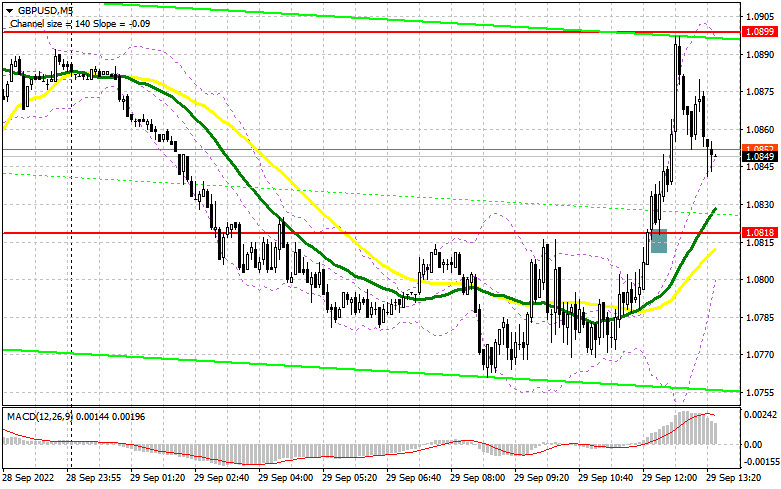

In my morning forecast, I paid attention to the level of 1.0818 and recommended making decisions on entering the market. Let's look at the 5-minute chart and figure out what happened. After a slight Asian correction, buyers of the pound returned to the market, counting on more global support from the Bank of England. The breakthrough and the reverse test of 1.0818 led to a good buy signal, which increased by more than 80 points. Then a resistance test of 1.0899 took place, from which it was possible to get a good sell signal. At the time of writing, the pound has already gone down more than 50 points.

To open long positions on GBP/USD, you need:

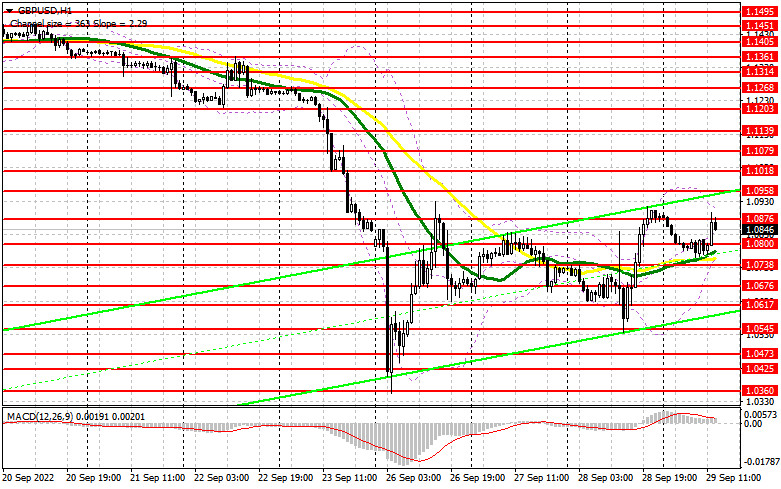

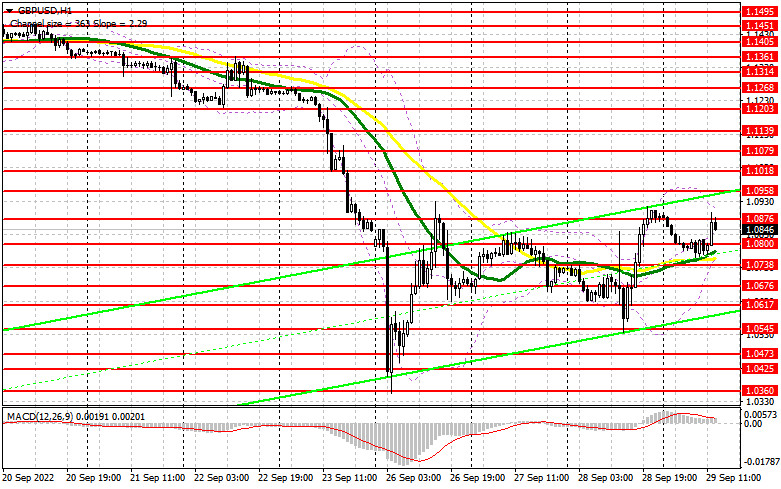

The pound buyers are counting on a dash up - they need to do something with the resistance of 1.0876, which they hit in the first half of the day. Let's see how the market reacts to the data on the number of initial applications for unemployment benefits in the United States and the change in GDP for the second quarter of this year. The fundamental background is not serious, so the bulls may be able to pull themselves together and break through to the weekly maximum. Statements by FOMC representatives James Bullard, Loretta Mester, and Mary Daly may slightly cool their ardor in the afternoon. In the case of a decline in GBP/USD, the optimal scenario for buying will be the formation of a false breakdown in the 1.0800 area, where the moving averages are playing on the buyers' side. This will give an excellent entry point to return to 1.0876. Only after getting above this range will it be possible to talk about building a further upward correction for the pair to move to 1.0958, where it will become more difficult for buyers to control the market. A more distant target will be the 1.1018 area, leading to a fairly large market capitulation of sellers. I recommend fixing profits there. In the event of a fall in GBP/USD against the background of hawkish statements by representatives of the Federal Reserve System and the absence of buyers at 1.0800, the pressure on the pound will return. If this happens, I recommend postponing long positions to 1.0738 and 1.0676. I advise you to buy there only on a false breakdown. You can open long positions on GBP/USD immediately on a rebound from 1.0617 or in the minimum of 1.0545 to correct 30-35 points within a day.

To open short positions on GBP/USD, you need:

Protecting the nearest resistance at 1.0876 remains an important task for the second half of the day. Yes, the bears showed themselves for the first time, and while trading will be conducted below this range, we may reach the support of 1.0800 – we need a good fundamental reason or another news about problems in the UK markets. In case of a re-growth of the pair, only the formation of a false breakdown at 1.0876 will confirm the presence of buyers in the market and return pressure on the pound, which forms a sell signal based on the development of a bearish trend and a decline to the nearest support of 1.0800. A breakthrough and a reverse test from the bottom up of this range, which was formed at the end of the first half of the day, will give an entry point for sale with a fall to a minimum of 1.0738, but a much more interesting target will be the 1.0676 area, where I recommend fixing profits. With the option of GBP/USD growth and the absence of bears at 1.0876, the situation will return to the control of buyers, albeit only for a while, which will lead to an update of the next weekly maximum in the area of 1.0958. Only a false breakout at this level forms an entry point into short positions in the expectation of a downward correction. If there is no activity, there may be a jump up to the maximum of 1.1018. I advise you to sell GBP/USD immediately for a rebound, counting on the pair's rebound down by 30-35 points within a day.

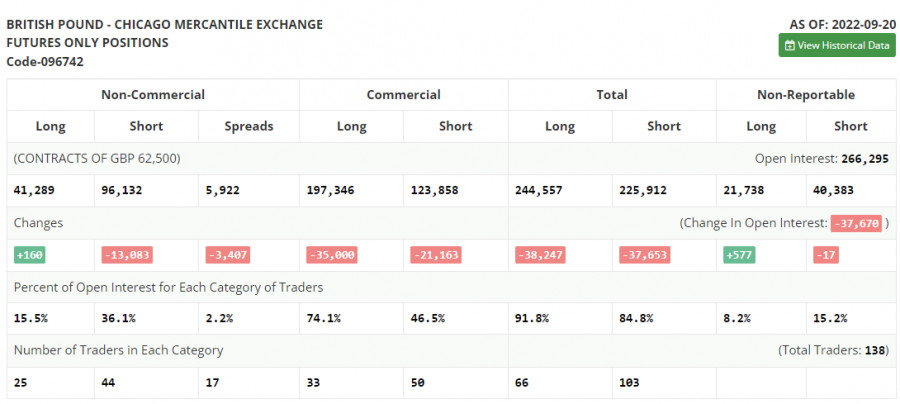

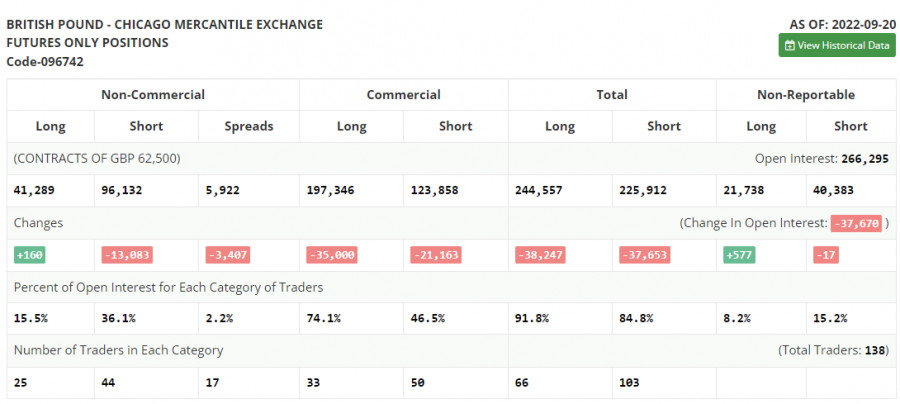

The COT report (Commitment of Traders) for September 20 recorded an increase in long positions and a reduction in short ones. However, this report does not consider what is currently happening in the market, so you do not need to pay much attention to it. The changes that have taken place in just a few days in the UK are now dictating the pair's direction. Last week, the Bank of England raised interest rates by only 0.5%. And they already regret it since, after that, the Ministry of Finance announced that they were ready to provide unprecedented assistance to households to cope with high energy prices. They also announced a large tax cut to support and stimulate the economy. However, they forgot to mention that this will further accelerate inflation, which the Bank of England is not very good at coping with. This provoked a pound sell-off by almost 1,000 points in two days. Investors took advantage of this moment and the well-depreciated pound and bought it off, but it is difficult to say that the market eventually found the bottom. There are a lot of statistics out of the US this week, which could put pressure on the GBP/USD pair. The latest COT report indicates that long non-commercial positions increased by 160 to 41,289. In contrast, short non-commercial positions decreased by 13,083 to the level of 96,132, which led to a slight reduction in the negative value of the non-commercial net position to the level of -54,843 versus – 68,086. The weekly closing price collapsed from 1.1392 to 1.1504.

Signals of indicators:

Moving Averages

Trading is conducted above the 30 and 50-day moving averages, indicating the bulls' attempt to build a correction.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In case of growth, the upper limit of the indicator around 1.0900 will act as resistance.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.