The EUR/USD currency pair demonstrated on Monday what to anticipate from it this week. To be more exact, market participants' present sentiments were reflected in the second half of last week. We have already mentioned that the moves on Wednesday, Thursday, and Friday are very difficult to call reasonable and logical. But, although two extremely significant events occurred last week, this is the case. These are the Friday release of labor market data and the Tuesday address by Jerome Powell to Congress. As we can see, these events were sufficient to cause traders' short-term mood to change to "bullish," and both technical pictures were in danger of being canceled. Recall that we have been anticipating a decline in the euro and the pound for a while, but something stands in the way of this possibility every time. In addition to the ECB meeting, other macroeconomic indicators will be released in the upcoming week. Even though we do not anticipate any surprises from the European Regulator, it is important to keep in mind that market reactions can occasionally be abrupt and forceful. And once again, everything will depend on how the market perceives the facts. And it is free to be interpreted (in its present form) as you like.

It should be highlighted that the technical picture has not yet been broken and may continue in its current form before moving on to the analysis of forthcoming events. To be more exact, everything now rests on overcoming the key line on the 24-hour TF. The departure of the pair from the Ichimoku cloud increased predictions of a further drop. Yet, as we can see, things are shifting far too quickly. Currently, a new fall of the pair, which objectively should be stronger than the level of 1.0515, can easily be triggered by Kijun-sen's rebound. Yet, growth may continue for a while if it consolidates above the crucial line, and the last local maximum is not too far away. The market is currently in an exciting mood, so we can anticipate any developments, but we see no reason to resume the upward trend.

It's going to be a great week.

The first European Union data will only start to come in on Wednesday. The release of the January industrial production report will be the catalyst for everything. This report is very difficult to categorize as "important" at the moment, but it has the potential to generate a 20–30 point response. The ECB will then hold a meeting on March 16, during which time the key rate may increase by an additional 0.5% to 3.5%. We continue to believe that the market has already factored in this increase and that a total rate of 3.5% or even 3.75% (if we include the next increase in May) will be insufficient to appreciably slow inflation. So the euro shouldn't increase, on the one hand, and Christine Lagarde's rhetoric might take on new "hawkish" overtones, on the other. She earlier stated that rates will likely need to be raised more than initially anticipated, along with nearly all other members of the ECB monetary committee. Nevertheless, who believed that a 3.5% interest rate would be sufficient to reduce inflation from "over 10%" to "2%"? The need to increase the rate to a minimum of 5–6% was clear from the start. Another question is whether the ECB can afford to tighten monetary policy so drastically. We have our doubts about this, and Ms. Lagarde can respond to them.

The February inflation report will be released on Friday. Forecasts predict a "mind-boggling" slowdown from 8.6% to 8.5%, which supports the necessity of tightening monetary policy even more. And, once again, everything will be determined by Lagarde's rhetoric on Thursday, her pronouncements and speeches, and her colleagues in the next few weeks and months. If concurrently similar signals from the Fed are not given, the tightening of rhetoric will help the euro. A slight decrease in the consumer price index at this time is by no means a guarantee that the rate will increase in strength and duration. The capabilities of the ECB and the condition of the European economy will be crucial factors in everything. And the only sources from which we can learn about this are the pertinent reports and the members of the monetary committee.

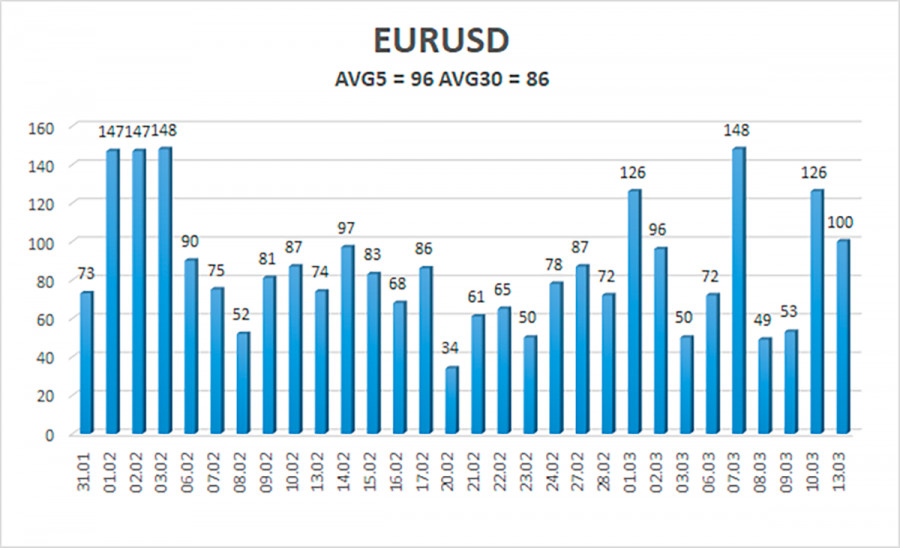

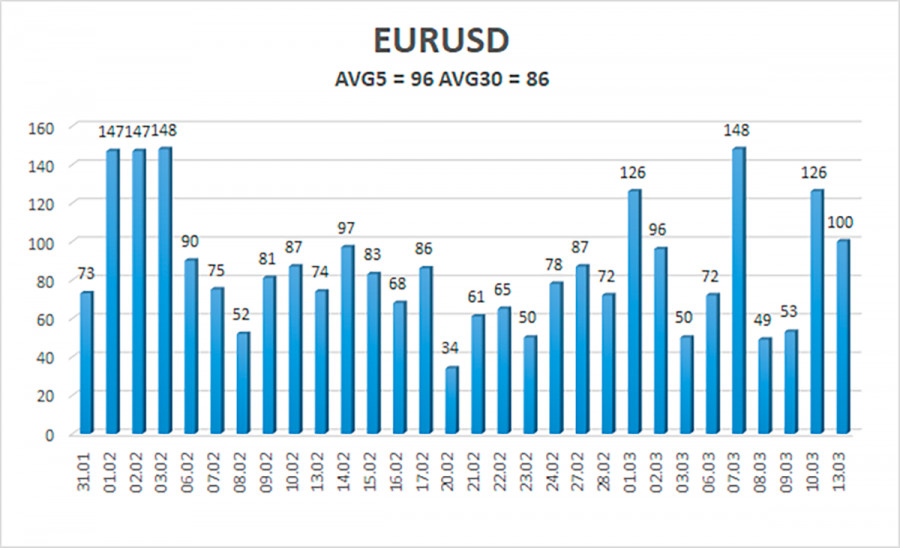

As of March 14, the euro/dollar currency pair's average volatility over the previous five trading days was 96 points, which is considered "high." Hence, on Tuesday, we anticipate the pair to move between 1.0646 and 1.0838. The Heiken Ashi indicator's downward turn will signal a potential continuation of the downward movement.

Nearest levels of support

S1 – 1.0620

S2 – 1.0498

S3 – 1.0376

Nearest levels of resistance

R1 – 1.0742

R2 – 1.0864

R3 – 1.0986

Trade Suggestions:

The pair EUR/USD has stabilized once more above the moving average line. Until the Heiken Ashi indicator turns down, you can continue holding long positions with targets of 1.0838 and 1.0864. After the price is fixed below the moving average line, short positions can be opened with a target of 1.0498.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.