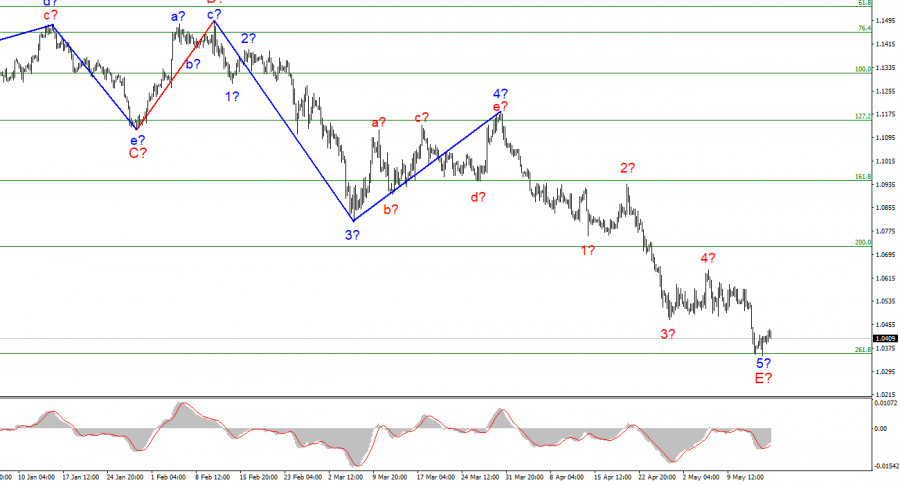

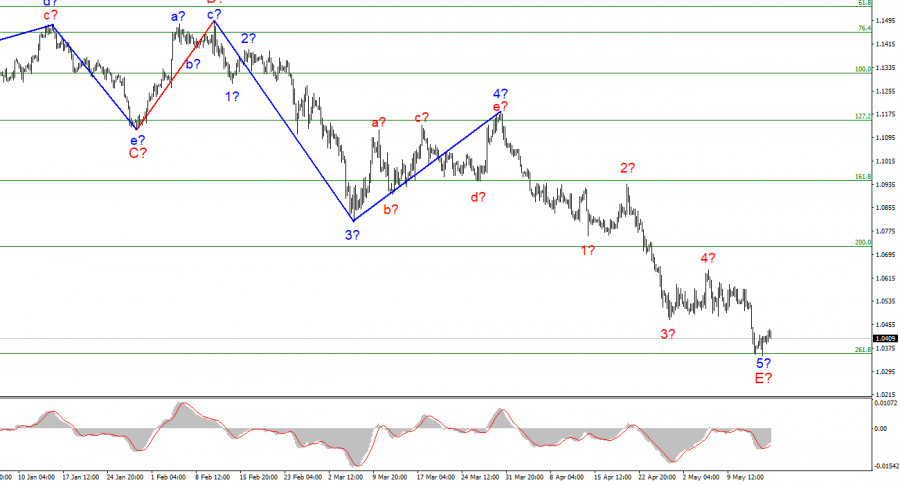

The wave marking of the 4-hour chart for the euro/dollar instrument continues to look convincing and does not require adjustments. The instrument continues the construction of the descending wave 5-E, which is the last in the structure of the descending trend section. If this is true, then the decline in the quotes of the euro currency may end at any moment, since the internal structure of this wave is already five-wave. And an unsuccessful attempt to break through the 1.0355 mark indicates that the market is not ready for new sales of the instrument. Suppose the breakout attempt of 1.0355 turns out to be successful after all. In that case, the instrument will further complicate its wave structure and continue to decline with targets located near the zero figure. So far, the wave marking looks like in a textbook, and even its complication (lengthening in the wave 5-E) will not lead to its scrapping. There are no alternative wave markings now. I continue to expect the downward trend to end, but a pronounced bearish market sentiment may lead to an even stronger decline in the instrument.

Both gas and oil continue to be supplied to the EU

The euro/dollar instrument did not rise or fall by a single point on Monday. The amplitude of the movement was very weak today, which partly explains the missing news background. Nevertheless, there was interesting news, and now I will try to focus on one of them. There has been so much talk about sanctions against the Russian Federation in recent months that only they could be written about every day. Russia has collected more sanctions than the DPRK and Iran, but the main sanctions against its oil and gas sector have not been imposed. Now imagine that the Russian economy is a pizza, where 7 out of 8 pieces is the oil and gas industry. The remaining one piece is divided into 10,000 small pieces representing other Russian economic sectors. The EU countries inflicted sanctions on that last piece of Russian pizza. On paper, there are almost 10 thousand of them, in practice, it is just one piece of cake.

When all the available restrictions for the Russian Federation ended, the question of oil and gas arose, and it immediately turned out that a good half of the EU countries did not want to give up hydrocarbons from Russia, because the ruling elite is at the head of each country. If prices for everything continue to rise, and there is a shortage of oil and gas, then this elite can very quickly fly off their seats. And it turns out that Hungary alone may well block the sixth package of sanctions, which included an oil embargo. All the others supported the embargo with gritted teeth and mentally applauded Hungary. The situation with gas is even more interesting. Moscow has officially announced that now the European Union will pay in rubles. Europe made several loud statements, they say, this will never happen, and immediately large companies ran to open accounts in the Russian Gazprombank to transfer euros there as payment for gas. Then these euros will be transferred by the bank itself into rubles and go to Gazprom. Voila, no problem. Of course, all this is very good for Russia and its economy. It was hit hard, but the preservation of oil and gas relations with the EU is more important than all those 10 thousand sanctions that were imposed. The ruble is getting stronger, the euro is not.

General conclusions

Based on the analysis, I still conclude that the construction of wave 5-E. If so, now is still a good time to sell the European currency with targets located around the 1.0000 mark, which corresponds to 323.6% Fibonacci. But first, you need to wait for confirmation that the descending wave will continue its construction - a successful attempt to break the 1.0355 mark.

On a larger scale, it can be seen that the construction of the proposed wave D has been completed, and the instrument regularly updates its low. Thus, the fifth wave of a non-pulse downward trend segment is being built, which turns out to be as long as wave C. The European currency may still decline for some time.