The EUR/USD pair tested the 1.1050 resistance level at the start of Thursday's US session – at this price point, the upper line of the Bollinger Bands indicator on the daily chart coincided with the Kijun-sen line. In a matter of minutes, the pair jumped by 60 pips, responding to the US inflation data. As one might guess, the report did not favor the greenback, although it carries a rather conflicting nature overall. Nonetheless, the fact remains: EUR/USD traders interpreted the report against the US dollar – at least in terms of the initial reaction.

On Thursday, the US Dollar Index hit a weekly low, returning to the 101 mark area. Following an impulsive decline, there was a corrective rebound, but bearish sentiments dominate among traders overall. This is quite understandable, as the figures failed to strengthen hawkish expectations regarding the Fed's future course of actions. The CME FedWatch Tool data shows a 9% chance of a 25-basis-point rate hike at the September meeting. At the beginning of the week, the odds of this scenario were estimated at 28-30%. As a consequence, the chances of keeping rates unchanged next month is 91%. These figures eloquently reflect the general sentiments prevailing in the currency market. It's clear that such sentiment is clearly not in favor of the greenback.

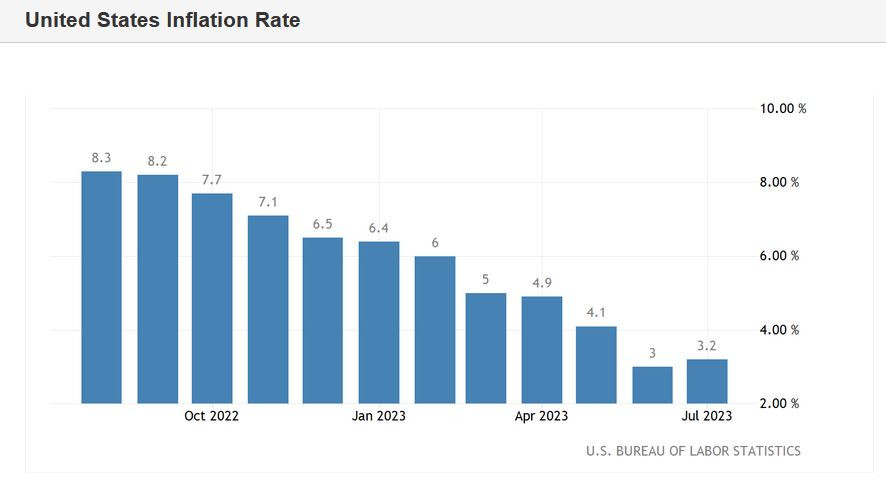

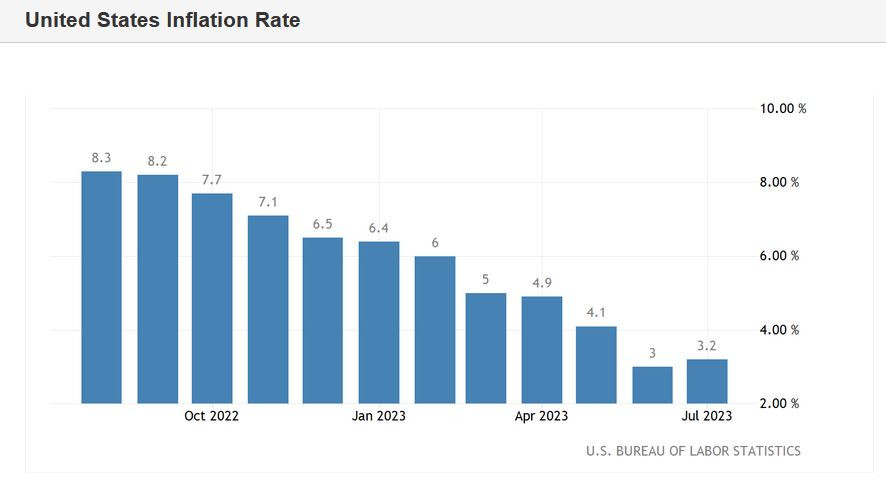

But let's return to inflation. The Consumer Price Index on a monthly basis was in line with forecasts, i.e., at 0.2%. However, in annual terms, the index showed acceleration – the first time in the last 12 months. Yet, instead of the expected rise to 3.3%, it increased to 3.2%. Nevertheless, the indicator had consistently decreased from July 2022, reaching the target of 3.0% in June. In July 2023, the sequential downtrend was broken.

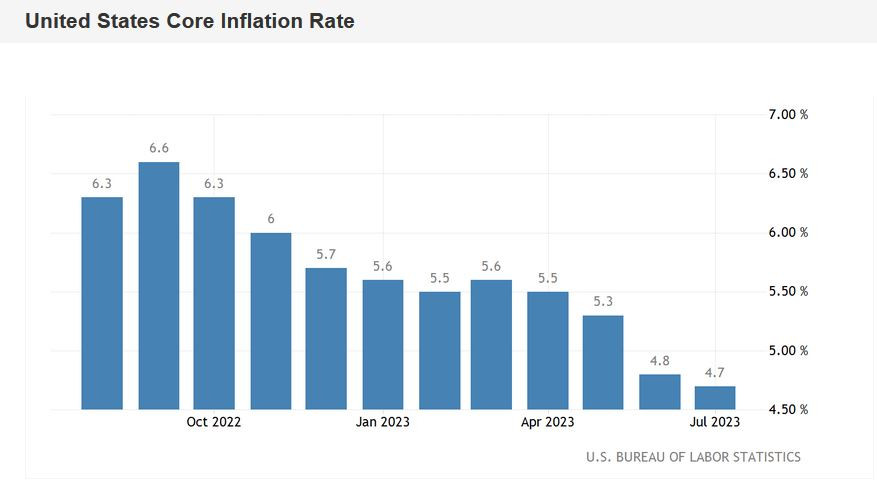

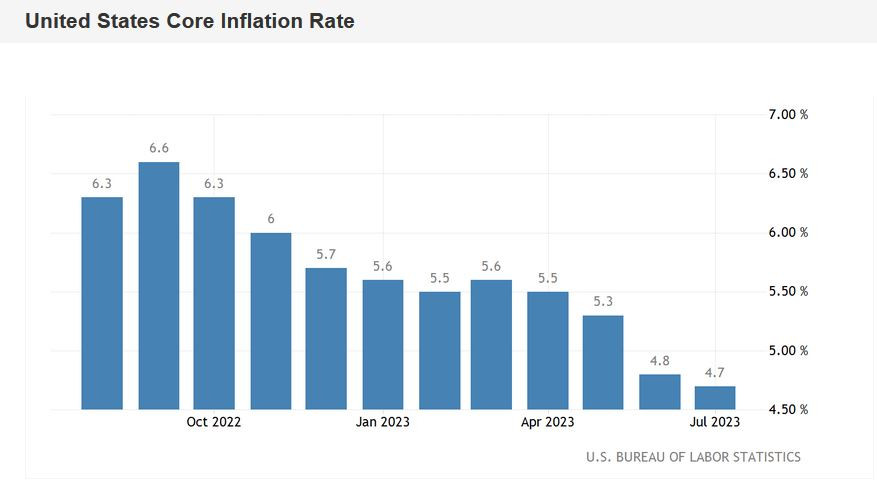

It might seem that this should have supported the dollar. However, judging by the reaction of the USD, traders focused on the core CPI, excluding food and energy prices. The core inflation in July on an annual basis decreased to 4.7%, compared to the forecasted rise to 4.8%. The July result is the weakest since November 2021. On a monthly basis, the core CPI was in line with forecasts at 0.2%.

The structure of the report indicates that energy prices in July fell by 12.5% on an annual basis (in June, the indicator dropped more significantly by 16.7%). Food prices increased by 4.9% after rising by 5.7% in the previous month. The cost of transportation services increased by 9% (compared to 8.2% in June), clothing by 3.2% (compared to 3.1% in June). Prices for used cars declined by 5.6% (in the previous month, a drop of 5.2% was recorded), while prices for new cars increased by 3.5% (4.1%).

At the end of July, the US published the core Personal Consumption Expenditures (PCE) Price Index, which measures the core level of expenditures and affects the inflation dynamics in the US (this indicator is closely monitored by the Fed officials). The US central bank's preferred inflation gauge ended up in the "red," decreasing to 4.1% – the weakest growth rate of the indicator since October 2021. It's also worth noting that the GDP Price Index in the second quarter decreased to 2.6% (from 4.1% in the first quarter).

All of this indicates that the Fed will most likely maintain a wait-and-see position both at the September and the November meetings. The CME FedWatch tool showed a 25% probability (previously estimated at around 35%) of a rate hike in November.

Furthermore, after Thursday's release, discussions about the prospects of rate cuts in the coming year will likely gain momentum in the market. Over the past week, several Fed officials have touched upon this topic, hinting at a dovish scenario. For instance, the head of the Federal Reserve Bank of New York, John Williams, stated that he doesn't rule out the possibility of rate cuts in early 2024. A similar stance was voiced by the head of the Federal Reserve Bank of Philadelphia, Patrick Harker. According to him, "a rate cut is likely to begin next year." The Chairman of the Federal Reserve Bank of Chicago, Charles Evans, also expressed concern about this issue. He noted, among other things, that the Fed "should consider how long it's necessary to keep the rate at such a high level."

Consequently, the latest report exerted pressure on the US dollar and, accordingly, provided support to EUR/USD buyers. However, take note that traders were not able to impulsively overcome the resistance level at 1.1050 (the upper Bollinger Bands line, coinciding with the Kijun-sen line on the daily chart). At the moment, they are trying to consolidate around the 1.10 level, but it appears that most buyers have decided to take profits, thus dampening the upward momentum.

Therefore, you can consider long positions once the pair settles above the 1.1030 target – which is the upper band of the Kumo cloud, coinciding with the upper Bollinger Bands line on the four-hour chart. In that case, the next targets for the bullish movement would be the 1.1050 and 1.1100 levels.