O dólar inicia a nova semana em queda. Os rendimentos dos títulos do Tesouro dos EUA também recuam nesta segunda-feira, exercendo pressão adicional sobre a moeda americana.

A semana passada, no entanto, foi marcada pela força do dólar, em meio ao aumento da inflação e à incerteza contínua quanto às próximas decisões do Federal Reserve.

Os dados mais recentes de Empregos Não Agrícolas (NFP) mostraram a criação de apenas 50.000 vagas, abaixo das expectativas de 66.000, enquanto a taxa de desemprego caiu inesperadamente para 4,4%. Já os ganhos médios por hora avançaram mais do que o previsto, alcançando 3,8% em termos anuais. Apesar dos sinais de arrefecimento no mercado de trabalho, analistas avaliam que o quadro está longe de ser tão preocupante quanto se imaginava inicialmente.

Além disso, o índice preliminar de Sentimento do Consumidor da Universidade de Michigan para janeiro, também divulgado na sexta-feira, subiu para 54,0, ante 52,9 em dezembro, superando a projeção de 53,5.

Em conjunto, os dados da semana passada sustentam uma leitura econômica mais otimista e reduzem a necessidade de cortes emergenciais nas taxas de juros.

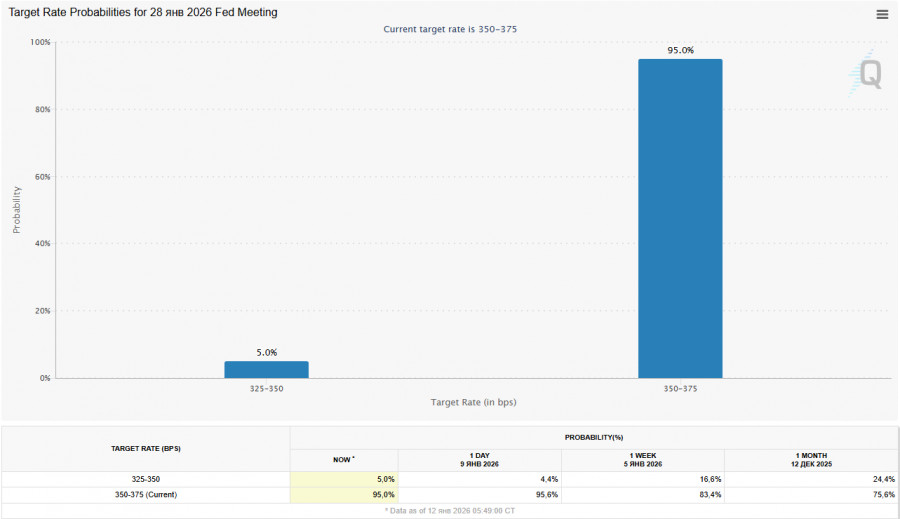

Como se sabe, em dezembro o Fed reduziu a taxa básica de juros em 0,25 ponto percentual. Contudo, a ata dessa reunião revelou divergências significativas entre os membros do comitê quanto ao rumo da política monetária.

Após a divulgação dos dados econômicos mais recentes, as expectativas para a trajetória dos juros foram revisadas. Agora, economistas projetam que o Fed promova dois cortes de 25 pontos-base, em junho e setembro, em vez de março e junho, como se previa anteriormente.

Enquanto isso, a ferramenta FedWatch do CME Group indica atualmente uma probabilidade de 95% de uma pausa em janeiro.

Ao mesmo tempo, está sendo dada atenção especial ao processo criminal contra o presidente do Fed, Jerome Powell, relacionado à reforma de US$ 2,5 bilhões do prédio do banco central. O próprio Powell chamou as acusações de manipulação política com o objetivo de prejudicar a independência do regulador e alterar a política monetária. Uma possível mudança na liderança do Fed poderia provocar uma queda acentuada do dólar.

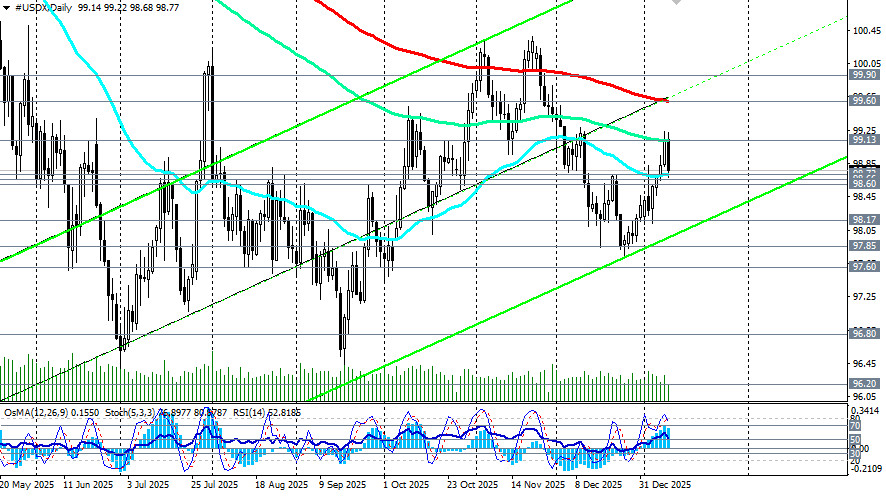

Após testar a forte resistência em 99,13 (EMA144 no gráfico diário) na sexta-feira, os futuros do USDX recuaram nesta segunda-feira e, no início da sessão norte-americana, avançaram em direção ao suporte em 98,72 (EMA 50 no gráfico diário). No entanto, considerando que os futuros do USDX ainda mantêm ímpeto ascendente no curto prazo, um rebote é esperado a partir da zona de suporte entre 98,72 e 98,60 (EMA 200 no gráfico de 1 hora), com retomada do movimento corretivo de alta.

Caso esse cenário se confirme, um reteste mais consistente e o rompimento da resistência em 99,13 poderiam criar condições para uma alta em direção à resistência-chave em 99,60 (EMA 200 no gráfico diário), nível que separa um mercado do dólar com viés de baixa de médio prazo de um cenário altista.

A superação desse patamar, seguida de um avanço acima de 99,90 (EMA 50 no gráfico diário), confirmaria a retomada de uma tendência de alta de médio prazo no USDX, abrindo espaço para um movimento em direção à borda superior do canal ascendente no gráfico semanal, que também coincide com a resistência de longo prazo em 101,45 (EMA 144 no gráfico semanal).

Em um cenário negativo para o dólar, uma quebra abaixo do nível de suporte de 98,60 levaria o preço de volta ao território de baixa, abrindo caminho para uma queda em direção ao nível de suporte estratégico em 96,80, que separa o mercado global de alta do USDX de um mercado de baixa.

Conclusão

- A dinâmica do dólar é impulsionada por uma combinação de dados econômicos, eventos políticos e expectativas do mercado.

- O processo criminal envolvendo Powell adiciona um novo elemento de incerteza e exerce pressão negativa adicional sobre a moeda americana.

- Nesse contexto, os níveis técnicos e os fundamentos macroeconômicos servirão como referências essenciais para os investidores nos próximos dias.

Os próximos desdobramentos na perspectiva do dólar, no curto prazo, dependerão da dinâmica da inflação — com a divulgação do CPI programada para terça-feira, às 13h30 GMT, e do PPI na quarta-feira — bem como das declarações de representantes do Federal Reserve. Entre elas, destacam-se os discursos previstos para hoje do presidente do Fed de Atlanta, Raphael Bostic (17h30 GMT), e do presidente do Fed de Nova York, John Williams (23h00 GMT).

O mercado aguarda sinais mais claros das autoridades monetárias dos Estados Unidos para definir os próximos passos. Embora as condições atuais permaneçam incertas, persistem os riscos de um fortalecimento mais expressivo do dólar, especialmente se os dados de inflação continuarem a surpreender para cima.

Seguiremos acompanhando os desdobramentos de perto, com o objetivo de tomar decisões de investimento equilibradas e bem fundamentadas.