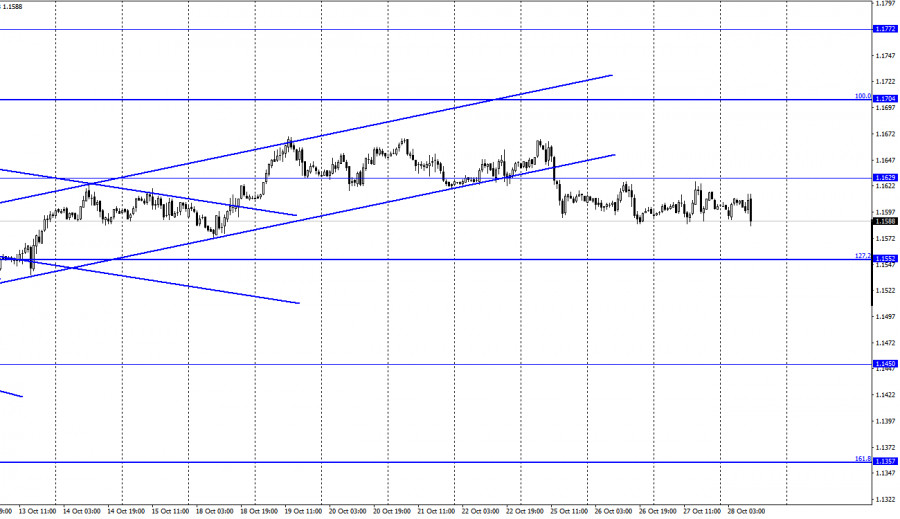

EUR/USD – 1H.

The EUR/USD pair continued to trade calmly on Wednesday. The pair did not show any sharp and strong movements during the day. Thus, after the closing of quotes under the level of 1.1629, it will still be possible to count on the continuation of the fall in the direction of the corrective level of 127.2% (1.1552). However, a lot will depend on the results of the ECB meeting, which will be known in a couple of hours. Traders do not expect any monetary policy parameters to be changed. It means that all traders' attention will be focused on the rhetoric of ECB President Christine Lagarde. At this time, we can only speculate on the topic of "what Lagarde can say at a press conference." Surely all the most pressing issues will be touched upon. For example, the coronavirus epidemic, which has begun to develop again in Europe in recent weeks. Against the background of a new round of infections, it is quite possible to expect a decline in economic growth, and, as a result, Lagarde may announce a reduction in GDP forecasts for the coming quarters.

The issue of inflation is also acute. In the European Union, it is not as high as in the United States. Nevertheless, rising energy prices and the PEPP program can further contribute to its acceleration. And we need to fight inflation. Recently, there have been many rumors that the Fed may begin to wind down its stimulus program. Most likely, the ECB may be somewhat late, but it will also begin to wind down the PEPP program. In this matter, the ECB often relies on the Fed. Thus, everything will depend on whether Christine Lagarde signals any changes in the monetary policy of the central bank in the near future. If traders see possible changes, which will undoubtedly concern tightening, then the European currency may resume growth. But it is unlikely to be long since the quotes have recently secured under an upward trend corridor.

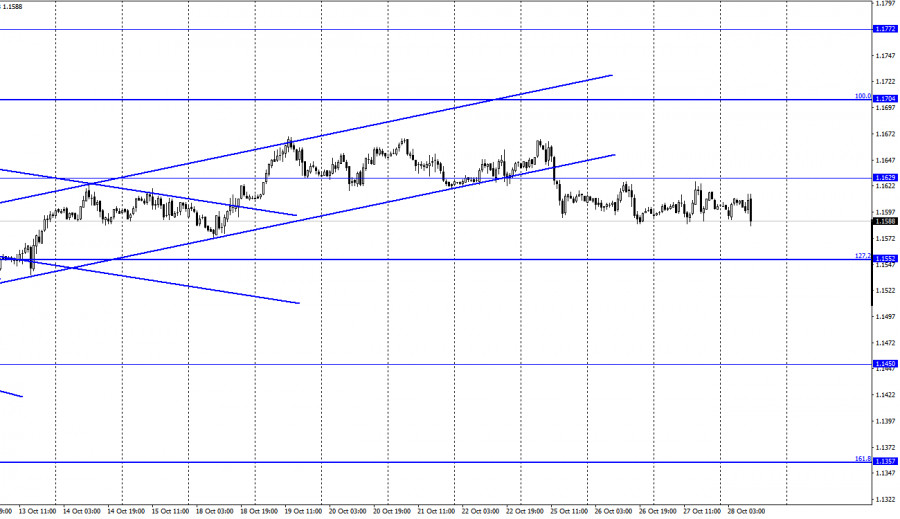

EUR/USD – 4H.

On the 4-hour chart, the quotes closed under the corrective level of 100.0% (1.1606) and failed to continue the growth process. Thus, the fall in quotes may now resume in the direction of the corrective level of 127.2% (1.1404). Emerging divergences are not observed in any indicator today. However, I want to note that neither the first close above 1.1606 nor the second one below it is deep and confident.

News calendar for the USA and the European Union:

EU - publication of the ECB decision on the main interest rate (11:45 UTC).

EU- monetary policy report (11:45 UTC).

EU - ECB press conference (12:30 UTC).

US - change in GDP volume for the quarter (12:30 UTC).

On October 28, the European Union will summarize the results of the ECB meeting, and Christine Lagarde will also speak at a press conference. However, there will also be an important report in the US, which will be released at the same time as Lagarde's speech begins. Thus, the information background may be strong today.

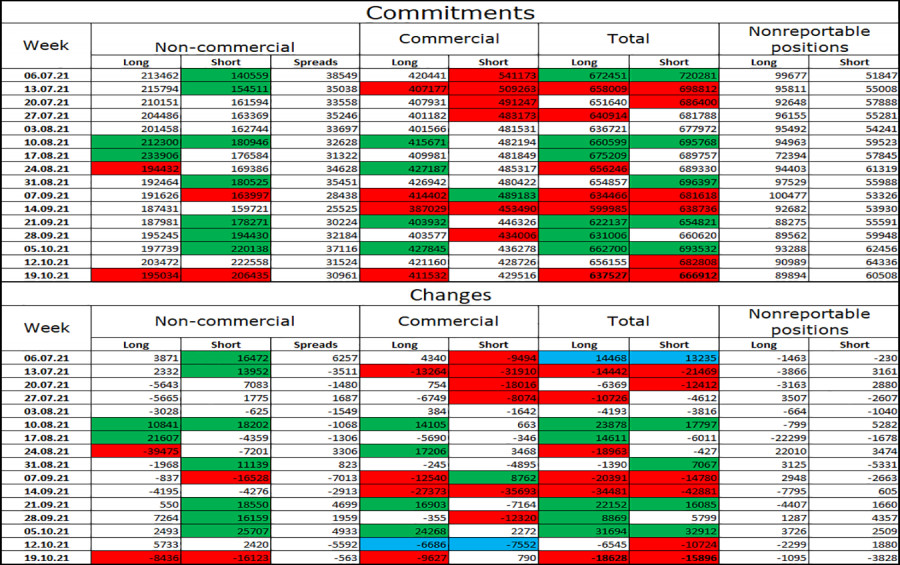

COT(Commitments of Traders) report:

The latest COT report showed that during the reporting week, the mood of the "Non-commercial" category of traders changed towards "bullish". Speculators closed 8,436 long contracts on the euro and 16,123 short contracts. Thus, the total number of long contracts in the hands of speculators decreased to 195 thousand, and the total number of short contracts - to 206 thousand. Over the past few months, the "Non-commercial" category of traders has tended to get rid of long contracts on the euro and increase short contracts. Or increase short at a higher rate than long. In general, this process continues now, but in the last two weeks, the European currency has shown weak growth.

EUR/USD forecast and recommendations to traders:

Traders are still not trading the pair too actively. I do not recommend buying the pair again yet, since there are no buy signals. I recommended selling the pair earlier, as there was a closure under the descending corridor on the hourly chart, with a target of 1.1552. Now, these transactions can be kept open. It should be borne in mind that today's information background may affect the mood of traders.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.