What is needed to open long positions on GBP/USD

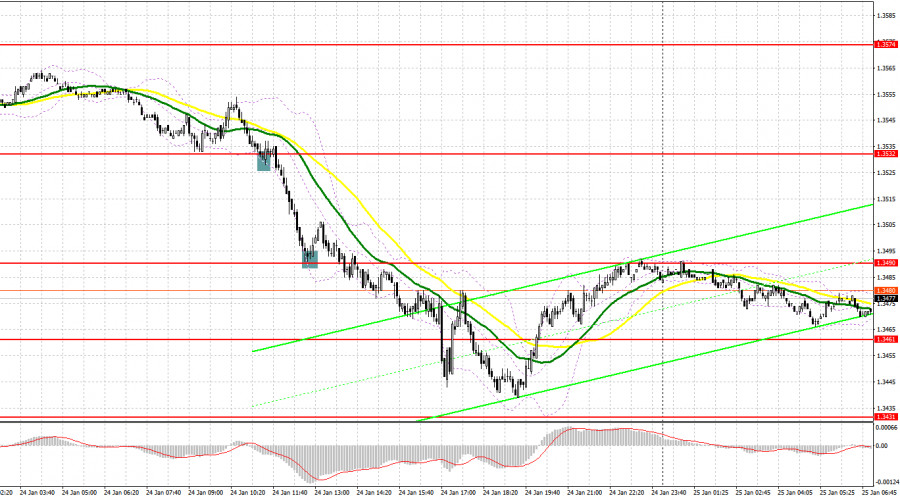

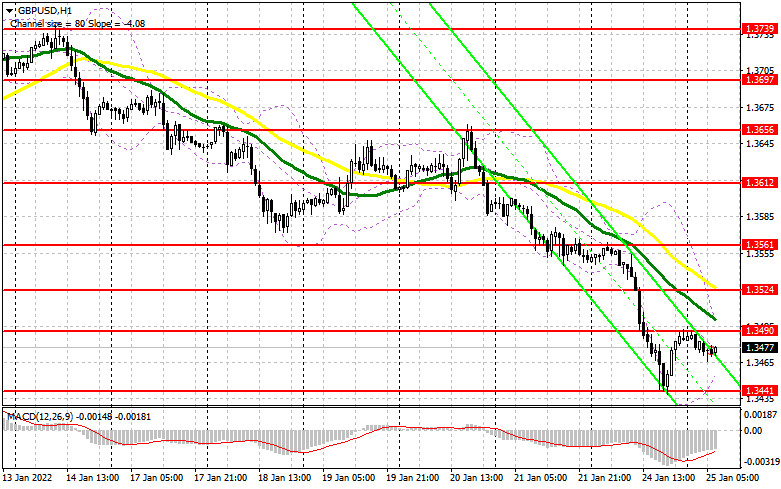

Yesterday, GBP/USD suggested a few signals for the market entry but all of them did not bring any profit. Now let's look at the 5-minute chart to evaluate these market entry points. In the first half of the day, I turned your attention to 1.3532 and recommended making trading decisions with this level in focus. GBP bulls did everything possible to enable an upward correction but to no avail. A false breakout at 1.3532 early in the morning generated a buy signal for GBP/USD. However, the UK manufacturing and services PMI discouraged traders. This caused a breakout of 1.3532 and a further decline of the currency pair. The level of 1.3532 was not tested upwards, so there was no sell signal. In the second half of the day, there was a false breakout of 1.3490 that generated a buy signal. But after the price had grown 15 pips, GBP/USD again came under pressure. Hence, the price went further downwards.

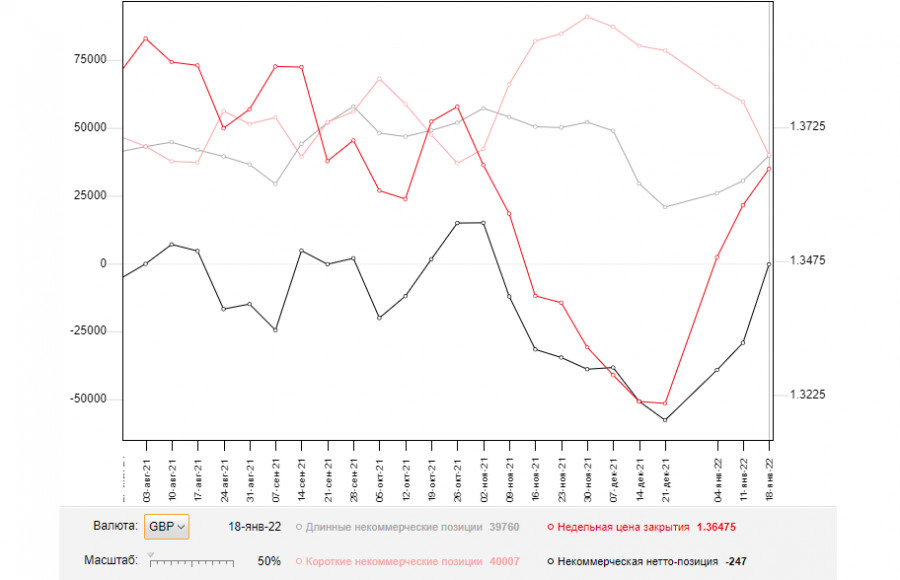

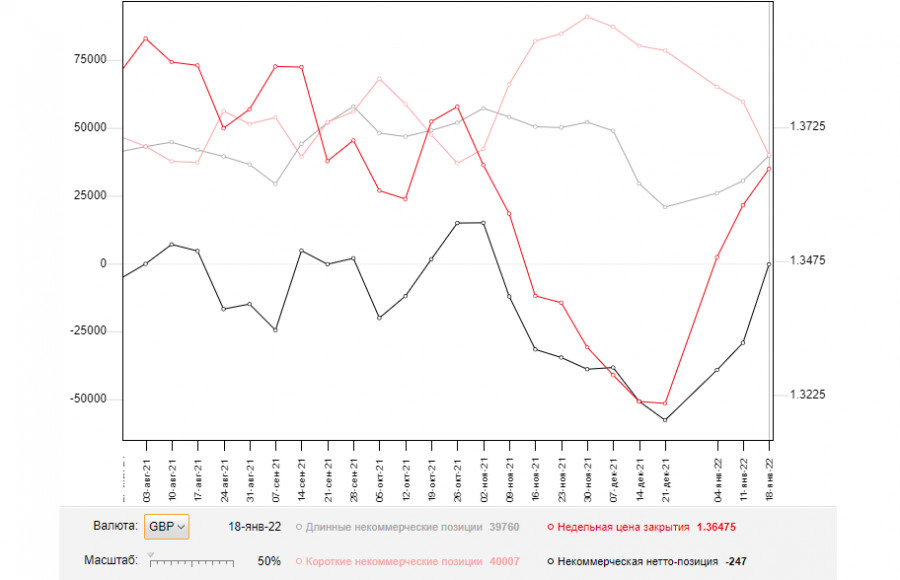

Before we figure out the technical picture of GBP/USD, let's see what happened in the futures market. According to the COT report from January 18, traders increased long positions and cut on short positions. It means that the sterling retains the speculative interest after the Bank of England raised the key policy rate at the end of the last year. Currently, traders have high expectations that the regulator could increase interest rates again by 0.25% at the nearest policy meeting. Such expectations are bullish for the pound sterling.

At the same time, the fundamental picture contains some factors that cap the pound's upside potential. First, soaring inflation that has been raging for almost half a year negates strong employment in the UK. Despite high wages and a decline in the jobless rate, rampant inflation erases households' incomes. Besides, elevates energy prices and costly services make a dent in the people's well-being so that living standards are currently below the ones during the COVID pandemic. By and large, the outlook for the sterling is bright. Moreover, the ongoing downward correction makes it more attractive. The Bank of England's intention to continue rate hikes this year will push the pound to new highs.

This week, traders are anticipating the crucial event: the FOMC policy meeting. The policymakers are widely expected to clear up the timeline for monetary tightening. Some analysts assume that the US central bank could decide in favor of raising interest rates at this policy meeting in January without delaying this question until March. The rate-setting committee is likely to announce tapering the Fed's balance sheet.

The COT report from January 18 reads that the number of non-commercial positions rose from 30,506 to 39,760 whereas the number of short non-commercial positions decreased from 59,672 to 40,007. This leads to a change in negative non-commercial net positions from -29,166 to -247. GBP/USD closed at 1.3647, higher than 1.3570 a week ago.

To sum up, the pound sterling fell sharply yesterday, but the buyers have a good chance to push the price up today. Today, the economic calendar lacks any macroeconomic data from the UK. The industrial orders book balance by the Confederation of the British Industry will hardly change market sentiment. So, I would recommend we should focus on support at 1.3441 and resistance at 1.3490. The buyers' prior task is to defend support of 1.3441. This level was formed yesterday as a result of a sell-off where large market players were especially active.

If GBP/USD declines, a fake breakout at 1.3441 will give a buy signal during the downtrend that has been going on since January 14. If this scenario comes true, the bulls will aim to break resistance of 1.3490. Moving averages that are capping the upside potential are passing above this level. A breakout and a test of this level downwards will generate an extra market entry point, thus reinforcing the bullish strength aiming to hit higher highs of 1.3524 and 1.3561. 1.3612 is seen as a more distant target where I recommend profit taking. If GBP/USD declines in the European session and the bulls lack activity at 1.3441, it would be better to cancel long positions until 1.3409. We will be able to enter the market on condition of a fake breakout there, reckoning a small upward correction. You could buy GBP/USD immediately at a bounce off 1.3389 or lower from 1.3368, bearing in mind a 20-25 pips correction intraday.

What is needed to open short positions on GBP/USD

The bears are holding the upper hand over the market for a while. Their major task is to defend 1.3490 that was successfully conquered yesterday. Weak data on UK industrial orders and a fake breakout at 1.3490 will create a market entry point with short positions as the bears are eager to resume the downtrend and push the price down to 1.3441, a one-week low. A breakout and a test of 1.3441 in the opposite direction will provide us with a new entry point for short positions. GBP/USD might drop lower to 1.3389 and 1.3368 where I recommend profit taking. In case the currency pair grows in the European session and the sellers trade sluggishly at 1.3490, it would be better to cancel selling until larger resistance of 1.3524. Short positions could be opened only on condition of a false breakout.We could sell GBP/USD immediately at a drop off a high at 1.3561 or higher from 1.3612, bearing in mind a 20-25 pips fall intraday.

Indicator signals:

Trading is carried out below the 30 and 50 moving averages. It indicates a further bearish trend.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakout of the indicators' lower border at 1.3450 will escalate pressure on GBP/USD. Alternatively, if the upper border at 1.3490 is broken, the price will develop a new bullish wave.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.