The AUD/USD pair shows mixed dynamics this month. In early February, the bears interrupted the price growth and pulled it down by more than 200 points. However, they failed to overcome the mark of 0.7000, and was followed by a corrective pullback, which subsequently received its continuation. As a result, the pair recovered almost all lost positions and is now trading in the mid-71st figure.

This week, the aussie will trade in conditions of increased price turbulence. There are many reasons for this. First, the minutes of the last RBA meeting will be published on Tuesday. A little later on (Thursday) we will learn the data on the growth of the Australian labor market. The head of the Reserve Bank of Australia Philip Lowe, who will speak in the country's Parliament on Friday, will report to the members of the Standing Committee on Economics of the House of Representatives, can also give impetus to the pair. The very theme of the presentation suggests a broad assessment of the current situation, so the market will respond to this speech accordingly. And in the end, the traders of the pair will keep track of the main political theme of the week: we are talking about the next (according to some information – the final) round of talks between Beijing and Washington.

All these fundamental factors will have a significant impact on the dynamics of AUD/USD, so each of them should be discussed in more detail. So, tomorrow we will know the text of the minutes of the last RBA meeting. Here it is worth recalling that traders actually ignored the results of this meeting. Contrary to pessimistic expectations, the regulator reacted rather restrained to the current economic situation. So, on the eve of the meeting, many analysts warned that the central bank will significantly reconsider its position on the country's GDP growth this year (up to 2.8% and below), but these fears were not justified: the regulator reduced the forecasts of economic growth to 3% from the previous forecast of 3.5%.

This fact even made it possible for the pair's bulls to claim an increase in price, but after a few days, such intentions were crossed out by the head of the RBA, who voiced too pessimistic comments. He acknowledged the heightening of both external and internal risks. The trade war between China and the United States could flare up with a new force in spring, pulling the world economy and the commodity market. Ascertaining this fact, Lowe stated that the regulator can react to external circumstances accordingly, and the option of lowering the interest rate cannot be ruled out.

It is worth noting here that earlier in the text of the accompanying statement of the RBA, there was a phrase that "the next action relative to the interest rate will most likely be upwards". Now the reverse option is not excluded. That is why the minutes of the last meeting of the Australian central bank in this case is quite significant. If the majority of the members of the RBA share the point of view of their "chief", then the aussie will once again fall under a wave of selling.

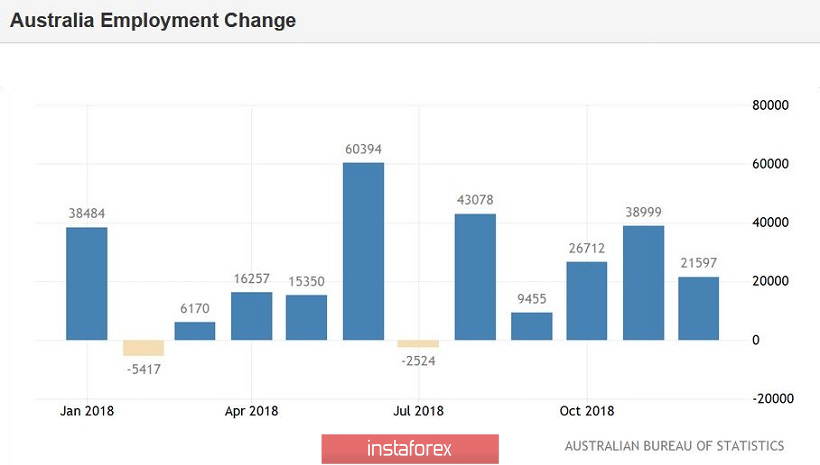

The dynamics of the labor market can also have a significant impact on the aussie. The unemployment rate should remain at the same five-percent mark, but the increase in the number of employees will decline slightly (relative to the previous month) to 15.2 thousand. The Australian dollar will again be under pressure if the real result is different from the forecast (especially downward). Here it is necessary to carefully look at the structure of indicators. The fact is that employment growth in December was entirely due to part-time hiring. But full employment, on the contrary, decreased by three thousand, continuing the negative trend. This factor adversely affects the dynamics of wage growth, since full-time positions offer a higher wage level. If a similar dynamic takes place in January, then even a low level of unemployment will not save the aussie from a pressure of being sold.

Despite the fact that risks of resuming the downward trend is quite high, short positions on the pair should be treated with extreme caution, especially if the price approaches the psychologically important level of 0.7000. This is due to the US-China trade negotiations, the next round of which will be held this week in Washington.

The priority of this fundamental factor for the aussie is unconditional - the Australian economy is too dependent on the Chinese, so any positive signals from the fields of the negotiation process will push the pair up, regardless of the results of macroeconomic reports. Donald Trump shows unusual optimism about the upcoming dialogue - and if his expectations are met, then the fundamental picture for most currency pairs will change significantly, and above all - for the AUD/USD pair. Because of this factor, you must not forget about the "foot".

Thus, on the approach to the "round" mark of 0.70, there is a strong support level of 0.7030 - at this price point the lower line of the Bollinger Bands coincided with the upper boundary of the Kumo cloud (on the daily chart). But the resistance level is the mark of 0.7280 - this is the upper line of the Bollinger Bands on the same timeframe.