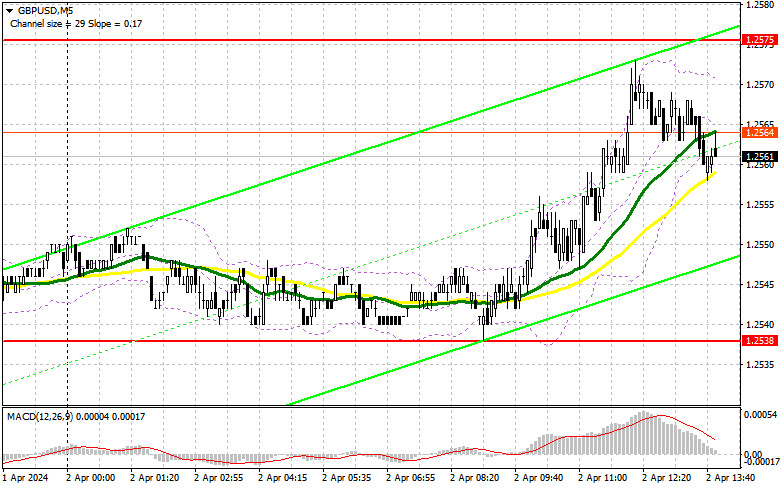

In my morning forecast, I focused on the level of 1.2575 and planned to make decisions based on it for market entry. Let's look at the 5-minute chart and see what happened there. The pound saw some growth, but it never reached the test and false breakout at 1.2575, so suitable signals for market entry were not obtained. The technical picture still needs to be revised for the second half of the day.

For opening long positions on GBP/USD:

Data showing that manufacturing activity in the UK has finally returned to growth provided support for the pound in the first half of the day, prompting a slight increase in the pair, offsetting some of yesterday's losses. However, this is far from what buyers had hoped for. Now, everything depends on US statistics. In the second half of the day, we await data on changes in manufacturing orders, the level of vacancies, and labor turnover from the Bureau of Labor Statistics, as well as speeches by FOMC members Michelle Bowman, John Williams, and Loretta Mester, advocating for a restraining and restrictive policy, which may help the dollar strengthen its position. In the event of a pair decline, I plan to look for long positions only after the formation of a false breakout around the new support at 1.2538, formed by the end of today. This will provide an opportunity to return demand with the prospect of updating to 1.2575, which we still need to reach today. A breakout and consolidation above this range will strengthen the bullish positions and open the way to 1.2609. The ultimate target will be a maximum of 1.2643, where I plan to make a profit. In the scenario of GBP/USD decline and lack of bullish activity at 1.2538 in the second half of the day, the pair will return to decline, allowing sellers to strengthen the downward trend. In this case, only a false breakout around the next support at 1.2507 will confirm the correct entry point. I plan to buy GBP/USD immediately on a rebound from the minimum of 1.2482, with a target of a 30-35 pip correction within the day.

For opening short positions on GBP/USD:

Bears have every chance of further trend development, but for this, good US statistics are needed. Today, I plan to act only after the defense of the resistance at 1.2575, where the moving averages, favoring sellers, have already converged. A false breakout there will confirm the correct entry point for selling in the development of the bearish market, leading to a downward movement to around 1.2538. A breakout and reverse test from the bottom to the top of this range will deliver another blow to bullish positions, leading to stop-loss triggers and opening the way to 1.2507. There, I expect the appearance of large buyers. The ultimate target will be the area of 1.2482, where profit will be taken. In the scenario of GBP/USD rise and lack of activity at 1.2575 in the second half of the day, as well as soft statements by Federal Reserve representatives regarding future interest rates, buyers will once again feel their strength. In this case, I will postpone sales until a false breakout at the level of 1.2609. If there is no downward movement there, I will sell GBP/USD immediately on a rebound from 1.2643, but only counting on a pair correction downwards by 30-35 points within the day.

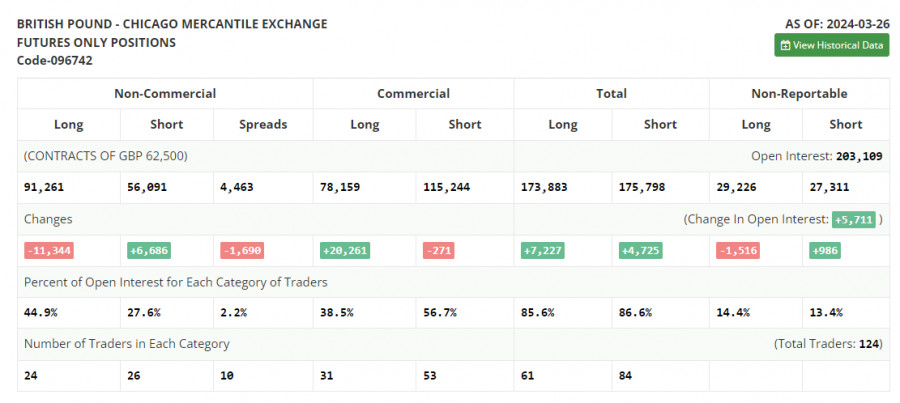

In the COT report (Commitment of Traders) for March 26, there was a sharp reduction in long positions and an increase in short positions. After the Bank of England meeting and statements by Governor Andrew Bailey, it became clear to everyone that the regulator's position was soft, prompting the pound to fall. Most likely, the development of the bearish market will continue, as, despite Chairman Jerome Powell's inclination toward a soft policy, many of his colleagues advocate for a more restrained approach, which maintains the chances for a strong US dollar. For this reason, I am betting on a further decline in the pair along the trend. The latest COT report states that long non-commercial positions decreased by 11,344 to 91,261, while short non-commercial positions increased by 6,686 to 56,091. As a result, the spread between long and short positions decreased by 1,690.

Indicator Signals:

Moving Averages

Trading is conducted below the 30 and 50-day moving averages, indicating further pair decline.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differ from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands

In the event of a decline, the lower boundary of the indicator, around 1.2530, will act as support.

Description of Indicators:

• Moving average (determines the current trend by smoothing volatility and noise). Period 50. Marked on the chart in yellow.

• Moving average (determines the current trend by smoothing volatility and noise). Period 30. Marked on the chart in green.

• MACD indicator (Moving Average Convergence/Divergence). Fast EMA period 12. Slow EMA period 26. SMA period 9.

• Bollinger Bands. Period 20.

• Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, using the futures market for speculative purposes and meeting certain requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between the short and long positions of non-commercial traders.