At yesterday's trading, the main currency pair continued a very modest and unhurried rise, comparable to that observed last Friday. Let's take a closer look at the EUR/USD price charts a little later, and now briefly about some events and macroeconomic statistics.

I think it's no secret that in connection with Russia's military special operation in Ukraine, Moscow has been hit by a hail of sanctions, the most painful of which is the refusal of European consumers of Russian oil and gas. Thus, Hungary, where the current head of the Cabinet of Ministers Viktor Orban has been elected Prime Minister for the fifth time, actively defends its right to receive relatively inexpensive Russian hydrocarbons, since there is no alternative to them in price and quality yet. So at the last meeting of the European Union, held within the framework of the Council on Foreign Affairs, Hungary again opposed the embargo on oil supplies from the Russian Federation. In addition, three more European countries, Bulgaria, Slovakia, and the Czech Republic are begging Brussels to allow them to use Russian hydrocarbons at least until the end of 2024 or to pay considerable compensation. Many other European countries are also very vulnerable to the supply of hydrocarbons from the Russian Federation, and this was openly stated by the EU High Representative Josep Borrel. At the same time, this politician, as usual, very extensively and not at all argumentatively called on European states to overcome energy dependence on the Russian Federation, without offering any alternative in return. In general, it's easy to say, but hard to do. As for the impact of this situation on the exchange rate of the single European currency, the energy problems of European countries, which may well lead to a crisis in this industry, certainly do not benefit the euro.

If you look at the economic calendar, first of all, I note that yesterday's data on the trade balance without seasonal adjustments of the eurozone, as well as the index of activity in the manufacturing sector from the Federal Reserve Bank of New York, came out in the red zone, so they could hardly have any impact on the course of Monday's trading. Today at 10:00 London time, reports on GDP and changes in the number of employed will be received from the eurozone. I would like to note that this is far from the latest statistics, but whether market participants will react to it will show the course of trading. From American reports, I recommend paying attention to retail sales and industrial production. In addition to all this, ECB President Christine Lagarde is scheduled to speak at 18:00 (London time), and Fed Chairman Jerome Powell will take up the baton in an hour. In general, today is quite informative and eventful. However, it is still completely unclear whether investors will react to these events.

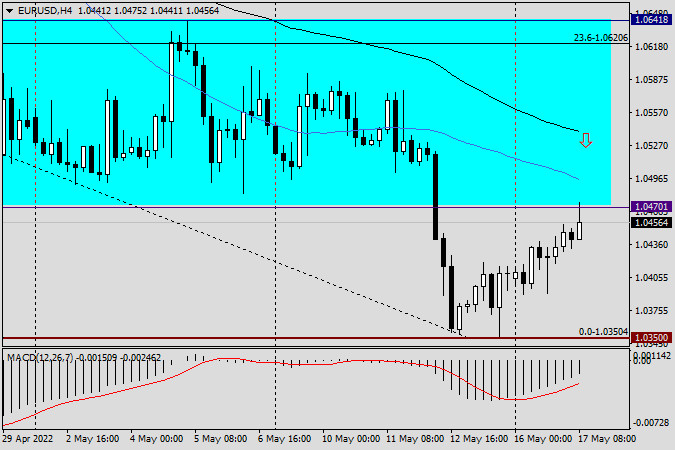

H4

On the four-hour chart, we see that after the pair exits the selected range to its upper limit, a slow and very cautious pullback occurs. In principle, the rollbacks should be like this. Here, an interesting moment will be the meeting of the euro/dollar with the lower limit of the selected range of 1.0470, just above which the blue 50-a simple moving average- passes. For sure, the euro bulls will try to return the quote to the limits of the abandoned range, as well as above the most important psychological mark of 1.0500. Because there is also a black 89 exponential at 1.0540, I suggest tracking the price behavior on this or hourly charts near 1.0470, 1.0500, and 1.0540. If bearish reversal patterns of candle analysis appear there, I recommend considering EUR/USD sales.