The GBP/USD currency pair tried to continue the upward movement on Monday, and not without success. The growth may not be as strong as last week, but everyone understands perfectly well that the pound will not be trading forever with a volatility of 200-300 points per day. The market has recovered from the shock, although it is still unclear exactly what caused it. We still believe this was an inertial downward movement of the pound, which may mean the end of the entire downward trend. A sharp and strong rebound from the absolute lows of the pair is a good reason to expect the beginning of a new trend. Nevertheless, we remind you that all the factors that led to the pound's fall remain in force. Therefore, why do we have no right to expect a new fall in the British currency?

From a technical point of view, the pound has even more reasons for growth than the euro currency. First, the UK is not affected by the problem of sabotage on the Nord Stream. Second, the British pound rose by 800 points last week, which is something. Third, it can overcome the key lines of the Ichimoku indicator on the 24-hour TF as early as this week. Therefore, we have the right to expect continued growth as long as the price is above the moving average. In principle, this was the case before, but it should be kept in mind that in the near future, the two main pairs may show uncorrelation and move differently for some time. And the reason for this may be the energy crisis. If in the UK the main problem is that energy is too expensive, which creates a serious burden on households and businesses, then in the European Union, the problem this winter may be a banal shortage of gas for these enterprises to work at all. Consequently, the recession in the European Union may be deeper and more pronounced than ever. And this is a good reason for the euro to continue its decline.

So are we reducing taxes or not?

The key topic in the UK remains the topic of taxes. Liz Truss cheerfully announced that several taxes would be reduced, financed from the state budget, and immediately received much criticism that some of the tax initiatives had already been canceled. In particular, we are talking about a tax for rich Britons whose income exceeds 150 thousand pounds yearly. For them, the tax could be reduced from 45% to 40%, but the opposition forces in the British parliament almost unanimously opposed such a measure. British Finance Minister Kwasi Kwarteng stated: "We listened to people and heard them, and decided to cancel the new tax rate." Thus, now we are talking only about reducing the basic income tax, and even then, only a few percent. It is very difficult to say what this minor measure will accomplish.

However, the following should be noted here: Liz Truss faced not support in the British Parliament but harsh criticism and opposition almost from the first days of her new position. That is, there is no question of any unity for national interests in the British government now. When it is necessary to unite to resist the economic crisis, each political force "pulls the blanket over itself" and pursues its interests. For example, Labor is ready to criticize any Conservatives' decision after suffering a crushing defeat in the last parliamentary elections. Their goal is to regain their former strength, so the Conservatives must lose popularity among the British. Under such serious pressure, Liz Truss, who is unlikely to become the "new Margaret Thatcher," was also forced to retreat. She acknowledged that the government could better prepare financial markets for tax cuts and better work out a plan to save the economy. She also acknowledged that the state budget deficit would grow in the coming years, so the government would have to issue more bonds. These measures do not bode well for the British economy, but nothing good will happen if they are not taken.

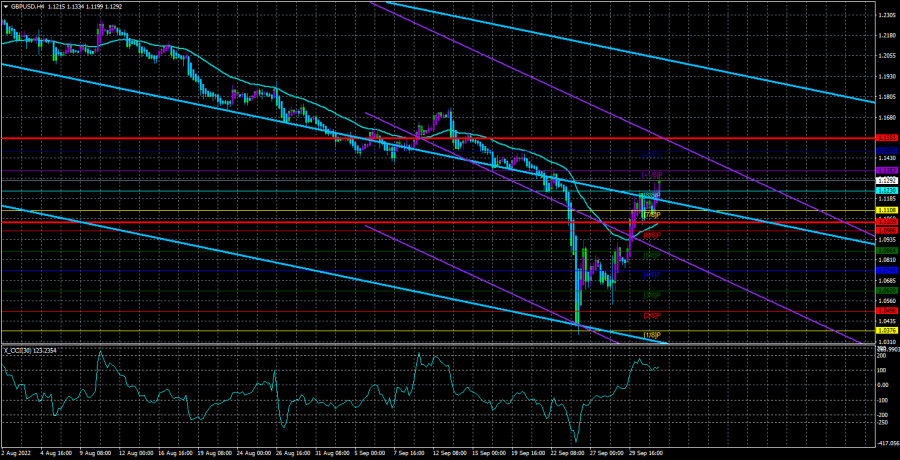

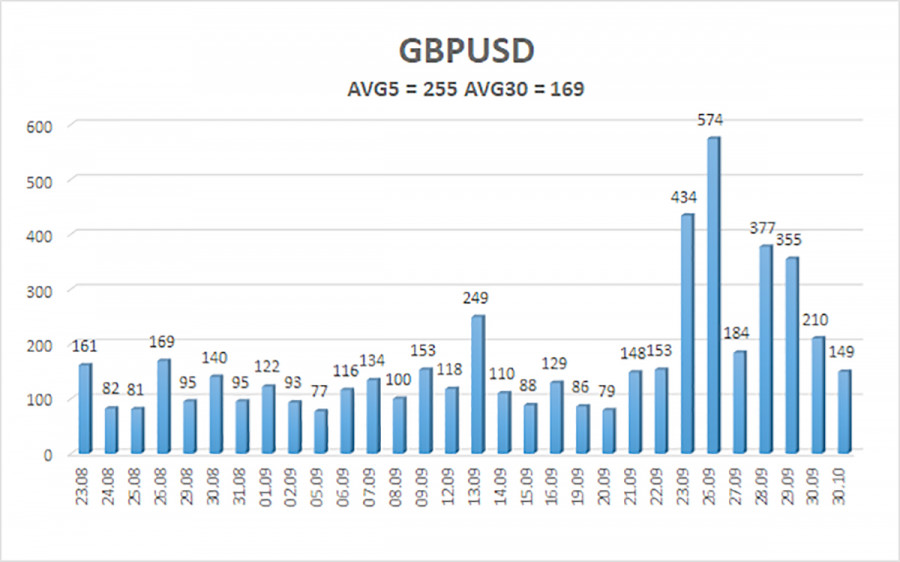

The average volatility of the GBP/USD pair over the last five trading days is 255 points. For the pound/dollar pair, this value is "very high." On Tuesday, October 4, thus, we expect movement inside the channel, limited by the levels of 1.1039 and 1.1551. The reversal of the Heiken Ashi indicator downwards signals a round of downward correction.

Nearest support levels:

S1 – 1.1230

S2 – 1.1108

S3 – 1.0986

The nearest resistance levels:

R1 – 1.1353

R2 – 1.1475

Trading Recommendations:

The GBP/USD pair in the 4-hour timeframe may continue to increase. Therefore, at the moment, you should stay in buy orders with targets of 1.1475 and 1.1551 until the Heiken Ashi indicator turns down. Open sell orders should be fixed below the moving average with targets of 1.0864 and 1.0742.

Explanations of the illustrations:

Linear regression channels help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) identifies the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.