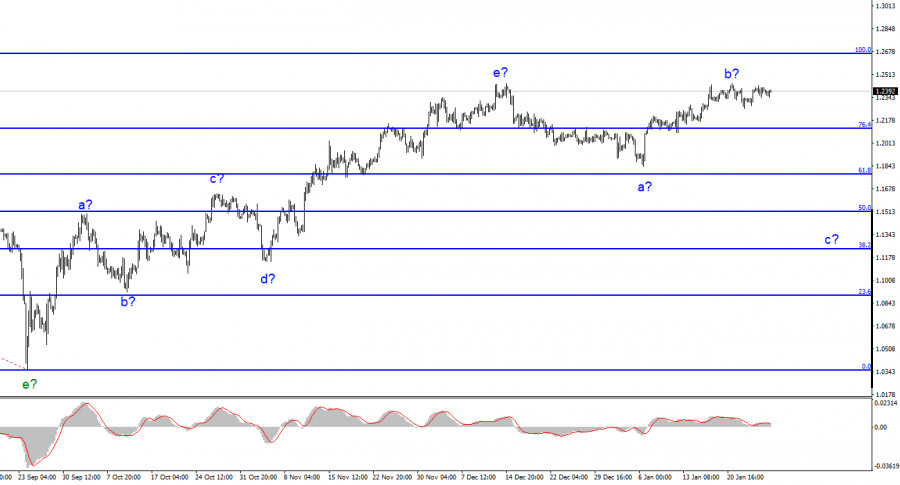

The wave analysis for the pound/dollar pair now appears rather complex, doesn't call for any clarifications, but starts to diverge significantly from the analysis of the euro/dollar pair. Our five-wave upward trend section has the pattern a-b-c-d-e and is most likely already finished. Although the recent increase in the pair's quotes proved to be too powerful, wave b has developed into a form that is too long and is on the edge of cancellation. I assume that the downward section of the trend has started to form and will take at least a three-wave form. The current upward wave will cease to be regarded as wave b if the increase in quotes even somewhat persists, and the analysis for the entire wave will need to be adjusted. However, if the wave analysis is still accurate, I still anticipate the development of a descending wave, and the pair has the potential to decline by 500–600 basis points, up to a level of 1.1508, which corresponds to a 50.0% Fibonacci ratio. The stability of the current wave analysis is maintained because the peak of the proposed wave b does not yet surpass the peak of wave e.

The British pound could begin a long decline.

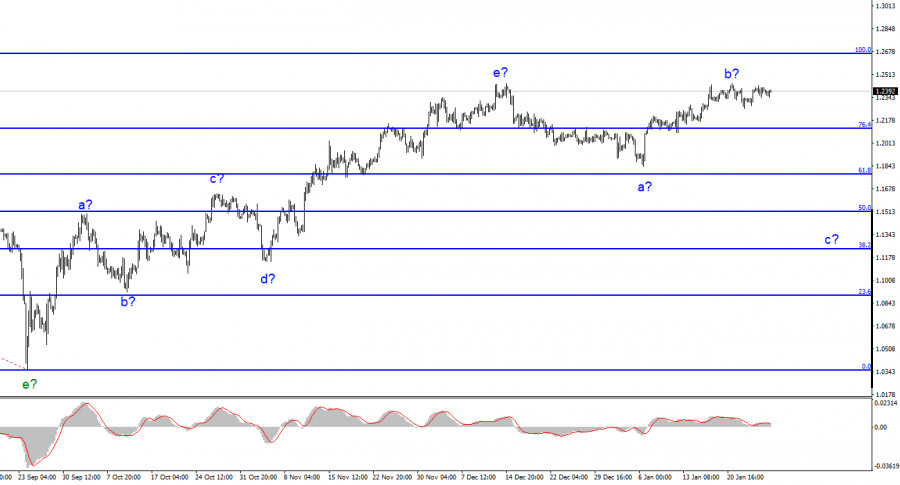

The pound/dollar exchange rate has been moving recently in horizontal patterns. Since quotes remain close to the peak of waves b and e, there is nothing to be said regarding changes in the exchange rate. Although wave B is about to be canceled, the market is still not in a rush to lower demand for the pair. It would be far more sensible and attractive to first develop three waves downward before beginning to develop a new upward trend section. I think that over the next six to twelve months, the news background will not help the British pound. This raises serious concerns about the idea of creating an upward section. Since the market is aware that there might no longer be a new trend, it may hold off on selling at this time. The time when the rate needs to stop rising is swiftly approaching for both central banks. Since inflation has been falling for six months in a row and the regulator has justification to delay the rise in interest rates, the Fed is approaching it in a positive frame of mind. Because inflation is not going down and the country is about to face a recession, the Bank of England approaches it in a dissatisfied mood.

At first glance, the British pound should keep rising since the Bank of England needs to raise interest rates at a faster rate and for a longer period than the Federal Reserve. However, a lot of economists are doubtful that the British regulator will exert deliberate pressure on its economy. The British Central Bank raising the rate to 5% or 6% is still unlikely, in my opinion. There is hardly any information available about this. Andrew Bailey mentioned tightening monetary policy several times, but he made no mention of the target interest rate.

Conclusions in general

The development of a new downward trend section is based on the wave pattern of the pound/dollar pair. Currently, sales with targets at the level of 1.1508, or 50.0% Fibonacci, might be taken into account. You can set a stop-loss order above the peaks of waves e and b. The upward section of the trend is probably complete; however, it might yet take a longer form than it does right now. However, you must exercise caution while making sales because the pound tends to rise.

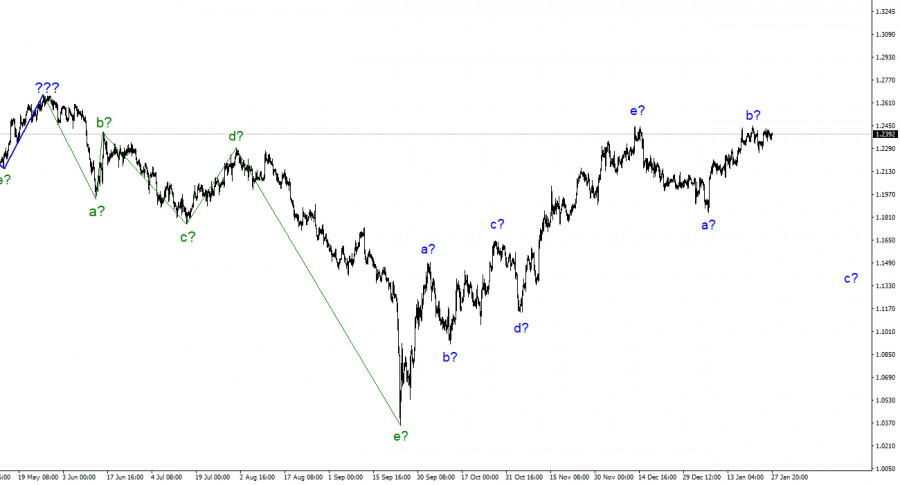

The image is comparable to the euro/dollar pair at the higher wave scale, but differences still start to show. Currently, the upward correction section of the trend is almost finished (or has already been completed). If this presumption is true, then we must wait for the development of a downward section to continue for at least three waves with the possibility of a decrease in the area of Figure 15.