The euro-dollar pair continues to dive down to the lower limit of the 1.0120 – 1.0280 range, within which it has been trading for the fourth week in a row. The US currency is growing amid strengthening anti-risk sentiment, while the euro is getting cheaper amid the energy crisis and the publication of extremely weak indices from the ZEW Institute.

The failed inflation reports published last week in the US seem to have gone into oblivion: EUR/USD traders have shifted their attention to external fundamental factors. In my opinion, US inflation will still remind of itself—after all, de facto, none of the Fed representatives have publicly commented on the slowdown in key inflation indicators.

But today, the market has focused on other fundamental factors. For example, it became known that gas prices on European stock exchanges broke through the mark of $2,500 per thousand cubic meters. Commenting on this news, the Russian Gazprom noted that, according to conservative estimates, "prices will exceed $4,000 per 1,000 cubic meters in winter" if the relevant trends continue.

Against the backdrop of rising cost of "blue fuel" in Europe, electricity is also becoming more expensive. And it is very significant. For example, according to the latest data, electricity tariffs for next year in Germany jumped to 474 euros per MWh. For comparison, we can say that this is six times more than last year. The price has doubled in the last two months. Given the gloomy prospects for gas prices to rise to $4,000, we can assume that this is not the last round of electricity price increases. A similar trend can be seen in other European countries.

According to Bloomberg, there is panic in the market about gas reserves in Europe to generate electricity this winter. Overwhelming doubts about this are pushing the price up, and, apparently, the mark of 2500 is far from the limit. Market participants complain that nuclear capacity in France is "extremely low," which reduces the possibility of exporting electricity in the autumn-winter period.

Earlier, the European press has already sounded alarming signals that in autumn and (especially) in winter, residents of the EU countries may face not only a reduction in industrial production but also power outages. And according to the Financial Times, the largest industrial energy consumers in the European Union have already warned that with the advent of cold weather, some plants may stop due to an acute shortage of fuel and due to emergency measures introduced to limit its use. Against such prospects, experts from large financial conglomerates continue to voice pessimistic estimates, predicting a recession in the eurozone economy as early as the 4th quarter of this year.

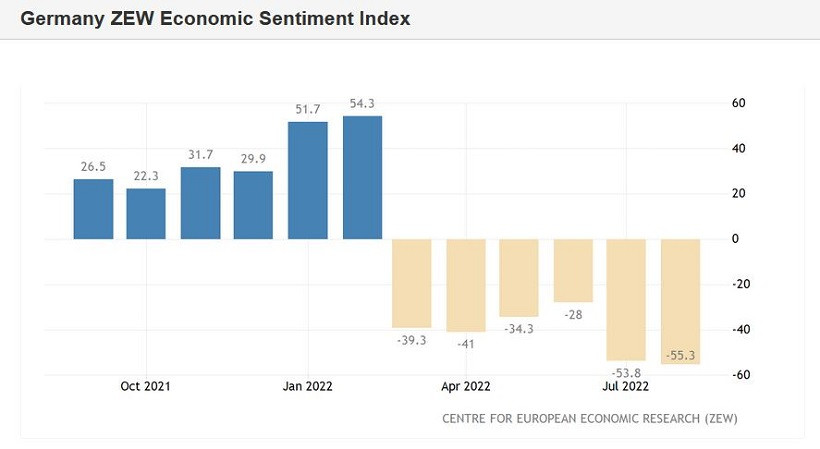

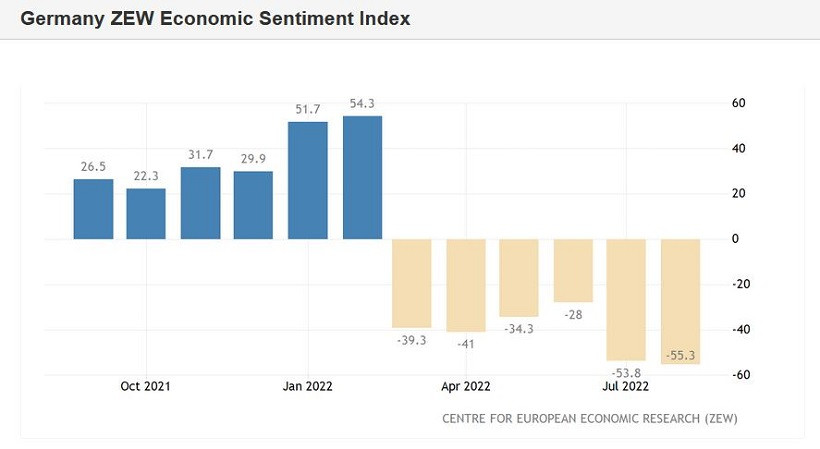

The ZEW indices published today have served as an eloquent illustration of the mood hovering in the European business environment. The indices came out in the red, reflecting the continued pessimism among German (and in general all European) entrepreneurs. In particular, German business sentiment in August came out at around -55 points, with a forecast decline to -52 points. The indicator has been in the negative area for the sixth month in a row.

The pan-European business sentiment index also showed negative dynamics, falling to -54.9 points. Therefore, there is no need to talk about any kind of clearance here—the release turned out to be worse than expected, and in general, the situation remains quite gloomy. Moreover, according to experts from the ZEW Institute, who commented on today's publication, the financial market experts interviewed expect a further decline in the already weak economic growth in Germany. The locomotive of the European economy continues to slip: high inflation and expected additional costs for heating and energy lead to lower profit expectations for the private sector.

Given the dynamics of growth in prices for "blue fuel" and Gazprom's forecasts of a 4,000 price level, it can be assumed that the energy crisis in Europe will only worsen. And the closer the fall, the stronger the panic about this will be felt (and manifested).

Thus, the US dollar is now strengthening its position due to the strengthening of anti-risk sentiment in the market. The euro, in turn, is under additional pressure amid the deepening energy crisis.

At the same time, there is no need to rush to sell EUR/USD now. The pair approached the lower boundary of the range 1.0120–1.0280, which also corresponds to the lower boundary of the Bollinger Bands indicator on the daily chart. In my opinion, it is advisable to consider short positions only if the bears consolidate below the level of 1.0100. In this case, the parity zone will become the next target for the downward movement. But if the downside impulse fades around 1.0120, longs with the first target at 1.0210 (the middle line of the Bollinger Bands indicator on the D1 timeframe) will be in priority.