The EUR/USD currency pair made two more tentative attempts on Tuesday to surpass the Murray level of "4/8," or 1.0254. Again, unsuccessful. After that, it dropped significantly below the moving average line. Thus, despite how it may sound, our assumptions were correct this time. We have often discussed the weakness of the European currency and its inability to react regularly. The largest correction within the more than 1.5-year-long downturn was approximately 400 points. Despite falling by 2,300 points during this period, the pair broke through 20-year lows and plummeted below parity with the dollar. Since Monday this week, we have been expecting the euro to decline. The conclusions of today's Fed meeting will be summarized in the United States, and this meeting may be the most aggressive in decades. However, we shall discuss this further below. It should be underlined that, despite the ECB's efforts, it lags considerably behind the Federal Reserve. Even an immediate increase of 0.5% in interest rates was insufficient to maintain the European currency. Traders merely simulated the most optimistic scenario in advance. Thus, when the findings were released, there was no increase in the euro currency (except emotional).

What about the remaining factors? They are either nonexistent or remain unmodified. We consider geopolitics and the "foundation" to be the two primary causes for the decline of the euro currency during the past six months. The "basis" as stated by the monetary policies of the ECB and the Fed is straightforward, and the victor is unmistakable. Regarding geopolitics, nothing has changed since the armed confrontation in Ukraine continues and may drag on for years. The APU has already initiated a counteroffensive in the south and is gradually approaching Kherson. The influx of Western weaponry to Ukraine has not reached the volume of a flood, but it continues to arrive routinely. The European Union and the United States continue to provide financial, humanitarian, and military aid.

The euro is once again headed for 1.0000 or perhaps lower levels.

Just determine the possibilities for altering the Federal Reserve's monetary policy, which will be announced tonight. There are essentially only two of them. And based on the current movement of the pair, we believe the market does not perceive a significant difference between them. Once more, we are reminded that the ECB could hike the rate by 0.25 percentage points or by 0.5 percentage points. It would appear that these two choices are very different, but the market began purchasing euros three or four days before announcing the meeting's outcomes. After I became familiar with them, I did nothing. Today, we can observe roughly the same thing. Yesterday, the US dollar began to rise slowly, and it is unlikely that traders will hurry to sell it if today's rate of increase is only 0.75 percent. It should be understood that a 0.75 percent rate increase is already one of the Fed's highest rates ever. If it grows by 1%, then the difference is, as they say, negligible. In any event, we are discussing a significant tightening of monetary policy, which cannot help but increase the dollar's value. The FOMC rate could rise to 2.5–2.75 percent today, while the ECB rate is 0.5 percent. With these inputs, which currency should experience growth?

In addition, technical reasons continue to favor the US dollar. Remember that COT data indicates a more "bearish" outlook from week to week. Over the previous two weeks, the euro has demonstrated that its price cannot rise by more than 300 points. What do these two facts indicate? Only market participants refuse to purchase the euro. If they refuse to do so even with valid reasons, what will they do when there are valid reasons to purchase a dollar? It is important to remember that the market's response to a Fed meeting can be unpredictable. However, we continue to study the issue and emphasize the most probable outcome. We predict the pair will return to price parity and establish a new 20-year low.

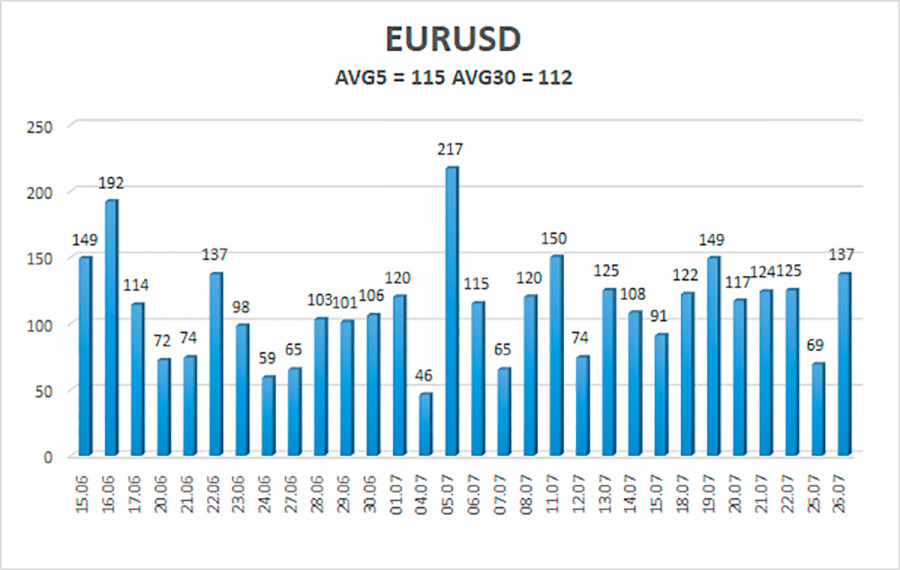

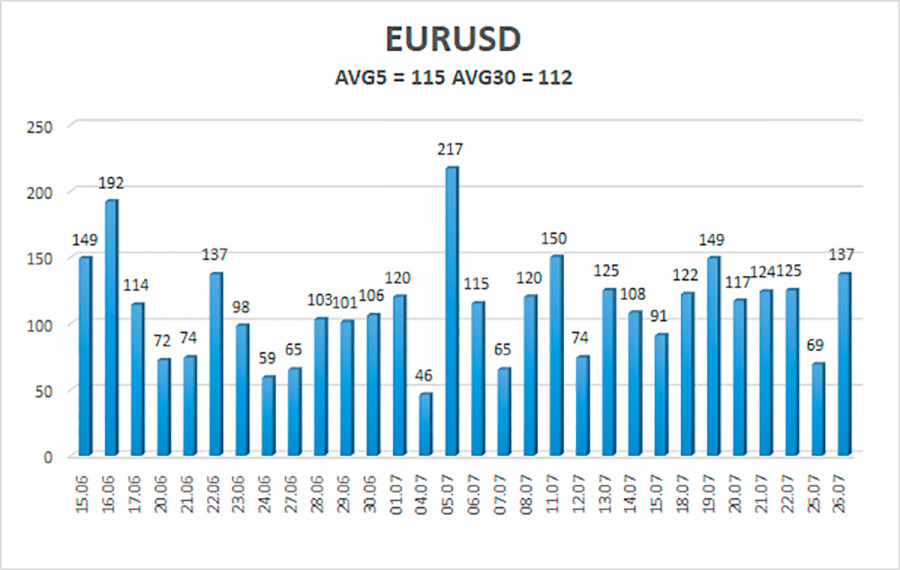

As of July 26, the average volatility of the euro/dollar currency pair over the previous five trading days was 115 points, which is considered "high." Thus, we anticipate the pair to trade between 1.0001 and 1.0231 today. The Heiken Ashi indicator's upward reversal indicates an upward correction.

Nearest support levels:

S1 – 1.0132

S2 – 1.0010

S3 – 0.9888

Nearest resistance levels:

R1 – 1.0254

R2 – 1.0376

R3 – 1.0498

Trading Recommendations:

The EUR/USD pair is attempting to resume its long-term decline. Consequently, it is crucial to maintain short positions with targets between 1.0010 and 1.0001 until the Heiken Ashi signal reverses direction. When fixed above the moving average with targets of 1.0254 and 1.0376, purchases of the pair will resume being meaningful.

Explanations for the figures:

Channels of linear regression – aid in determining the present trend. If both are moving in the same direction, the trend is now strong.

The moving average line (settings 20.0, smoothed) – determines the current short-term trend and trading direction.

Murray levels serve as movement and correction targets.

Volatility levels (red lines) represent the expected price channel that the pair will trade within over the next trading day, based on the current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is imminent.