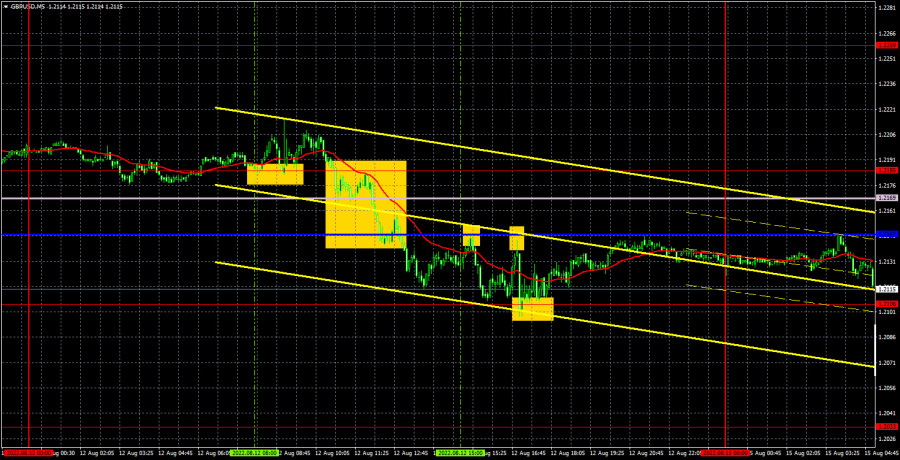

GBP/USD 5M

The GBP/USD currency pair was inclined to fall on Friday. However, it moved in a much more complicated way than the EUR/USD pair during the day. Firstly, the pound was trading in such a price range, in which there were a lot of lines and levels. Four, to be exact. All these levels and lines were located quite close to each other, so they formed whole areas of support/resistance. Secondly, the price changed direction quite often. Thirdly, traders were clearly confused early in the morning due to conflicting macroeconomic statistics from the UK. What was so strange about it? The GDP indicator in all its variations turned out to be better than forecasts. But at the same time, in monthly and quarterly terms, it decreased. And Bank of England Governor Andrew Bailey last week already announced a five-quarter recession. Accordingly, traders simply waited for even lower values, but did not wait for them. The same is true for the industrial production report. Its value turned out to be negative, but better than traders expected. In general, such statistics should have led to the strengthening of the pound. But, as we have already said, it was contradictory, and the pound was clearly not eager to continue rising for a few more days based on the US inflation report alone.

As for trading signals, the very first buy signal turned out to be false. The price rebounded from the level of 1.2185, but managed to go up 20 points, so Stop Loss should have been set to breakeven, at which the deal was closed. The next sell signal was formed in the area of 1.2185 - 1.2169 - 1.2147. It could have been worked out, but then the price got stuck between the Kijun-sen line and the level of 1.2106, moreover, it managed to bounce off the critical line twice more and reach the level of 1.2106 once. Thus, the short position brought about 25 points of profit, but the buy signal should no longer be processed, since it was formed too late.

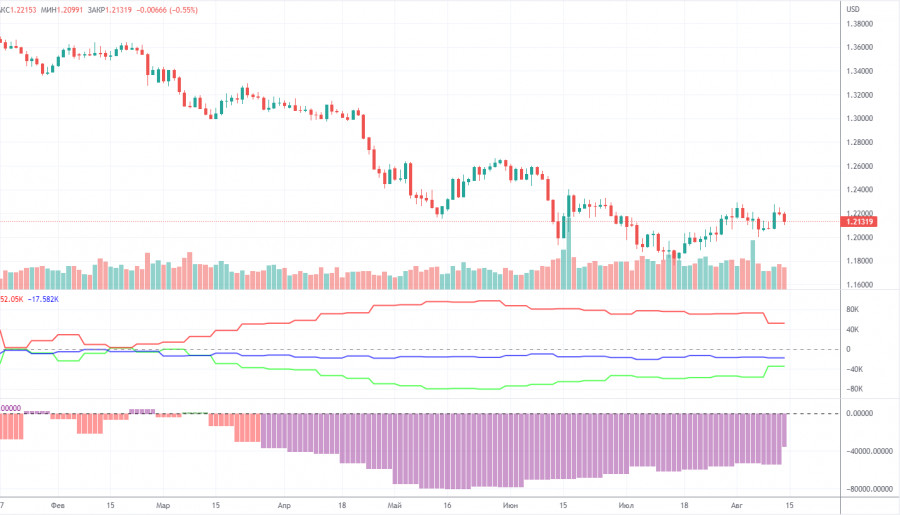

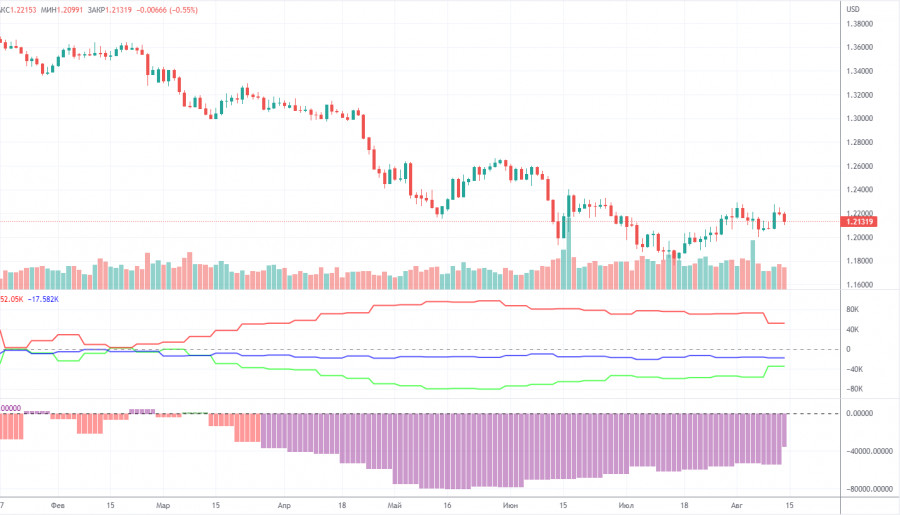

COT report:

The latest Commitment of Traders (COT) report on the British pound has finally impressed. During the week, the non-commercial group opened 12,900 long positions and closed 9,000 short positions. Thus, the net position of non-commercial traders immediately increased by 21,900. This is quite a strong change for the pound. However, the mood of the big players still remains "pronounced bearish", which is clearly seen in the second indicator in the chart above (purple bars below zero = bearish mood). To be fair, in recent months the net position of the non-commercial group has been constantly growing, but the pound shows only a very weak tendency to increase. The growth of the net position and the growth of the pound itself are now so weak (if we talk globally), it's hard to draw a conclusion about the beginning of a new upward trend. It is rather difficult to call the current growth even a "correction". We also said that the COT reports do not take into account the demand for the dollar, which is likely to remain very high right now. Therefore, for the British currency to appreciate, the demand for it must rise faster and stronger than the demand for the dollar. And on the basis of what factors is the demand for the pound growing now? Traders have already been hard at work ignoring strong US data and a 0.75% Fed tightening in recent weeks. The pound could already go again to conquer 2-year lows.

The non-commercial group now has a total of 76,000 short positions and 42,000 long positions open. The net position will have to show growth for a long time to at least equalize these figures.

We recommend to familiarize yourself with:

Forecast and trading signals for EUR/USD on August 15. Detailed analysis of the movement of the pair and trading transactions.

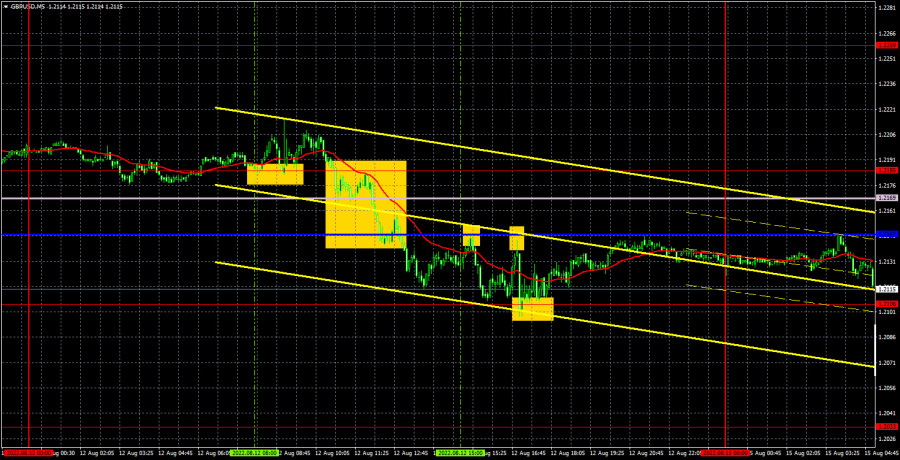

GBP/USD 1H

The pair failed to consolidate above the level of 1.2259 on the hourly timeframe. But it managed to settle below the Senkou Span B and Kijun-sen lines, so the likelihood of a resumption of the downward trend has now increased many times. The pound has once again shown its inability to rise strongly and for a long time, so we are in favor of maintaining a long-term downward trend, which is best seen on the 24-hour timeframe. We highlight the following important levels for August 15: 1.1974, 1.2033, 1.2106, 1.2185, 1.2259, 1.2342. Senkou Span B (1.2147) and Kijun-sen (1.2169) lines can also be sources of signals. Signals can be "rebounds" and "breakthroughs" of these levels and lines. The Stop Loss level is recommended to be set to breakeven when the price passes in the right direction by 20 points. Ichimoku indicator lines can move during the day, which should be taken into account when determining trading signals. The chart also contains support and resistance levels that can be used to take profits on trades. The calendar of events in the UK and the US does not provide anything interesting on Monday. Volatility may decrease today, and the pair may trade mostly sideways. However, given that the probability of a new downward trend is high, we do not exclude that the market will get down to business from the very beginning of the week.

Explanations for the chart:

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one.

Support and resistance areas are areas from which the price has repeatedly rebounded off.

Yellow lines are trend lines, trend channels and any other technical patterns.

Indicator 1 on the COT charts is the size of the net position of each category of traders.

Indicator 2 on the COT charts is the size of the net position for the non-commercial group.