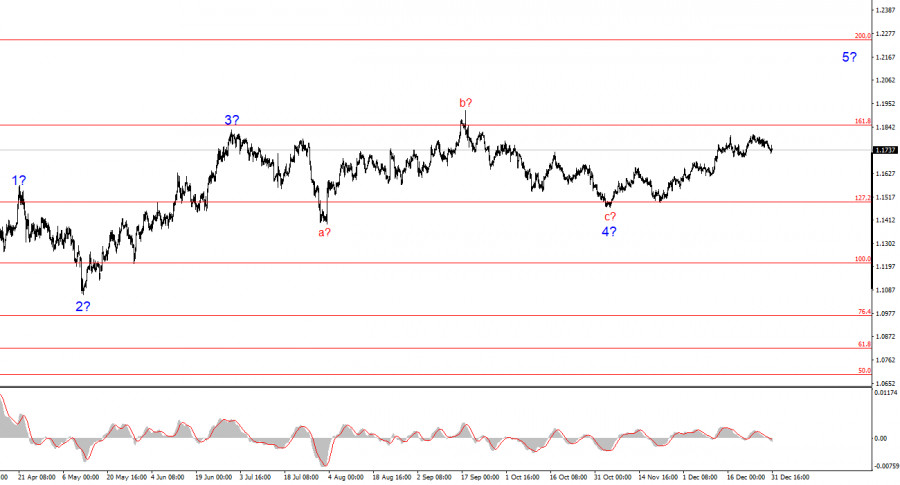

The wave count on the 4-hour chart for EUR/USD has a fairly clear, albeit rather complex, structure. There is no talk of canceling the upward trend segment that began in January 2025, but the wave structure starting from July 1 has taken on a complex and extended form. In my view, the instrument has completed the formation of corrective wave 4, which took on a very non-standard shape. Within this wave, we observed exclusively corrective structures, so there is no doubt about the corrective nature of this wave.

In my opinion, the construction of the upward trend segment has not been completed, and its targets extend as far as the 25th level. The series of waves a–b–c–d–e appears complete; therefore, over the coming weeks I expect the formation of a new upward wave sequence. We have seen the presumed waves 1 and 2, and the instrument is now in the process of forming wave 3 or c, which took on a five-wave form and, consequently, has been completed. In the coming days, a decline in quotes can be expected, which is exactly what we are currently observing.

The EUR/USD pair declined by 10 basis points during Wednesday, having lost another 25 the day before. As we can see, there is downward movement, but it is very weak and holiday-related. Therefore, no conclusions should be drawn from such minimal price fluctuations. Since the U.S. currency has been rising slightly over the past few days, many economists have immediately begun looking for reasons for this move. In my opinion, a 30-point move is not even worth trying to explain, especially when the news background is absent. The only more or less interesting event this week was the release of the FOMC minutes, which became available on Tuesday evening.

Naturally, analysts unanimously rushed to label the report as "hawkish." However, I would like to point out that the report was released late in the evening, while demand for the U.S. currency had been increasing before its publication, not after. In any case, the Fed meeting took place three weeks ago, and immediately afterward the FOMC's stance was already 100% clear. Therefore, the meeting minutes did not bring any new information to the market. Explaining the dollar's rise during the New Year week by the FOMC minutes is simply wishful thinking.

In reality, everything is much simpler. The pair built a five-wave upward structure and then moved on to forming a downward wave sequence or a single wave. I have said many times that higher-degree waves are important, but trading can also be based on individual five-wave and three-wave structures. We saw three waves up, with the third wave consisting of five waves. A correction naturally suggests itself, and the FOMC minutes have absolutely nothing to do with the decline in EUR/USD.

General Conclusions

Based on the EUR/USD analysis, I conclude that the pair continues to build an upward trend segment. Donald Trump's policies and the Federal Reserve's monetary policy remain significant factors weighing on the U.S. currency in the long term. The targets of the current trend segment may extend as far as the 25th figure. The current upward wave sequence may not be complete, but three waves have already been formed. If it continues to develop, growth can be expected with targets around 1.1825 and 1.1926, which correspond to the 200.0% and 261.8% Fibonacci levels. However, in the near term, a corrective wave or wave sequence may be forming.

On a smaller timeframe, the entire upward trend segment is visible. The wave count is not entirely standard, as the corrective waves differ in size. For example, the higher-degree wave 2 is smaller than the internal wave 2 within wave 3. However, this also happens. Let me remind you that it is best to identify clear and understandable structures on charts rather than strictly tying analysis to every single wave. At present, the upward structure raises no doubts.

The main principles of my analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often signal changes.

- If there is no confidence in what is happening in the market, it is better not to enter it.

- There is no and never can be 100% certainty about the direction of movement. Do not forget to use protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.