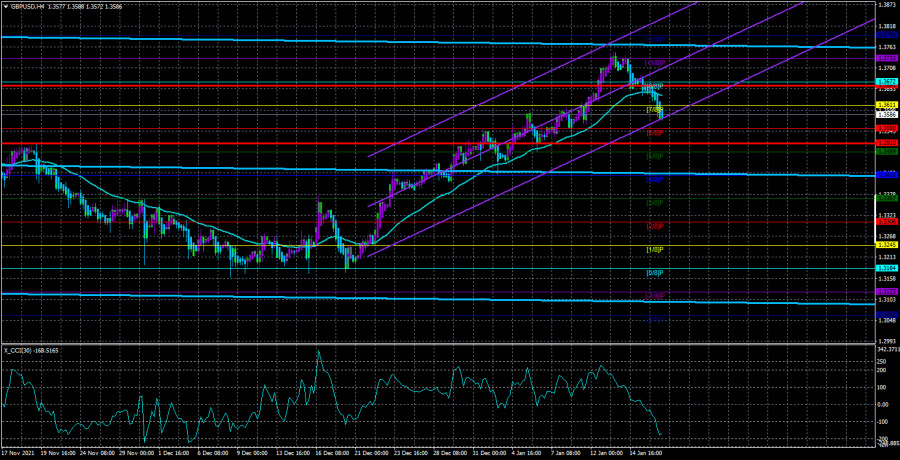

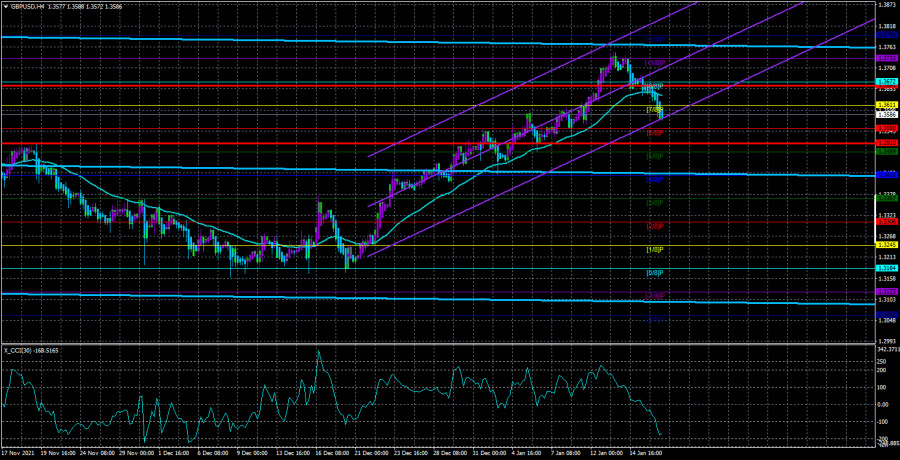

The GBP/USD currency pair also broke the moving average line on Tuesday. Of course, reports on unemployment and wages cannot be considered important, and British statistics cannot be considered more important than American ones. In other words, the markets are much more likely and more zealously working out American data, and not British. Thus, the fact of ignoring the British reports yesterday does not surprise us. From a technical point of view, the fall of the British pound has also been brewing for two weeks. Recall (and this is seen in the illustration above) that the pound/dollar pair has shown impressive growth over the past month, during which it managed to rise in price by 600 points or so. If we take into account the fundamental reasons for such a movement, then only an increase in the key rate by the Bank of England comes to mind. However, it is quite difficult to imagine that the market has been buying pounds for a whole month based on a single tightening of monetary policy. Thus, we are more inclined to believe that the pair has simply adjusted. If you look at the 24-hour TF, it becomes clear: this is exactly how the pair traded throughout 2021. 600 points down - 450-500 points up. Deep corrections while maintaining a downward trend, which itself is a correction against the 2020 trend. Therefore, two months ago we said that we expect growth of 400-500 points, after which, if there is no strong fundamental background for the British currency, the pair's decline may resume. A new strong fundamental background has not appeared, so now the pound may fall by at least 100-150 points to form a correction against the local upward trend. What happens next will largely depend on the results of the meeting of the Bank of England and the Fed at the end of January. If the BA suddenly raises the rate again or abandons the quantitative stimulus program, the pound may regain its spirits and feel a surge of strength.

Omicron and Boris Johnson are key topics in the UK.

Unfortunately, in the UK, all macroeconomic data is now moving away not even to the second, but the third plan. Over the past two months, the markets have been closely monitoring the development of the situation with Omicron. During this period, Britain set several more anti-records on the rate of spread of the strain and the number of diseases but did not introduce quarantine, for which Johnson was harshly criticized in the Labor camp, but welcomed in the Conservative camp. However, it still did not help to keep David Frost, the chief Brexit negotiator, in his position, who had just left his post due to disagreement with the current government on quarantine and pandemic issues. A rather formal reason, since in fact, Johnson did exactly what Frost wanted. But Frost left anyway. The pandemic has also faded into the background since now no one is afraid of 100-150 thousand new infections per day, and the fact that the military is helping doctors in British hospitals has become something taken for granted. In the autumn, for example, the British military delivered gasoline to gas stations, as the authorities failed to resolve the issue with labor immigrants. Well, the key topic remains the possible resignation of Boris Johnson in 2022. One of the last drops could be a party on the eve of Duke Philip's funeral, which Johnson arranged at his residence. He has already made his official apologies to Queen Elizabeth II, however, we recall that this is not the first time Johnson has behaved extremely disrespectfully towards her. At the very beginning of his reign, he blocked the work of Parliament, simply letting it go on forced vacations. And the corresponding decision was approved by Elizabeth II, as it is a British tradition to follow the requests of the Prime Minister. As a result, through the court, the opposition achieved the cancellation of this decision, which put the Queen herself in a very uncomfortable position. In general, now there is only talk that the Prime Minister may leave his post ahead of schedule. And these data on the "bearish" trend may give an additional acceleration to the fall of the pound.

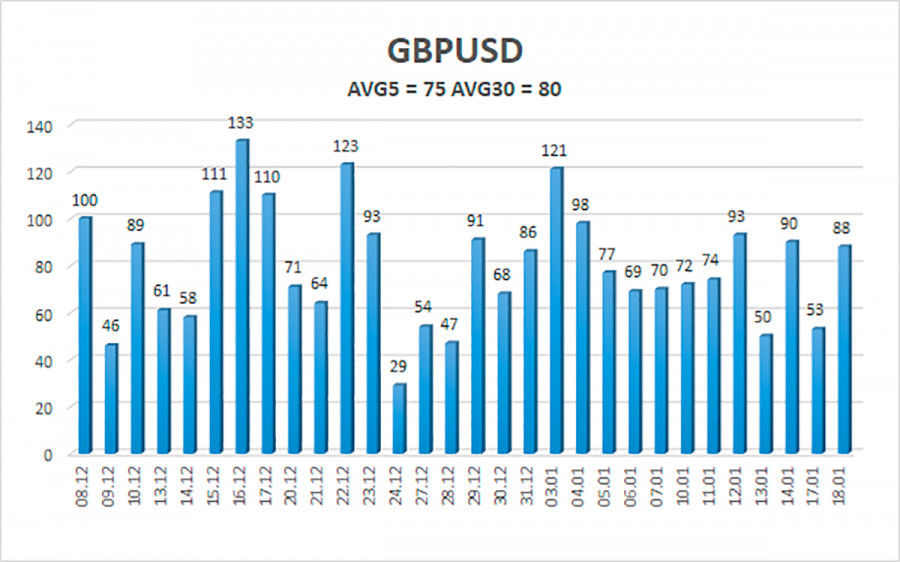

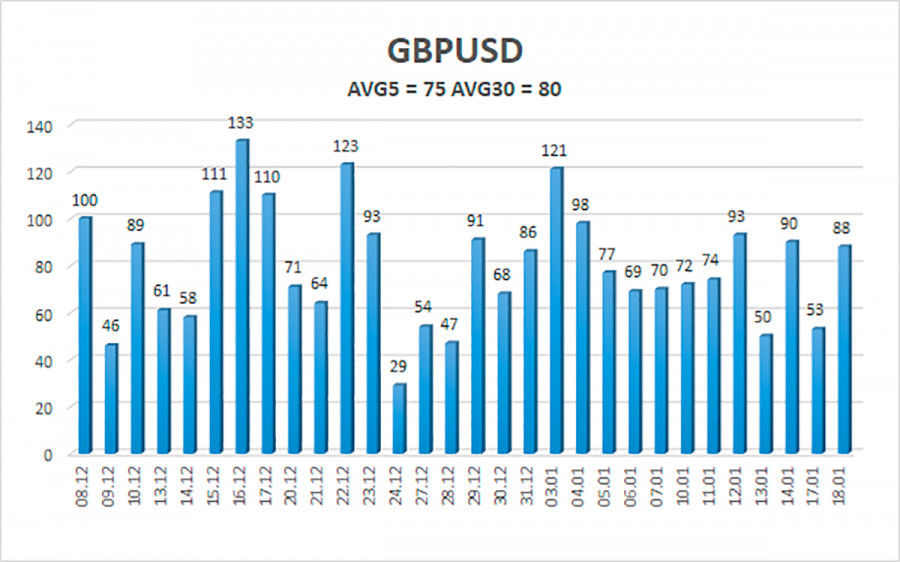

The average volatility of the GBP/USD pair is currently 75 points per day. For the pound/dollar pair, this value is "average". On Wednesday, January 19, thus, we expect movement inside the channel, limited by the levels of 1.3510 and 1.3660. The upward reversal of the Heiken Ashi indicator signals a round of upward correction.

Nearest support levels:

S1 – 1.3550

S2 – 1.3489

S3 – 1.3428

Nearest resistance levels:

R1 – 1.3611

R2 – 1.3672

R3 – 1.3733

Trading recommendations:

The GBP/USD pair has started a new downward movement on the 4-hour timeframe. Thus, at this time, it is recommended to stay in shorts with targets of 1.3550 and 1.3510 until the Heiken Ashi indicator turns up. It is recommended to consider long positions if the pair gains a foothold above the moving average with targets of 1.3672 and 1.3733, and keep them open until the Heiken Ashi indicator turns down.

Explanations to the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.