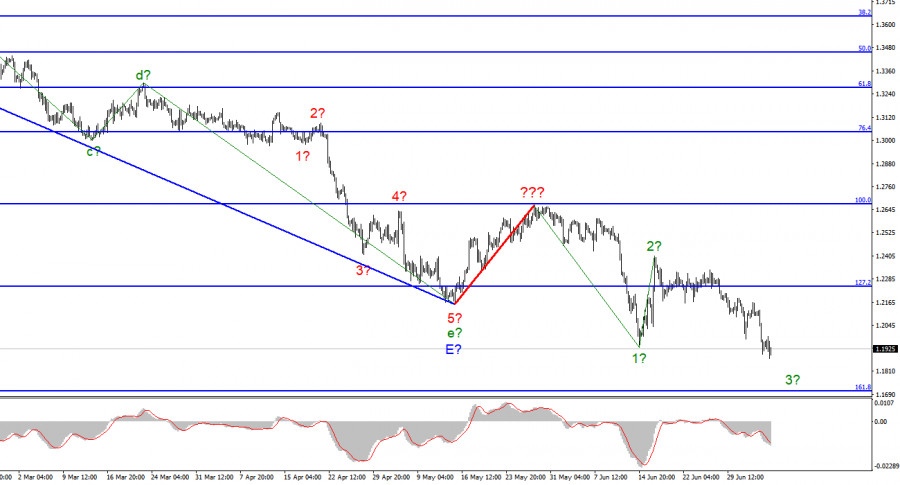

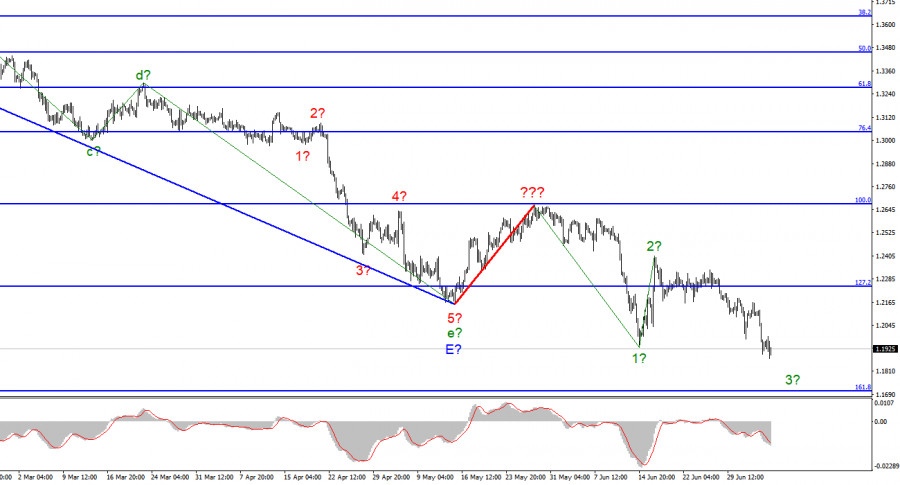

The wave marking for the pound/dollar instrument required clarifications, which were made. The last downward wave has already exceeded the prior wave's minimum, indicating the continuation of the downward trend section. In addition, the drop in the price of the instrument over the past two days has caused the current downward wave to surpass its predecessor's minimum. Thus, it is certain that the construction of the trend's correction portion has been canceled, and the trend's downward segment will assume a more protracted form. I'm not a big fan of continually complicating the wave marking when dealing with a highly elongating trend zone. I believe it would be far more efficient to recognize rare corrective waves, following which new impulse structures can be constructed. We observe waves 1 and 2. Thus, we may assume that the instrument is currently constructing wave 3. If this is the case, the slide may continue with objectives near the Fibonacci level of 161.8%. The market has demonstrated that it is now more necessary to adhere to the trend than to mark waves.

The industry's activity index in the United Kingdom is dropping.

The exchange rate of the pound/dollar instrument declined by only 40 basis points on July 6, compared to 150 the day before. Thus, the value of the British pound has plummeted by about 200 points in two days. I cannot claim this is a collapse, but I want to point out that the news background in recent days has been pretty poor, and it was completely lacking on Monday. Many did not anticipate such high market activity in the two days after the Fourth of July in the United States. However, the market might occasionally surprise. Yesterday and today, a business activity index was released in the United Kingdom. There were no American figures yesterday, and today – just an hour ago – the PMI and ISM business activity indices for the services sector were issued, but for obvious reasons, they could not alter the market sentiment on Tuesday and Wednesday.

Consequently, the demand for the pound has diminished for no visible reason. This leads me to the conclusion that market sentiment is now more essential than wave identification. However, we now have a new plan, which entails the development of a five-wave structure. Currently, wave 3 is being constructed, and the British pound may fall another 200-300 points before completion. Nonetheless, I do not forget that the wave marking needs revisions and currently lacks a holistic perspective. Consequently, it can assume a more sophisticated shape in the future. Despite the market's continued commitment to the strategy observed over the past year and a half, it is nevertheless evident that it is apprehensive about new instrument sales at such low prices.

I would also like to discuss American business activity indicators. In June, the PMI indicator for the service sector was 52,7, while the ISM index was 55,3. Both values are lower than they were in May, but not enough to cause a reduction in dollar demand. Although it would be intriguing to observe the market's reaction, would the dollar tumble if both indices sank significantly? Or does the market as a whole now disregard news, and there is no use in attempting to identify a correlation between market movements and news?

General conclusions

The increased complexity of the pound/dollar pair wave structure currently signals a further collapse. For each "down" MACD signal, I recommend selling the instrument with objectives at the estimated mark of 1.1708, corresponding to 161.8% Fibonacci.