As expected, the FOMC raised the upper limit of the federal funds rate by 0.75%, to 3.25%. At the final press conference, Federal Reserve Chairman Powell tried to downplay the significance of any mention of a possible rate hike by 100 bps, citing uncertainty about fluctuations in the inflation rate in recent months. He noted that "we got surprisingly low inflation figures in July and surprisingly high figures in August. We don't want to overreact."

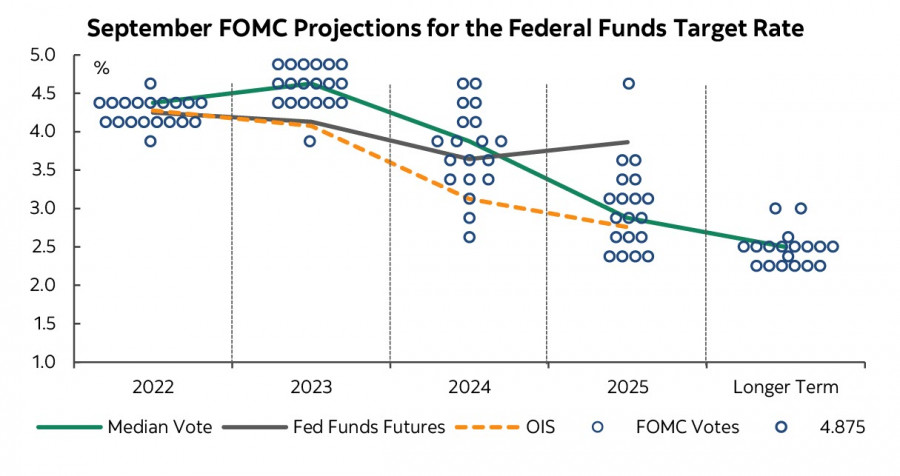

The expected decision would not have caused a rather violent reaction of the market, if not for the surprise that appeared in the dot chart. The FOMC predicts a rate of 4.25% at the end of 2022, which is 100p higher than in June, but one of the FOMC members sees the rate at the end of the year at 4.5%, and then even more curious – some of the participants see a rate of 5% in the 1st quarter of 2023.

This is significantly higher than was voiced by at least one of the Committee members earlier. When Powell was asked why the pace of rate hikes was accelerating, he was forced to admit that the Committee did not see a decrease in inflation, it was higher than expected, the 3-, 6- and 12-month averages for core inflation were higher than forecasts, and therefore more decisiveness was needed.

Simply put, the Fed is scared by the inflation data for August, and by the fact that the smoothed inflation trend is more stable than we would like. Powell's reservation also pushes to this conclusion that if they do not show determination now, a situation of loss of control over inflationary processes may develop.

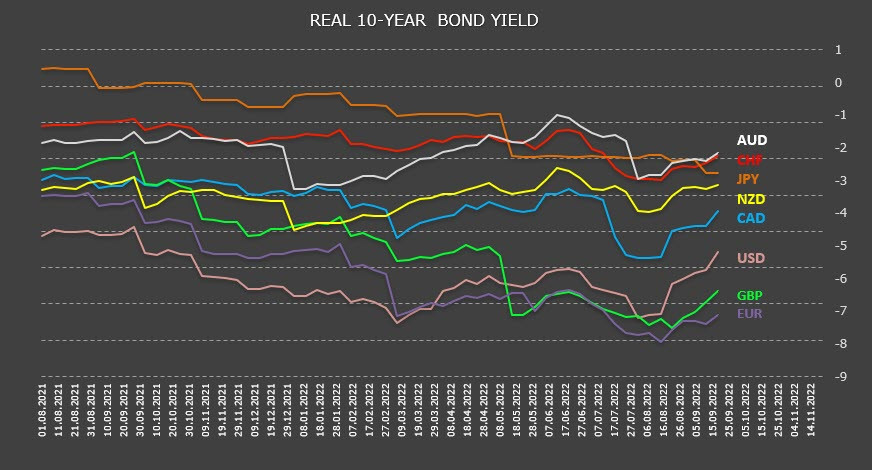

The key to understanding lies in the following phrase: "We want real rates to be positive across the yield curve." Yes, while the situation with real rates is far from optimistic. Despite the fact that the decisive actions of a number of central banks this week and earlier led to some growth in real yields, they are still deeply negative, which is clearly visible on a simple graph of 10-year bond yields minus inflation. We can say that the picture of global inflation in comparison with June has become not better, but even worse.

So, the FOMC clearly makes it clear that it is preparing for a longer period of high inflation than it expected quite recently. A slowdown in the rate of rate growth is possible only if several conditions are met, for which there is no clarity yet, namely, a slowdown in economic growth, a steady unemployment rate near 4.5% and cooling consumer demand, and most importantly, evidence that inflation is returning to 2%, which may happen by about 2025.

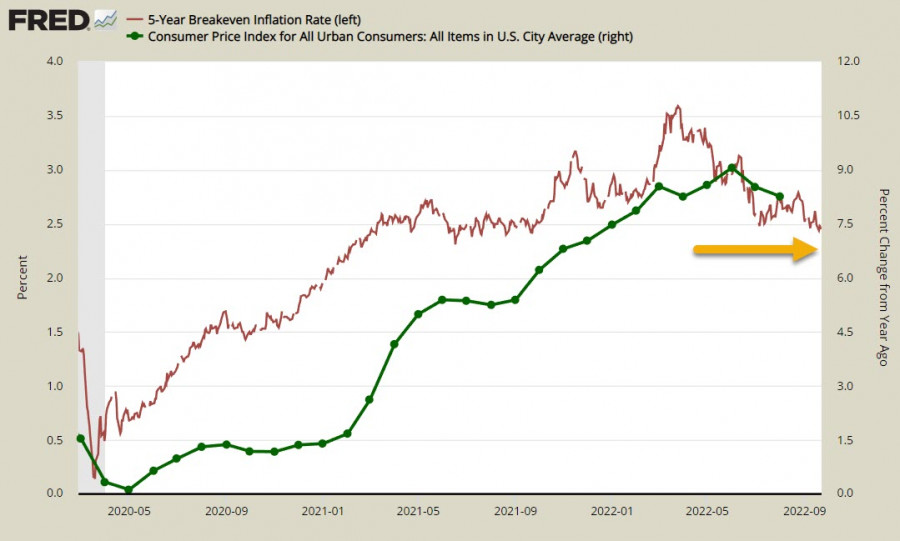

The last point also raises quite obvious questions. As follows from the dynamics of the yields of inflation-protected 5-year Tips bonds, business sees inflation in the future 5 years above 2.5%. Yes, there is a pullback from the peak of 3.6% in April, but the goal is still noticeably higher than the target, which means additional steps are needed so that inflation expectations come to where the Fed wants them to be.

The House Committee on the Budget has released an extensive study in which it notes that higher interest rates will lead to higher interest expenses paid by the Treasury, and slower economic growth will lead to lower tax charges. In any case, the growth of the budget deficit cannot be avoided.

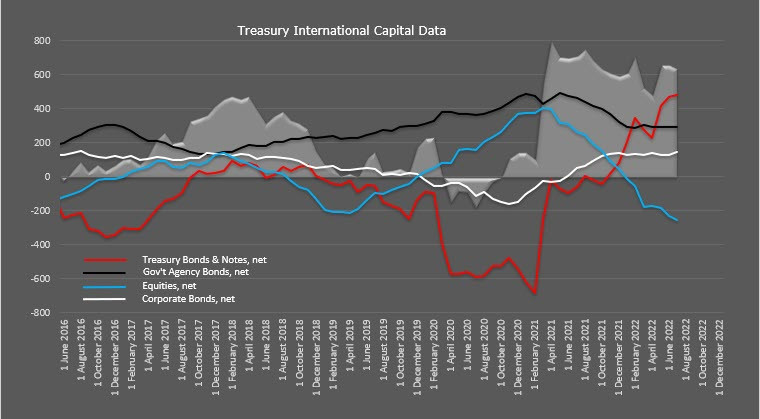

The report of the US Treasury on the movement of foreign capital confirmed all the trends that had developed earlier. The exit from the stock market continues, for 12 months -257.5 billion, but the growth of investments in US Treasuries is growing slightly, despite the fact that a number of oil countries receive huge windfalls.

The general conclusion of the FOMC meeting is as follows. Inflation is stronger than it was assumed quite recently, and a much tougher policy is required to bring it under control. This is, on the one hand, a faster increase in rates and an attempt to get out of the zone of negative real profitability, but on the other hand, a slowdown in GDP, an increase in unemployment, a decrease in consumer demand, a reduction in budget revenues from taxes with a simultaneous increase in interest costs. All the signs of a deep recession are there, and it cannot be avoided.

In the foreign exchange market, these trends will presumably give the following result. The incomes of commodity-producing countries will fall due to a reduction in demand, despite relatively high prices. Accordingly, commodity currencies will remain under pressure and are unlikely to find the strength to grow. The yen will weaken until there are prerequisites for a change in the monetary policy of the Bank of Japan, and this will not happen soon.

Europe is waiting for an increase in capital flight, which will be compensated by more aggressive actions of the European Central Bank. It is still impossible to say for sure whether the ECB will be able to keep the euro from a large-scale fall.

The US dollar will remain the main favorite of the foreign exchange market. The demand for the dollar will be supported not only by the energy crisis, in which domestic energy prices within the United States are cheaper than in the rest of the world, but also by the growth of geopolitical tensions, which always leads to an increase in demand for the dollar as the main protective asset.