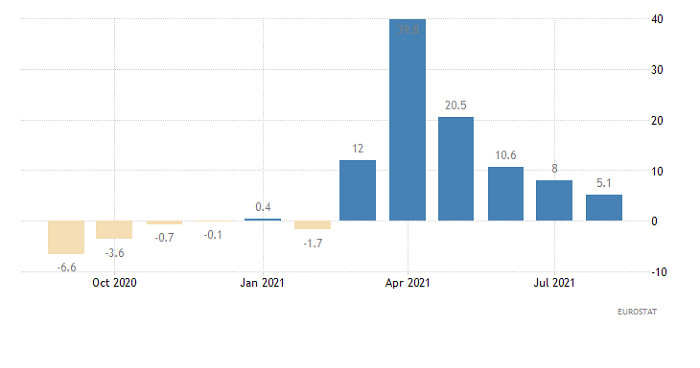

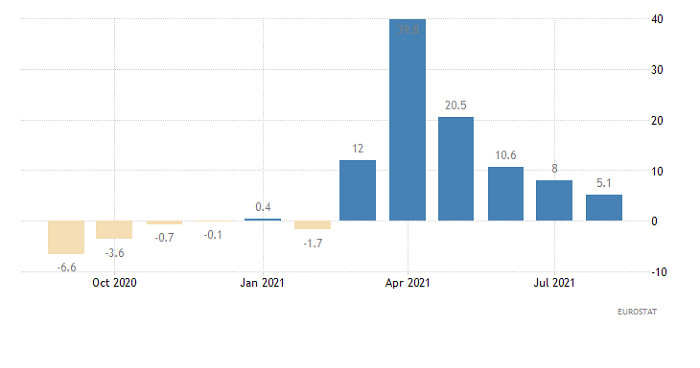

On the one hand, industrial production in the eurozone came better than expected and rose by 5.1%, following a reversed 8% growth in the previous month. It turns out that the eurozone economy expanded slightly better than expected in the previous month. However, this is exactly why the latest data came worse than expected. The fact is that industrial output was estimated to decline by 1.2% but actually fell by 1.6% m/m.

Eurozone Industrial Production:

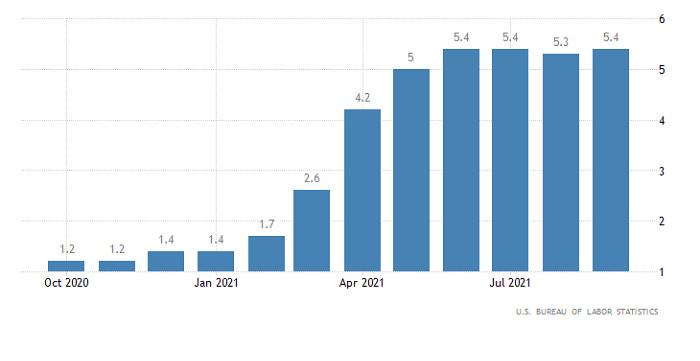

Given all the importance of the eurozone's industrial production report, US inflation data is definitely the key event of the entire week. The annual inflation rate in the US edged up to 5.4% in September from 5.3% in August. Its acceleration leaves almost no doubt that the Federal Reserve would start QE tapering in November. As soon as the data was published the greenback went up. Almost an hour later, something extraordinary happened and the dollar tumbled in the blink of an eye and continued to make losses. Such price behavior is simply contrary to common sense. It was all about countless comments made by representatives of the US financial sector. The idea of all these comments is simple: the regulator will possibly announce tapering of the quantitative easing program if inflation rises. Although not only inflation but also the state of the labor market clearly indicate that there is simply no other possible scenario. Yet, the financial authorities are trying to believe that there is still more to come or that there is hope. Indeed, such behavior of the market can be interpreted as an attempt to pressure the Federal Reserve so that the regulator can give up plans to tighten monetary policy. Clearly, tapering of the QE program - the main driver of growth in financial markets - looks almost like a disaster from the point of view of the financial sector. It is obvious why it is so motivated. But the Federal Reserve must be guided by more than just the short-term interests of the financial sector. By and large, the regulator should ignore them, especially if they run counter to the long-term prospects of economic development.

United States Inflation:

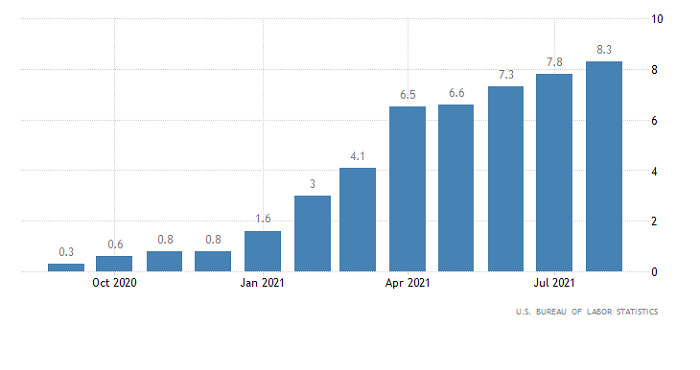

Today, everything can get back to normal and the US dollar is likely to grow again. It is not about jobless claims that are forecast to show positive results. In particular, the number of initial jobless claims is estimated to reduce by 11K and continuing ones by 65K. This data will only confirm the results of the US Labor Department report and will not give any new information to market participants. Meanwhile, the producer price index can put things in perspective. The reading is expected to rise to 8.5%, or even to 8.7%, versus 8.3%. Given that the PPI is considered a leading indicator for inflation, its growth will mean that inflation is unlikely to slow any time soon. In fact, it may accelerate. That is why the Federal Reserve will have no other choice but to tighten monetary policy. Therefore, after the release of the PPI, QE tapering will no longer be a possibility but a fact.

United States PPI:

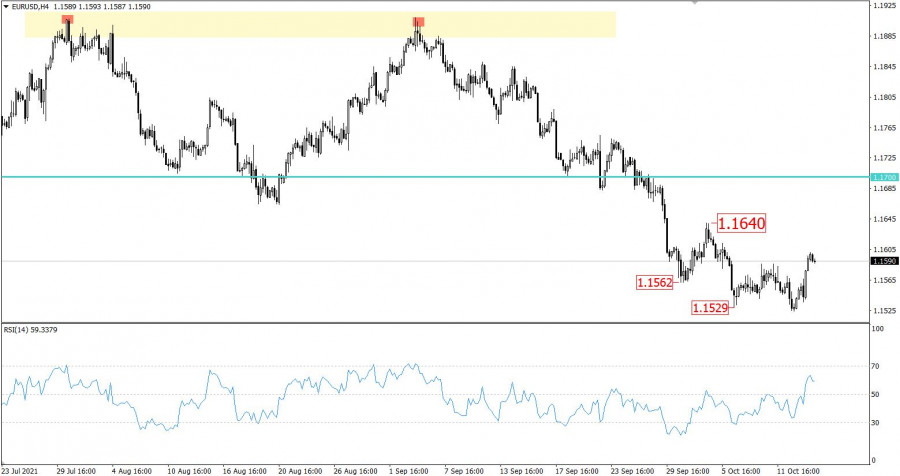

EUR/USD bounced from the pivot point of 1.1529 and rose by more than 70 pips. Anyway, it is too early to talk about a full-fledged correction because the euro is still oversold.

The euro has lost over 3% since the beginning of autumn and 5.6% since June.

The RSI bounced from the oversold zone on the D1 chart, approaching 40. On the H4 chart, the indicator rebounded to the 50-70 zone.

In this light, we have 2 possible scenarios:

Given the oversold status of the euro, a correction might occur. For that, the quote should consolidate above 1.3600. If so, the price is likely to go to the swing high as of October 4. The most significant price changes are expected in the market after consolidation above 1.1640.

Alternatively, the downward trend might extend. That is why if the price returns below 1.1520, the volume of short positions will increase. In such a case, the quote might go to the support level of 1.1420.

In terms of complex indicator analysis, technical indicators are signaling to buy the pair in the short term and intraday amid a price rebound. Technical indicators are giving a sell signal for medium-term trading amid the possibility of a downward trend.