The EUR/USD currency pair once again demonstrated "mind-boggling" volatility on Monday. However, this time, such a scenario was easily predictable. The thing is, at the moment, volatility in the currency market is generally very low, and on Mondays when there are traditionally few news releases, it is often absent altogether. The only report of the day - on inflation in the European Union - did not stir any emotions among traders. We warned about this in advance, as the report implied a second estimate, which rarely differs from the first. If there are no differences, then there is no reason for the market to react.

So, inflation in the European Union has already dropped to 2.6%. Despite the concerns of ECB representatives, we would call such slowing rates confident and positive. For example, inflation is declining more slowly in the United States and the United Kingdom. Thus, it is quite expected that the first central bank of the "big three" to act may not be the Fed but the ECB. Recall that just two months ago, the market was 100% confident that the Fed would be the first to start easing monetary policy. However, in reality, it should be the ECB. All this time (the last two months), we have repeatedly mentioned that the Fed has no reason to rush with rate cuts. Inflation is far from the target, and the economy is in excellent condition despite high rates. We were right.

Now it's time for the market to admit that it was wrong. If the European currency has been rising for a long time based on market expectations regarding ECB and Fed rates, then now the American currency should show growth for a long time, as expectations are directly opposite. It is unknown how many easing steps the European regulator plans for 2024, but the market expects no more than 3 rate cuts from the Fed. This figure contrasts sharply with the 6-7 rate cuts expected by the market at the beginning of the year. In other words, expectations for the Fed's monetary policy have tightened, while expectations for the ECB's monetary policy have softened. And we believe that this is a very weighty reason for the US dollar to continue to rise against the euro.

In principle, over the past nine months, it has indeed been rising. But it's rising very weakly and very reluctantly. We believe that the pair should be close to price parity, or at least around the level of $1.04. However, the market is still not rushing to sell, although it understands that the fundamental and macroeconomic background now supports the dollar much more. We are confident in this because there simply cannot be another opinion here.

At the end of Monday, the EUR/USD pair remained below the moving average line, so the new short-term trend has not been canceled. Therefore, in any case, we should expect only downward movement now. From the Fed meeting, one should expect rather additional support for the dollar than the opposite. Speeches by Christine Lagarde and Luis de Guindos during the current week are unlikely to indicate a change in the ECB's stance to a more "hawkish" one.

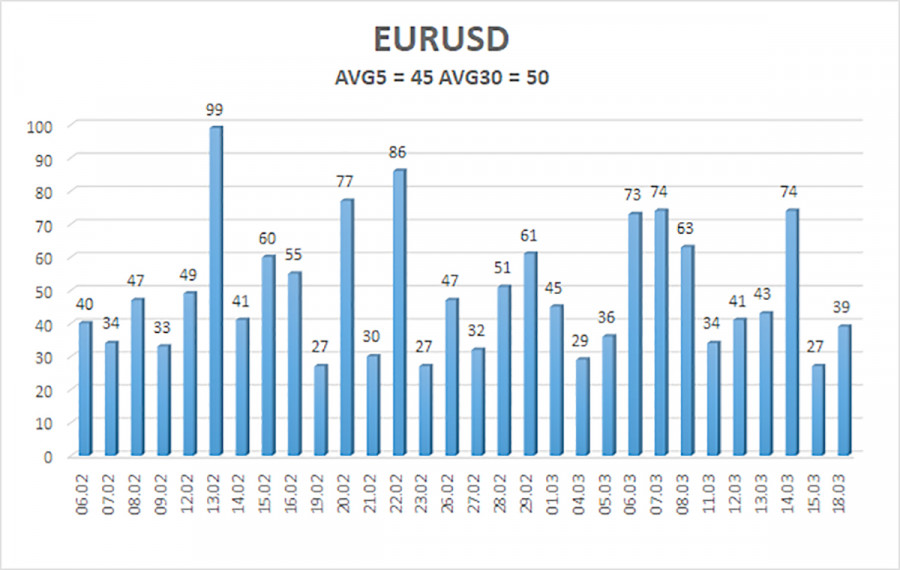

The average volatility of the euro/dollar currency pair for the past 5 trading days as of March 19 is 45 points and is characterized as "low". Thus, we expect the pair to move between the levels of 1.0823 and 1.0913 on Tuesday. The senior linear regression channel still points downwards, so the global downtrend is still intact. The oversold condition of the CCI indicator suggests the need for an upward correction, but we still expect a decline in the European currency.

Nearest support levels:

S1 - 1.0864

S2 - 1.0834

S3 - 1.0803

Nearest resistance levels:

R1 - 1.0895

R2 - 1.0925

R3 - 1.0956

Trading recommendations:

The EUR/USD pair continues to be located below the moving average line. Thus, it is possible to remain in short positions with targets at 1.0834 and 1.0823. If the market finally gives up on similar dollar sales, then the American currency may rise only soon to the 7th level. And in the long run, to the level of 1.0200. After a fairly long growth of the pair (which we consider a correction), we see no reason to consider long positions. Even if the price consolidates above the moving average.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are pointing in the same direction, it means the trend is currently strong.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into oversold territory (below -250) or overbought territory (above +250) indicates that a trend reversal towards the opposite direction is approaching.