Trade Analysis and Tips for Trading the European Currency

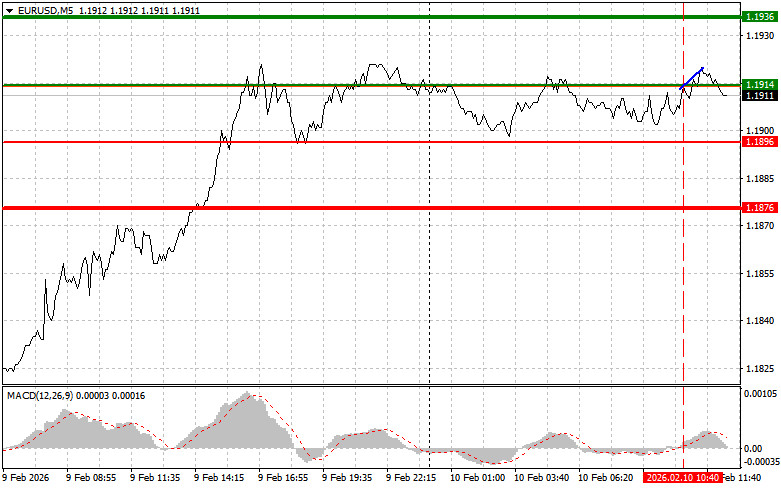

The test of the 1.1914 price level occurred at the moment when the MACD indicator was just beginning to move upward from the zero line, which confirmed a correct entry point for buying the euro. However, the pair failed to develop a strong upward move.

There is nothing surprising about the euro's failure to continue rising, as there was simply no necessary fuel in the form of strong fundamental data from the eurozone. Later in the day, the market will closely monitor the release of important U.S. macroeconomic reports. Among the expected publications are data on changes in retail sales, reflecting consumer activity, as well as the weekly ADP employment report. If the figures turn out to be strong, pressure on EUR/USD will increase significantly.

In addition, statements from representatives of the Federal Reserve may influence market sentiment. Speeches by Beth M. Hammack and Lori K. Logan are expected today. Their comments on the current economic situation, inflation trends, and monetary policy plans may serve as signals regarding possible future steps by the Fed. Any hints of further tightening or easing of policy will be carefully analyzed and reflected in market quotes.

The upcoming combination of events promises high trading activity, which was sorely lacking during the first half of the day. Particular attention will be paid to how the market reacts to discrepancies between actual data and preliminary expectations.

As for the intraday strategy, I will rely more on the implementation of scenarios No. 1 and No. 2.

Buy Signal

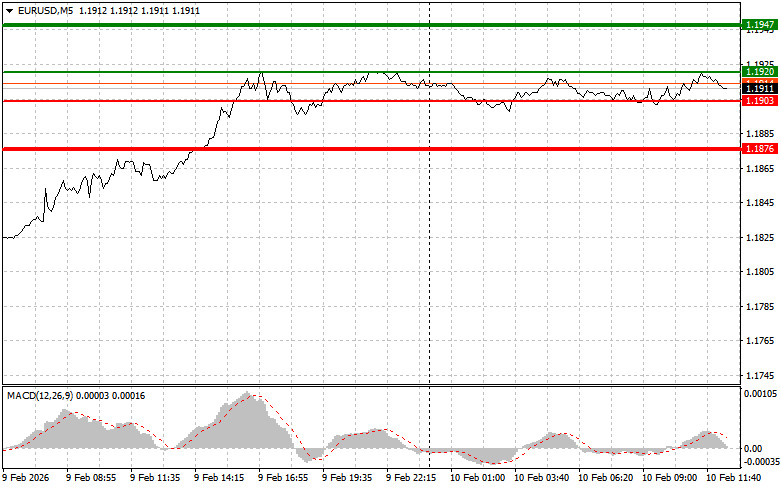

Scenario No. 1: Today, the euro can be bought after the price reaches the 1.1920 level (green line on the chart), with a target of growth toward the 1.1947 level. At 1.1947, I plan to exit the market and also sell the euro in the opposite direction, expecting a move of 30–35 points from the entry point. A strong rise in the euro can be expected only after weak economic data.Important! Before buying, make sure that the MACD indicator is above the zero line and is just beginning to rise from it.

Scenario No. 2: I also plan to buy the euro today in the case of two consecutive tests of the 1.1903 price level at a time when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a reversal upward. Growth toward the opposite levels of 1.1920 and 1.1947 can be expected.

Sell Signal

Scenario No. 1: I plan to sell the euro after the price reaches the 1.1903 level (red line on the chart). The target will be the 1.1876 level, where I plan to exit the market and immediately buy in the opposite direction (expecting a move of 20–25 points in the opposite direction from that level). Pressure on the pair will return in the case of strong economic data.Important! Before selling, make sure that the MACD indicator is below the zero line and is just beginning to decline from it.

Scenario No. 2: I also plan to sell the euro today in the case of two consecutive tests of the 1.1920 price level when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a reversal downward. A decline toward the opposite levels of 1.1903 and 1.1876 can be expected.

What's on the Chart:

- Thin green line – the entry price at which the trading instrument can be bought;

- Thick green line – the projected price where Take Profit orders can be placed or profits can be fixed manually, as further growth above this level is unlikely;

- Thin red line – the entry price at which the trading instrument can be sold;

- Thick red line – the projected price where Take Profit orders can be placed or profits can be fixed manually, as further decline below this level is unlikely;

- MACD indicator. When entering the market, it is important to be guided by overbought and oversold zones.

Important. Beginner Forex traders need to be extremely cautious when making market entry decisions. Before the release of important fundamental reports, it is best to stay out of the market to avoid being caught in sharp price fluctuations. If you decide to trade during news releases, always place stop orders to minimize losses. Without stop orders, you can lose your entire deposit very quickly, especially if you do not use money management and trade large volumes.

And remember that successful trading requires a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation are an inherently losing strategy for an intraday trader.