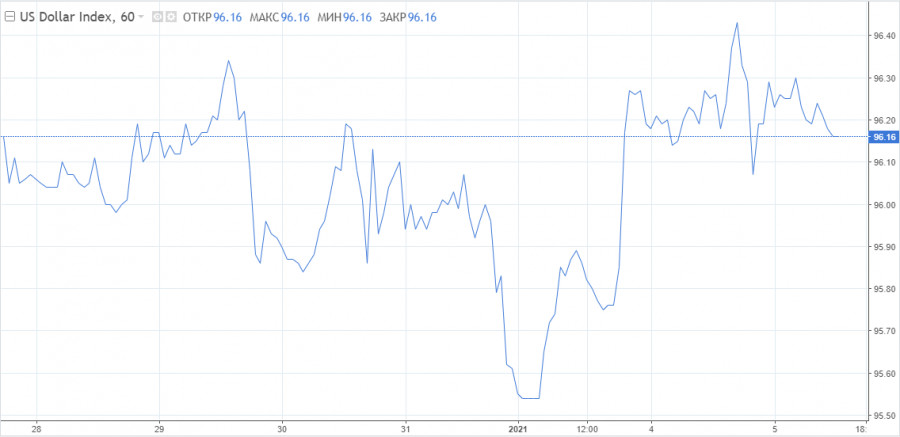

It is also worth monitoring the trend of the dollar index. Since the timing of the first rate hike has not yet been announced, the greenback will react actively to reports or signals, which could come from inflation expectations, for example.

Thus, according to the St Louis Fed, inflation expectations in the US hit a new 6-week high on Monday, reaching 2.60%, the highest since November 24. This indicates that the Fed could rush into a policy tightening. It is also clear, that Treasury yields remain bullish and support the dollar.

Analysts have different opinions on how the Fed's hawkish attitude will affect the dollar. DBS Bank does not believe that the first rate hike in the US will take place immediately after March. According to their estimates, the full completion of the stimulus tapering will be in the middle of the year, after which the central bank will begin to raise rates. The regulator could raise rates twice in the fourth quarter.

The dollar will continue its rally right up to the first rate hike. Subsequently, the momentum will weaken. Analysts generally point out that an aggressive upward movement of the dollar index along the lines of the second half of the year 2021 is unlikely to take place.

What will be the further movements of the USD/JPY pair? Perhaps the currency changes are already priced in and it will not move any further than 116.00. The DBS Bank does not think so. The yen was one of the weakest currencies of last year. However, the situation is unlikely to change this year. This is mainly due to the strong contrast with western inflationary trends.

Japan is still a long way from reaching its 2% inflation target. Over the next two years CPI inflation in Japan will be 0.5%. In the meantime, the regulator will mention more and more about winding down anti-crisis measures but take no action.

This year, the yen could enter the 115.00-120.00 range against the dollar.

The forecast will remain relevant in the absence of any economic surprises that stimulate demand for the yen as a safe haven.