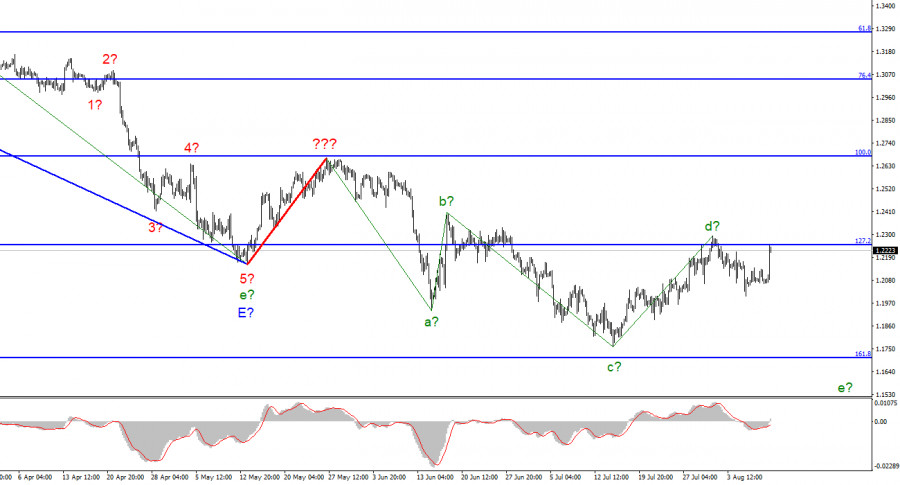

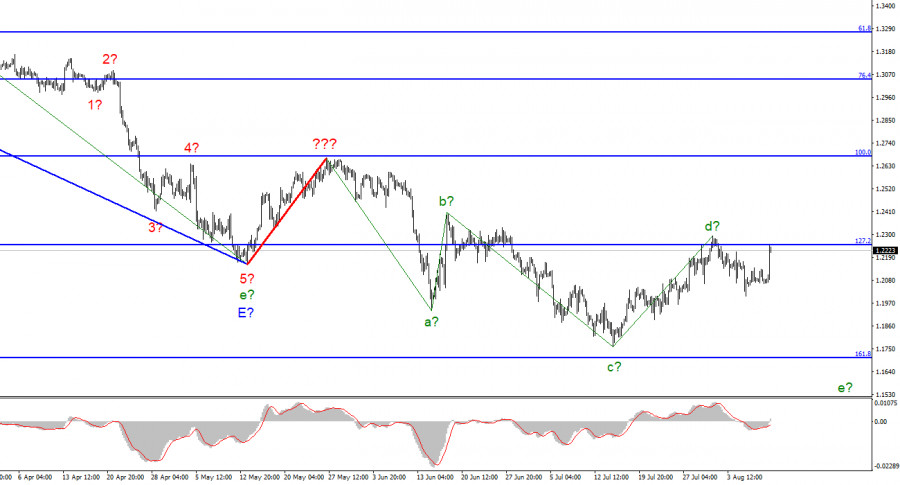

For the pound/dollar instrument, the wave marking looks quite complicated at the moment but does not require any clarifications yet. The upward wave, which was built between May 13 and May 27, does not fit into the overall wave picture, but it can still be considered corrective as part of the downward trend section. Thus, it can now be concluded that the downward section of the trend takes a longer and more complex form. I am not a big supporter of constantly complicating the wave marking when dealing with a strongly lengthening trend area. It would be much more appropriate to identify rare corrective waves, after which new clear structures will be built. At the moment, we have completed waves a, b, c and d, so we can assume that the instrument has moved on to constructing wave e. If this assumption is correct, the quotes' decline should continue in the coming days and weeks. The wave markings of the euro and the pound differ slightly in that for the euro, the downward section of the trend has an impulse form (for now), but the ascending and descending waves alternate almost identically, and at this time, both instruments presumably completed the construction of their fourth waves at the same time. However, there are other more significant differences. The increase in quotes today, caused by the US inflation report, had a very bad effect on both wave markings.

The exchange rate of the pound/dollar instrument increased by 130 basis points on August 10. During the day, it was even higher, but at the time of writing, it stopped at +130 points. It is obvious to everyone that the only reason for such a strong decline in demand for the US dollar is the inflation report, which showed its decline by 0.6% year on year. I want to draw attention to an important factor that can help determine the further dynamics of the pound/dollar instrument. The pound has now returned to the 127.2% Fibonacci level, near which the (presumably) construction of wave d was completed a week earlier. If the increase in quotes continues, a successful attempt will be made to break through the 1.2250 mark, and the d wave will have to be recognized as even more extended. But then it can go beyond the peak of the expected wave b, disrupting the structure of even the correction set of waves. Thus, the situation is now very complicated but almost unambiguous. Until a successful attempt to break through the 1.2250 mark, the chances of building a wave e remain. After the breakthrough of 1.2250, serious changes will have to be made, and it is impossible to say what kind of wave structure will take after that.

The pound will still have to face Britain's GDP report this week. For everything to go according to the plan I have outlined, the GDP report should be weaker than market expectations, which are -0.2% q/q. Then the demand for the British dollar will decrease, and the increase in quotes on Wednesday can be considered an internal corrective wave as part of the future wave e.

General conclusions

The wave pattern of the pound/dollar instrument suggests a further decline. I now advise selling the instrument with targets near the estimated mark of 1.1708, which equates to 161.8% Fibonacci, for each MACD signal "down." But a successful attempt to break through the 1.2250 mark will indicate the cancellation of the scenario with the instrument sales.

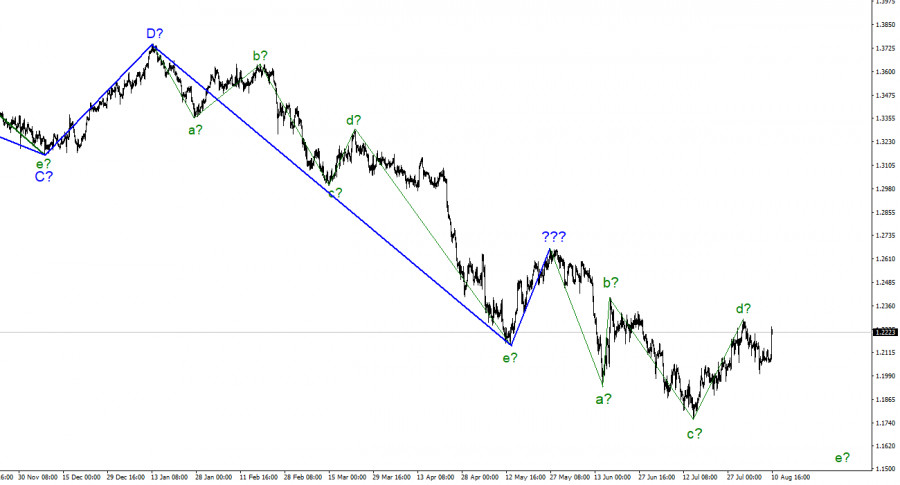

The picture is very similar to the Euro/Dollar instrument at the higher wave scale. The same ascending wave does not fit the current wave pattern, the same three waves down after it. Thus, one thing is unambiguous – the downward section of the trend continues its construction and can turn out to be almost any length.