Analyzing Thursday's trades:

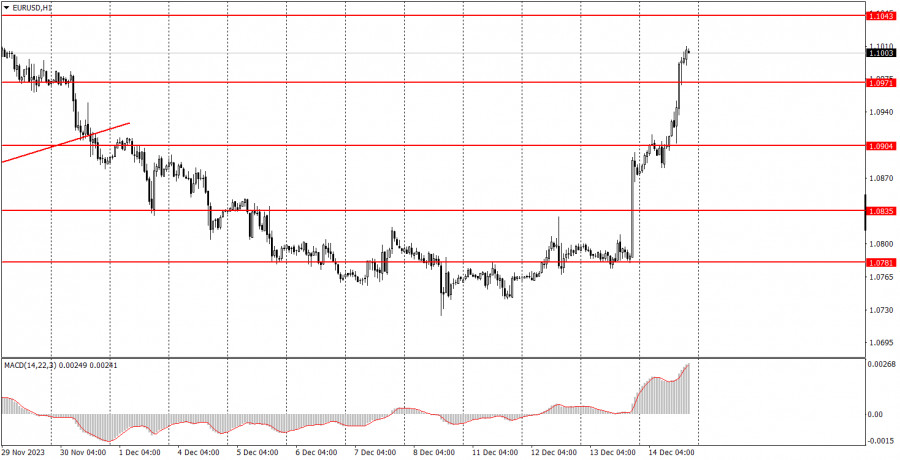

EUR/USD on 30M chart

EUR/USD continued to appreciate throughout Thursday. We did not expect the single currency to extend its upward movement, but the results of the European Central Bank meeting left the market with no other option. The euro started to rise while the dollar fell during Federal Reserve Chairman Jerome Powell's speech. Powell said that the Fed will begin its pivot towards lowering rates, and at the upcoming meetings, tightening is unlikely to happen. Naturally, the market interpreted these words to the detriment of the dollar.

On Thursday, the ECB left key rates unchanged, and ECB President Christine Lagarde said that "we definitely did not discuss rate cuts today." Therefore, Lagarde did not support Powell's rhetoric, despite lower inflation in the European Union than in the United States. It turns out that both Lagarde and Powell's respective remarks weighed on the dollar. We cannot say that the market reacted illogically this time. Rather, the combination of circumstances was such that the dollar simply could not help but fall. We already warned you that the background would be very strong, and the pair could move in any direction, and it is simply impossible to predict the decisions of central banks.

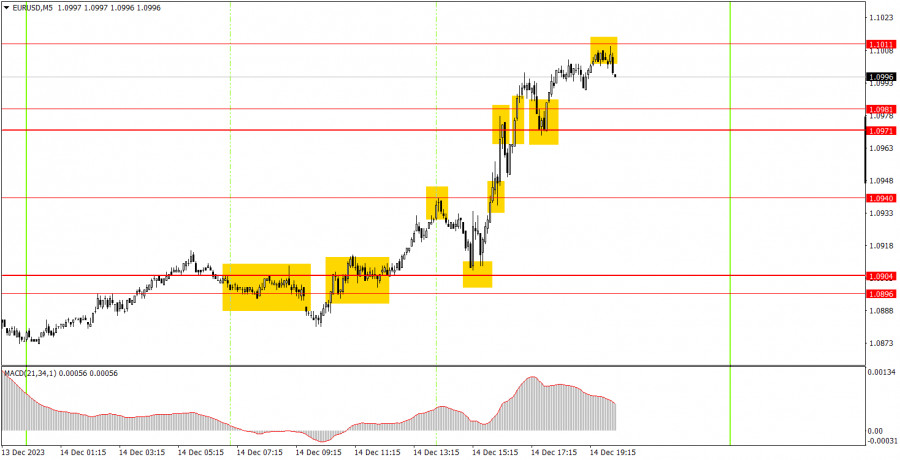

EUR/USD on 5M chart

On the 5-minute chart, the price worked through many levels. Almost all of them were executed perfectly or almost perfectly. The very first sell signal turned out to be false, but then the situation leveled out. Overcoming the area of 1.0896-1.0904 made it possible for beginners to open long positions, but the bounce from 1.0940 prompted closing long positions and opening shorts. The situation reversed again around the level of 1.0904, but during the US trading session, it was necessary to be cautious or even avoid entering the market. As we can see, the price worked through the levels but often rolled back down. Therefore, there should have been many open trades. Since Lagarde's rhetoric was hawkish, traders should have paid more attention to buy signals. Traders clearly did not leave without profit on Thursday.

Trading tips on Friday:

On the hourly chart, EUR/USD sharply and unexpectedly started an uptrend. Perhaps this trend will end on Friday since all the upward movement was provoked by two central bank meetings. However, Wednesday and Thursday's movements can also set the tone for trading for the next few weeks. Unfortunately, the Fed took a dovish position, and the ECB took a "moderately hawkish" one.

We suggest that you continue to closely monitor the 1.0971-1.0981 area. Consolidating below it, combined with a rebound from the level of 1.1011, will be a strong signal for a downward correction. The pair can continue to rise with a bounce from the specified area.

The key levels on the 5M chart are 1.0611-1.0618, 1.0668, 1.0733, 1.0767-1.0781, 1.0835, 1.0896-1.0904, 1.0940, 1.0971-1.0981, 1.1011, 1.1043, 1.1091, 1.1132-1.1145. On Friday, Services and Manufacturing PMI data for December will be published in the European Union, the United States, and the United Kingdom. The US will release a report on industrial production. We believe that the market will have a muted reaction to these reports, and the pair may start a corrective movement after a two-day rise.

Basic trading rules:

1) Signal strength is determined by the time taken for its formation (either a bounce or level breach). A shorter formation time indicates a stronger signal.

2) If two or more trades around a certain level are initiated based on false signals, subsequent signals from that level should be disregarded.

3) In a flat market, any currency pair can produce multiple false signals or none at all. In any case, the flat trend is not the best condition for trading.

4) Trading activities are confined between the onset of the European session and mid-way through the U.S. session, post which all open trades should be manually closed.

5) On the 30-minute timeframe, trades based on MACD signals are only advisable amidst substantial volatility and an established trend, confirmed either by a trend line or trend channel.

6) If two levels lie closely together (ranging from 5 to 15 pips apart), they should be considered as a support or resistance zone.

How to read charts:

Support and Resistance price levels can serve as targets when buying or selling. You can place Take Profit levels near them.

Red lines represent channels or trend lines, depicting the current market trend and indicating the preferable trading direction.

The MACD(14,22,3) indicator, encompassing both the histogram and signal line, acts as an auxiliary tool and can also be used as a signal source.

Significant speeches and reports (always noted in the news calendar) can profoundly influence the price dynamics. Hence, trading during their release calls for heightened caution. It may be reasonable to exit the market to prevent abrupt price reversals against the prevailing trend.

Beginning traders should always remember that not every trade will yield profit. Establishing a clear strategy coupled with sound money management is the cornerstone of sustained trading success.