Long-term perspective.

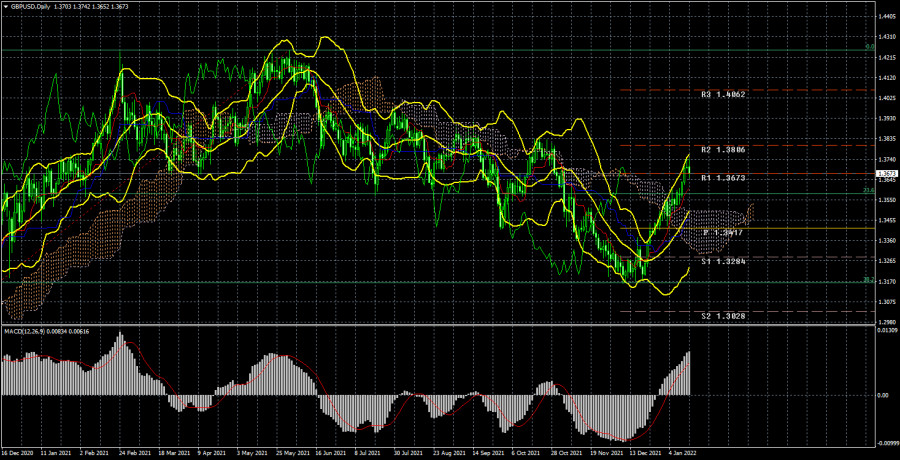

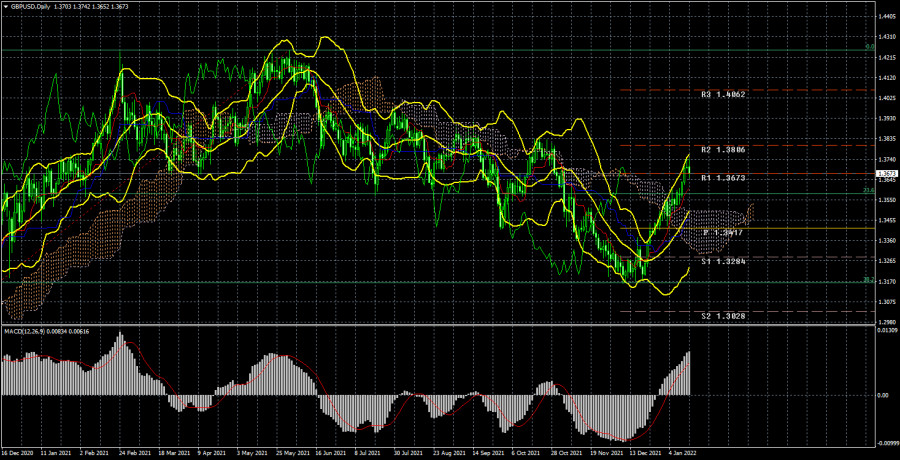

The GBP/USD currency pair has increased by another 100 points during the current week. Thus, the recoilless growth has been going on for almost a month. We have already said earlier that at first this growth could have been triggered by the decision of the Bank of England to raise the key rate. But almost a month has passed since that moment, and the pound continues to grow although no positive news is coming from the UK. However, the pound overcame the Ichimoku cloud almost seamlessly, therefore, traders are set to buy the pound/dollar pair. What can all this mean? First, it may mean a banal correction against the downward trend of 2021. On the 24-hour TF, it is visible that at the moment the price has failed to go beyond the previous local maximum. Consequently, the downward trend may persist. Second, it means that the fundamental background does not play a special role for traders now, since many significant events did not provoke the reaction that one would expect. Third, this means that in the near future the euro/dollar and pound/dollar pairs may try to "come into balance". Most of the time they move the same way, as they are influenced by strong American factors. However, in recent months they have been moving in completely different ways, although the fundamental background from the UK or the European Union is not so strong. Based on this, we believe that the pound sterling may begin to fall in the near future. At least a part of the correction, since the overall growth over the past month is already 560 points.

Analysis of fundamental events.

In principle, everything we said in the article on the euro/dollar is also relevant for the pound/dollar. This week, representatives of the Fed made it clear that they are not going to deviate from the planned plan to tighten monetary policy, therefore, the "hawkish" rhetoric not only persists but also intensifies. However, for most of the weeks, the pound calmly continued to grow. On Friday, when the report on retail sales in the United States failed, and a little earlier, quite good statistics were released in the UK on GDP and industrial production, the pound was falling. There was absolutely no logic. Or traders react selectively to the fundamental background. But even in this case, it is quite difficult to explain the movement of quotes from the point of view of the "foundation". At the end of this month, the Bank of England and the Fed will hold new meetings at which new important decisions can be made. Perhaps these events will bring traders back from their "parallel reality", but since the "foundation" is being ignored at the moment, more attention should be paid to the "technique". Separately, I would like to note the report on American inflation this week, which showed another acceleration of the consumer price index to 7.0% y/y. Earlier, rising inflation also supported the US currency, as it increased the likelihood of tightening the Fed's monetary policy. This week, the inflation report provoked a drop in the dollar, which once again confirms that the markets interpret the "foundation" and "macroeconomics" in their way.

Trading plan for the week of January 17 - 21:

1) The pound/dollar pair has overcome the Kijun-sen and Senkou Span B lines and is now ready to form a new upward trend. Thus, at this time, it is possible to continue trading on the lower TF for an increase, but we should expect a small pullback down, which should end at least below the critical line. After that, a new round of upward movement should begin with the goals of 1.3673 and 1.3806, and maybe even higher. But for this, the pound sterling must receive fundamental support.

2) The bears have let the initiative out of their hands. Now it will be possible to consider selling the pair again no earlier than fixing the pair below the Kijun-sen line. The level of 1.3162, which is a strong Fibonacci level of 38.2%, kept the pair from falling further, so the "technique" does not imply a new strong fall in the pound in the first months of 2022.

Explanations to the illustrations:

Price levels of support and resistance (resistance /support), Fibonacci levels - target levels when opening purchases or sales. Take Profit levels can be placed near them.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).