The GBP/USD currency pair also soared yesterday and gained about 150 points in just the first hour after the publication of the US inflation report. That is, the reaction to the inflation report was much stronger than the reaction to the Fed and Bank of England meetings. The market made it clear yesterday what is most important for it now. Reports of non-farm payroll and unemployment are interesting, and meetings of central banks are delightful. However, inflation now determines the prospects of the economy, further actions of central banks, and the likelihood of a recession. And with their sales of the US currency yesterday, traders showed that they are now waiting for a monthly slowdown in the pace of price growth and a decrease in the pace of tightening of the Fed's monetary policy. If this is the case, the US dollar lost almost its most important trump card in the confrontation with European currencies yesterday.

However, we would not draw premature conclusions. First, the inflation report is certainly important, but you will not be fed up with inflation alone. It is unlikely that a single report will now push the euro and the pound up for several weeks or months. For example, if inflation in the UK also starts to slow down, the market will have to arrange sales of the British pound similarly. And if the GDP report this Friday turns out to be weaker than forecasts? There can be a lot of such "ifs", since it should be remembered that we are dealing with the UK, where there have been a huge number of problems, conflicts and crises over the past 6 years. And the British themselves are also wonderfully able to create and invent them out of the blue. Therefore, so far, we can say this: the pound has made a strong step forward in maintaining an upward trend, but at the same time, yesterday's market reaction may not be long-term.

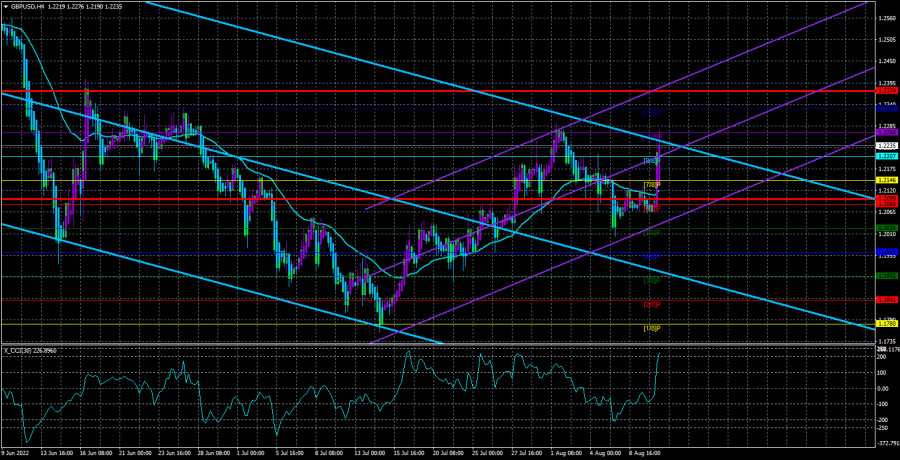

The pound now needs to break through the level of 1.2268 and hope for a strong GDP.

We have sorted out the inflation report. Now it remains only to wait for this week's report on British GDP, which seems to be expected to shrink by 0.2% in the second quarter. And it seems that this reduction should be the first in a series of falls in the British economy, which Andrew Bailey has already driven into recession, in his own words. More precisely, Bailey has already announced the beginning of a recession, and now it remains only to wait for it and guess how strong it will be. In any case, we try to rely on clear statistical data when concluding. Many experts believe that Bailey is exaggerating, and that the recession will not be as terrible as in the 90s or 2000s.

Moreover, we would like to remind you that the last two reports on US GDP were below forecasts and also negative. Nevertheless, they did not have a destructive impact on the dollar. Further, traders frankly ignored the last meeting of the Fed, at which the rate was raised by 0.75%, and yesterday they collapsed the dollar due to a good inflation report. What does all this tell us?

We believe that an option is possible in which the dollar is already overbought and its further growth, although it looks obvious, but at the same time, does not have a lot of chances of being realized. It should be clarified that this hypothesis is more valid for the pound, which in recent months has become weaker against the dollar than the euro and more expensive. In other words, it showed a higher resistance against the US currency. If the Bank of England continues to raise the rate and inflation in the UK continues to grow, as the regulator expects, we believe this may support the pound in the next two to three months. Of course, as before, we must not forget about technical analysis. For example, buying a dollar when the price is above the moving average is not worth it. There should be fundamental hypotheses, but specific technical signals should confirm them. At this time, the probability of the pound/dollar rising or falling is 50/50. The market may be at the point of changing the global mood.

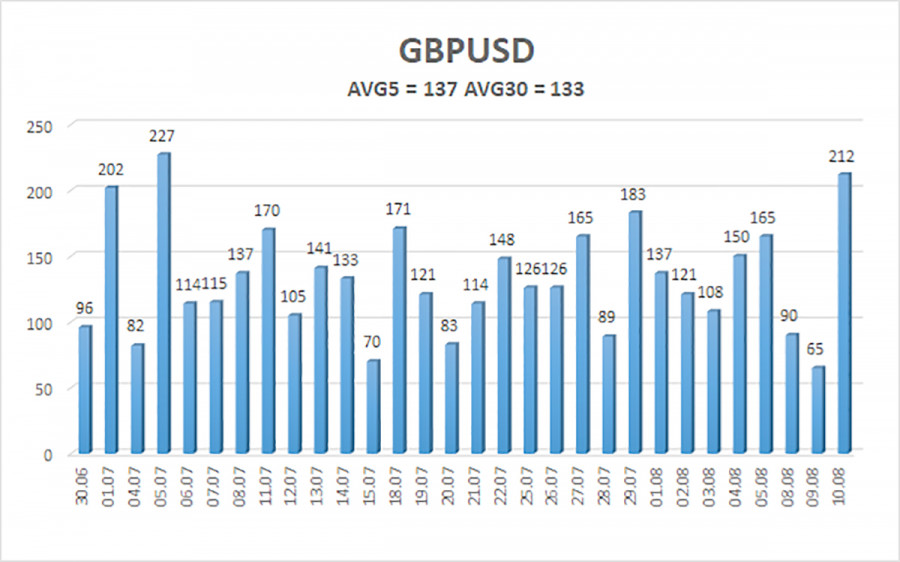

The average volatility of the GBP/USD pair over the last 5 trading days is 137 points. This value is "high" for the pound/dollar pair. On Thursday, August 11, thus, we expect movement inside the channel, limited by the levels of 1.2099 and 1.2374. The reversal of the Heiken Ashi indicator downwards signals a round of downward correction.

Nearest support levels:

S1 – 1.2207

S2 – 1.2146

S3 – 1.2085

Nearest resistance levels:

R1 – 1.2268

R2 – 1.2329

Trading Recommendations:

The GBP/USD pair turned sharply upwards in the 4-hour timeframe and consolidated above the moving average. Therefore, at the moment, you should stay in buy orders with targets of 1.2329 and 1.2374 until the Heiken Ashi indicator turns down. Sell orders should be opened when anchoring below the moving average line with targets of 1.2024 and 1.1963.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which you should trade now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.