Wave pattern

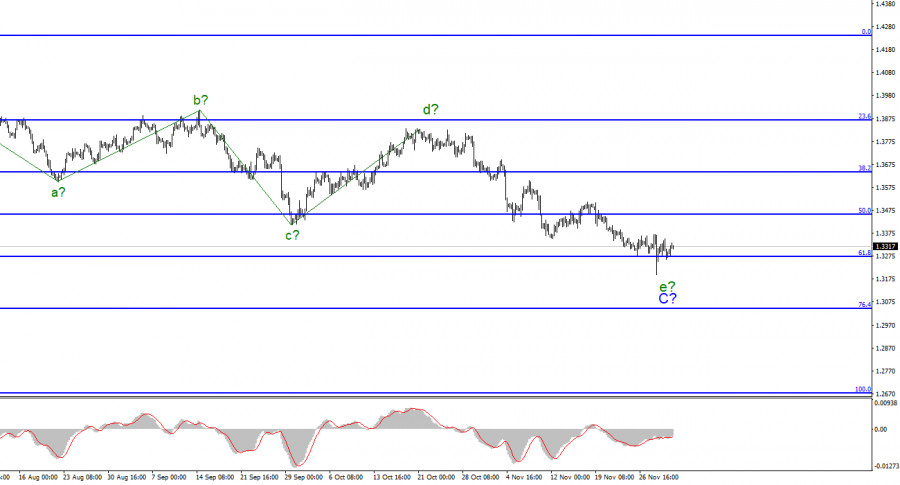

The wave counting for the Pound/Dollar instrument continues to look quite complicated, but at the same time quite convincing. Five internal waves are visible inside the last wave C, and each subsequent one is approximately equal in size to the previous one. However, since all the waves in the composition of C or A are almost equal in size, the last wave e may be nearing its completion or already be completed. An unsuccessful attempt to break through the 1.3271 mark indicated that it was completed and with it the entire downward section of the trend.

However, the collapse of the instrument on Tuesday cast doubt on this assumption, but the next two days showed that it could be true. The instrument has spent all this time above the 61.8% Fibonacci level, which equates to 1.3271. Thus, the markets have already twice made an unsuccessful attempt to break through the 1.3271 mark, which indicates readiness to increase the instrument. However, without an increase in demand for the pound, there will be no increase. A successful attempt to break through this mark will lead to a complication of wave e in C.

Boris Johnson and Emmanuel Macron continue their verbal skirmish

The exchange rate of the Pound/ Dollar instrument gained about 50 basis points on Thursday, but this increase does not make any special sense for the British pound, since it still remains around the 33rd figure, and cannot decide in any way whether the construction of the downward wave e in C will continue or the construction of a new upward trend section will begin. Unfortunately, the demand for the British pound is minimal at present. And depressing news, albeit not coming from the UK, are directly affecting the pound.

On Wednesday, French President Emmanuel Macron had a personal conversation with British Prime Minister Boris Johnson, which somehow became public. According to reports, Johnson's post on a social networking site addressed to Macron, displeased the French president. Macron then called this way of doing things "clowning."

"I am surprised by methods when they are not serious. We do not communicate from a leader to another on these issues through tweets or letters made in public," the French president said.

The media also report that in a personal conversation with Macron, Johnson communicates absolutely normally, and only then, in public, arranges a "circus". However, the words "clowning" / "clown" were not uttered publicly, so there is always the possibility of a "newspaper duck."

The fact is that relations between France and the UK continue to become more complicated due to fishing dispute, as well as because of the issue of illegal migrants crossing the English Channel from France to the UK.

General conclusions

The wave pattern of the Pound/Dollar instrument looks quite convincing now. The intended wave e can be completed. Thus, now I would advise buying the instrument with the expectation of building a new trend section in the near future since there are already two unsuccessful attempts to break through the 1.3271 mark. As in the case of the Euro/Dollar, I advise cautious, small purchases with targets located near the estimated mark of 1.3456, which corresponds to 50.0% Fibonacci level.

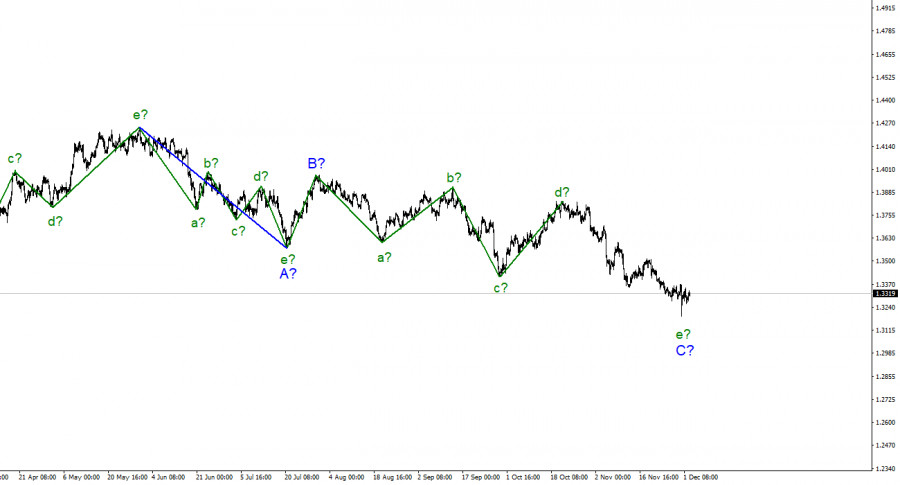

Starting from January 6, the construction of a downward trend section continues, which can turn out to be almost any size and any length. At this time, the proposed wave C may be nearing its completion (or completed), but there is no unambiguous confirmation of this yet. The entire downward section of the trend may lengthen, but there are no signals about this yet either.