Last Friday's mixed macro data from the UK also had a mixed effect on the pound. According to the Office for National Statistics, manufacturing output in November declined more than forecasted (-0.2%), amounting to -0.5% (against growth of +0.7% in October); total industrial output also declined by -0.2% (against forecast of -0.3% and -0.1% in October).

At the same time, the total international trade balance moved into the deficit zone in November, amounting to -1.802 billion pounds against a surplus of +1.498 billion pounds a month earlier. Other articles of the report of the ONS on UK international trade were also weak.

However, this negative data was ignored by buyers of the pound and British stock market assets, focusing on UK GDP data, which indicated a growth rate of +0.1% (vs. -0.2% expected): the British economy unexpectedly expanded in November.

The pound was also supported by macroeconomic statistics published earlier, which shows retail sales volume (from the British Retail Consortium) rose by 6.5% in December from 4.1% in November.

And yet, many economists believe that the economic situation in the country remains tense, and the onset of a recession is inevitable, given the rapidly growing inflation.

Although investors expect the Bank of England to raise its interest rate further by 1.0% and to 4.50% by summer (the BoE interest rate is currently at 3.50%), the possibility of tightening monetary conditions in the current situation remains a moot point for British central bank policymakers.

Tomorrow, market participants watching the pound quotes will have new information that can either strengthen or weaken its bullish momentum, including against the dollar: at 07:00 (GMT), the Office for National Statistics will publish a report on the country's labor market, which includes data on average earnings for the last three months (with and without bonuses), as well as data on unemployment in the UK, also for the period of the last three months.

A rise in earnings is bullish for the GBP, indirectly indicating a rising consumer spending power and encourages inflation. A low reading is negative (or bearish) for the GBP.

Average wages, excluding bonuses, are expected to rise again over the last three months (September–November) by +6.3% after rising by +6.1%, +5.8%, +5.5%, +5.2%, +4.7% in previous periods, while unemployment has remained at the same 3.7% level.

In general, these are positive factors for the pound: the labor market remains stable, and British wages continue to grow.

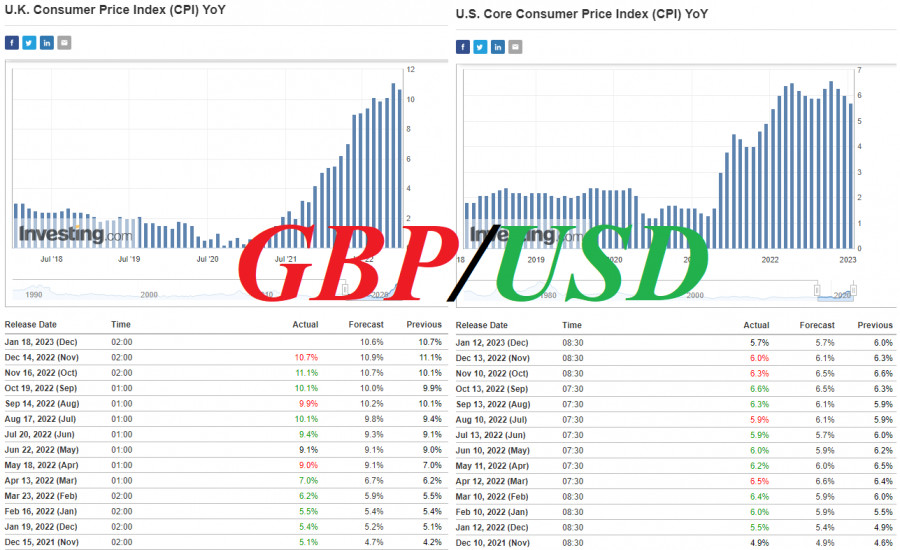

Later this week, several key macro data from the UK will also be released, including the latest inflation data (Wednesday at 07:00 GMT) and retail sales data (Friday at 07:00 GMT). Of particular note is the release of annual core inflation data, which is expected to rise again in December by +6.6% after rising 6.3% in November. This increases pressure on the Bank of England to further tighten monetary policy. Although in the current conditions, as we noted above, it is becoming increasingly difficult to do so.

Some hints to that effect are likely to come from Bank of England Governor Andrew Bailey today: he will deliver (at 15:00) his Financial Stability Report to the Treasury Select Committee. His unexpected statements might again cause volatility in the pound and, consequently, the GBP/USD pair.

At the same time, market participants expect the Fed to further slow down the pace of monetary tightening.

As follows from the previously published data, consumer price growth fell to its lowest levels since November 2021, amounting to 6.5% in December. New evidence of declining inflation risks will strengthen the inclination of Fed policymakers to slow the pace of interest rate hikes and then possibly ease monetary conditions for American businesses, although it is too early to tell: either way, inflation is still at an unacceptably high level, significantly and many times the Fed's 2% target level.

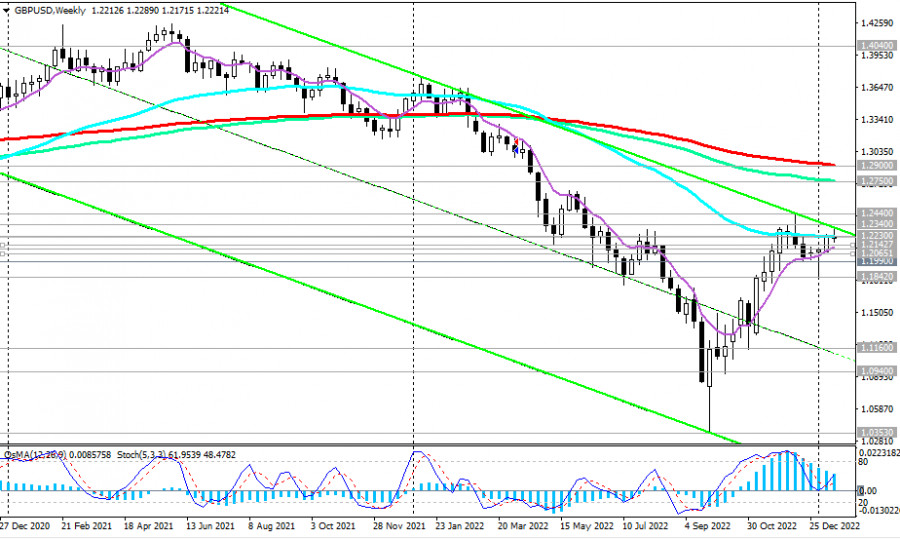

From a technical point of view, the GBP/USD is trying to break into the medium-term bull market zone, trying to break through the 1.2230 strong resistance level for the third trading day in a row. At the same time, GBP/USD is above the 1.2110 key support level, which implies that the bulls will have an advantage in this currency pair.

To consolidate its success, it needs to break into the zone above the long-term resistance level at 1.2230, then head towards the key resistance levels 1.2750, 1.2900, separating the long-term bullish trend from the bearish one.