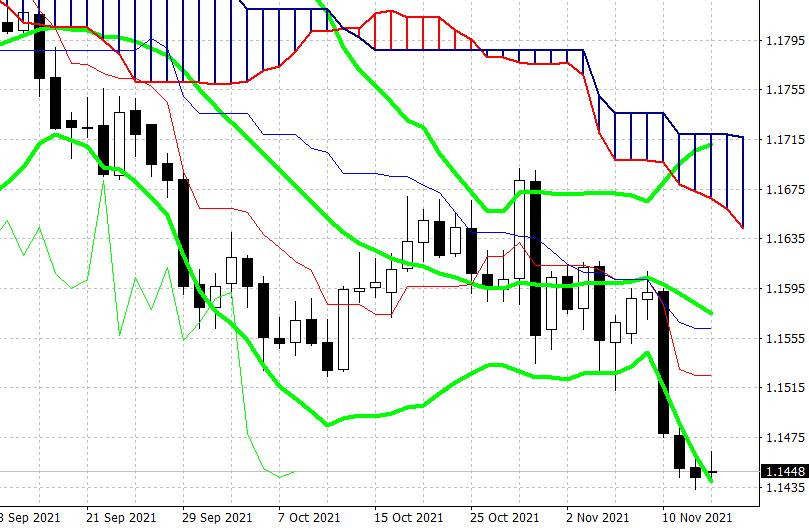

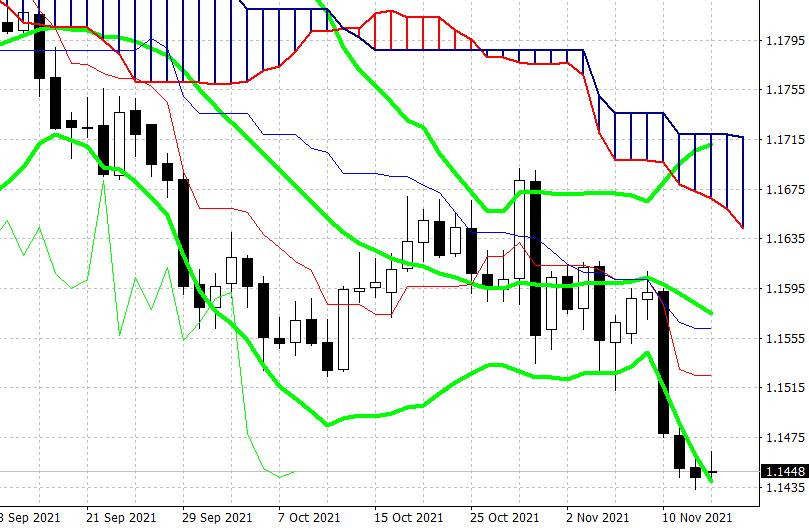

The EUR/USD pair is showing an upward correction at the start of the new trading week, after an impulse decline. Last Friday, the bears managed to update their 16-month price low, emerging at the level of 1.1433. However, traders did not have time to test the borders of the level of 1.13 – the downward impulse disappeared before the weekend.

During Monday's Asian session, the price left the aforementioned lows, amid a corrective pullback that was triggered by the publication of Chinese data. It became known that China's volume of industrial production increased in October by 3.5% against the forecasted growth of 3.0%. The retail sales were also encouraging, the volume of which rose by 4.9% last month, against the forecast of 3.5%. The growth of Chinese macroeconomic indicators led to the craving for risky assets, allowing EUR/USD buyers to organize a corrective rebound.

Nevertheless, the pair still remains within the level of 1.14. The first resistance level is located at 1.1525 (the Tenkan-sen line on the daily chart), while the main price barrier is higher – at 1.1580 (the average Bollinger Bands line on the same timeframe). If this target is broken, the Ichimoku indicator will form a "Golden Cross" signal, which will indicate the final extinction of the downward price wave. However, this is still a long way off – EUR/USD bulls are not yet able to even approach the borders of the 15th mark, let alone break through the level of 1.1580. Therefore, we are currently talking about a fairly modest corrective pullback, which may fade away in the afternoon today.

The fact is that ECB President Christine Lagarde is expected to speak today. She will announce a report to the members of the European Parliament's Committee on Economic and Monetary Issues. Since the topic of the report is directly related to monetary policy, the market will show special interest in it. It can be recalled that according to the results of a survey conducted by Reuters among economists, inflation in the eurozone will continue to accelerate and will exceed the ECB's 2% target level in the first half of 2022. But at the same time, some experts admit an increase in the interest rate at the end of 2022. As for the prospects for QE, economists' opinions are also divided here. Almost everyone agrees that the size of the APP asset purchase program will be increased from the current 20 billion euros per month after the completion of the PEPP emergency asset purchase program at the end of March next year. However, some analysts said that the volume will be increased to 30 billion, while others said up to 40 billion (this scenario sounded most often), or up to 60 billion.

At the same time, the ECB's economic bulletin published last Thursday indicates that inflation should decrease next year, despite the fact that it turned out to be more stable than previously predicted. According to Central Bank economists, price pressure remains high due to rising inflation in the food and energy sectors (oil, gas, electricity), as well as the effect of the low base of last year. "The main part of this price pressure is temporary," this phrase of the bulletin reflects the ECB's current position.

And yet, contrary to the declarations of the European regulator, the market makes independent conclusions about the prospects of the Central Bank's monetary policy (in fact, as in the case of the Fed). Against the background of Europe's record inflation growth, traders started talking about the "forced" tightening of monetary policy again. According to Capital Economics, the market expects a rate increase of 10 basis points in the fall of next year.

It is necessary to emphasize here once again that such hawkish expectations are not provoked by ECB members (unlike the situation with the Fed, where representatives of the "hawkish wing" are calling for a rate hike in 2022). Throughout the previous week, many ECB representatives have spoken – in particular, Lane, Knot, Shimkus, Ren, Schnabel. They all voiced a "dovish" position, emphasizing the temporary increase in inflation in the eurozone. There is no doubt that Christine Lagarde will "moderate the hawkish character" of some traders in the walls of the European Parliament today, ruling out the possibility of a rate hike next year.

This fact may put pressure on EUR/USD, although Lagarde's speech is unlikely to provoke another downward wave. Most likely, the pair will trade in the range of 1.1430-1.1500 in the medium term, reacting reflexively to the current news flow. If we talk about a trading strategy for a pair, then it is uncomplicated – any more or less large-scale upward correction can still be used to open short positions. The main target is the lower limit of the above range (1.1430). It will be possible to talk about the first signs of a trend reversal only when the pair breaks through the resistance level of 1.1580 (the average line of the Bollinger Bands on the D1 timeframe).