4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - downward.

The EUR/USD currency pair continued its downward movement slowly and unhurriedly on Wednesday. Every day, the European currency loses 30-50 points, which seems to be a little. However, if every day, then this is already 400 points over the past two weeks. And if you look at the older timeframe, you can see how much the downward movement has intensified over the past few weeks. We have already said in recent articles that, most likely, the euro is not just getting cheaper or the dollar is getting more expensive. Most likely, both. The drop in the pair's quotes has increased too sharply and unexpectedly. Recall that a couple of months ago, in global terms, we expected the resumption of the upward trend, since the pair barely managed to adjust by 600 points in 7-8 months of 2021, which is very small even for it. However, since the beginning of September, the euro currency has lost another 600 points, so now we are not talking about a simple correction, but about a strong trend. At least on a 4-hour timeframe. It should also be noted that the fundamental background has not changed too much in recent months. At least, there was no discouraging and shocking news. Has the Fed started to wind down the QE program? Everyone has been waiting for this since the summer. Does the ECB refuse to raise the rate? Look at the growth rates of its economy over the past year and it becomes clear why. Even these two factors can and should put pressure on the euro and support the dollar. However, they were not something unexpected for the markets. Therefore, we treat them with understanding and respect. However, we note that the market itself decided to work them out, which means it was set up to sell the euro and buy the dollar. Also, another factor of the decline of the euro/dollar pair should be noted separately. This factor is the fourth "wave" of the pandemic in the European Union.

Germany is breaking anti-records of the incidence of "coronavirus".

The first reports from the European Union about the "fourth" wave of the pandemic began to arrive from the very beginning of autumn. And this is not surprising. The "coronavirus" becomes more active with the arrival of the cold season, when people's immunity weakens, like any other virus. At first, several Eastern European countries announced high levels of morbidity and went into quarantine, but over time, even EU countries that were successful in terms of vaccination also began to suffer from the fourth "wave". This is quite strange, since countries such as Germany, the Netherlands, Italy, and Spain have high vaccination rates, so it would be logical to assume that residents of these countries will not be infected by tens of thousands. However, as practice shows, all existing vaccines do not work very well against the "coronavirus". At least there's nothing stopping people from continuing to infect each other. There may be much fewer hospitalizations and deaths from the disease, but, as the official data show, in some EU countries, the incidence rates are now higher than in any other "wave". The greatest concern is caused by Germany, where 50-60 thousand inhabitants a day have been infected in recent days. The head of the German Ministry of Health, Jens Spahn, had to make a very tough statement: "By the end of this winter, no matter how cynical it may sound, almost all residents of Germany will either be vaccinated, or will get sick, or will die." He urged everyone who has not yet been vaccinated to get both vaccinations, as "the situation in hospitals is very serious." According to official data, about 1,400 people have died in the country over the past week from complications caused by the "coronavirus", which is about 4 times less than at the peak in January 2021. Thus, in part, it can still be concluded that vaccines work, since the incidence rates in Germany are now the highest for the entire time of the pandemic. For the EU economy, this means only new potential problems, since Germany is its locomotive. Austria has already gone to lockdown, its example may be followed in Germany, as well as other countries where morbidity records have been breaking in recent weeks.

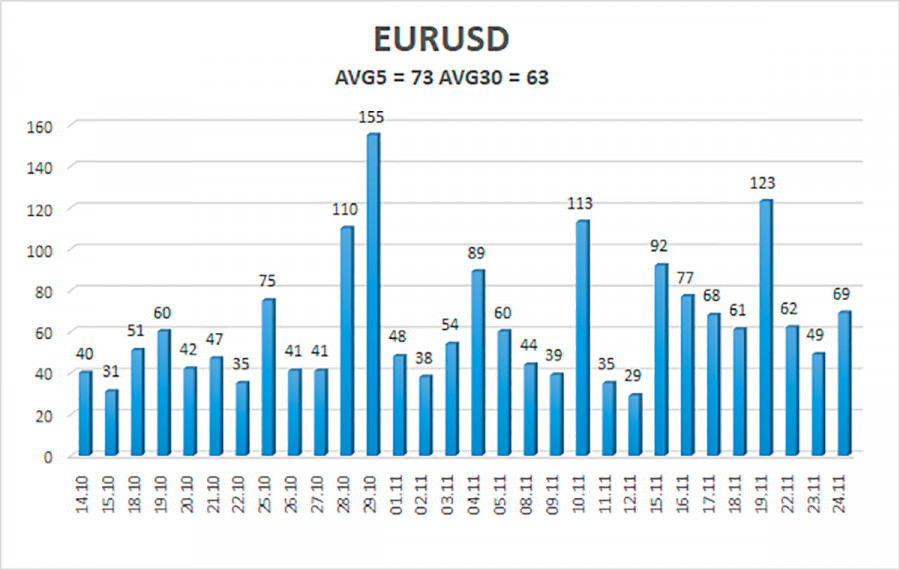

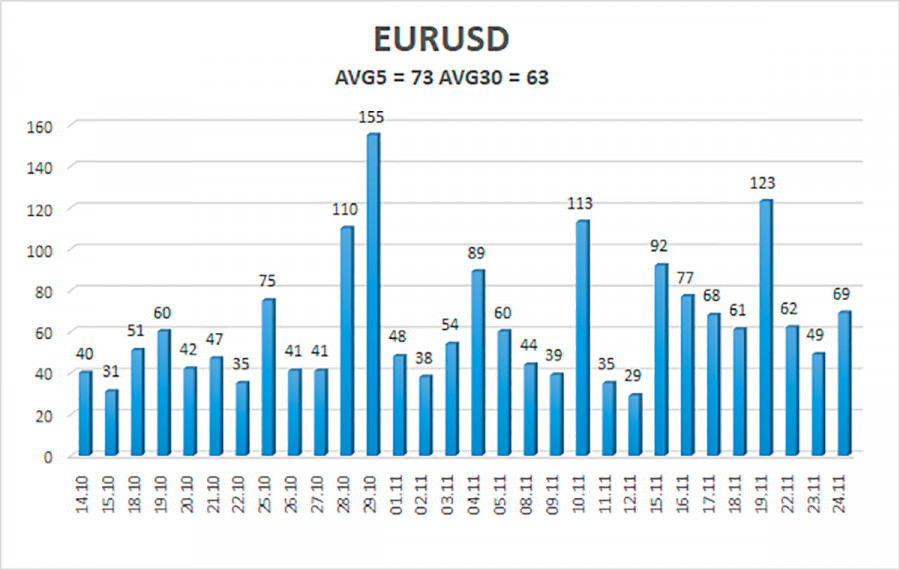

The volatility of the euro/dollar currency pair as of November 25 is 73 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1121 and 1.1267. A reversal of the Heiken Ashi indicator upwards will signal a new round of correction.

Nearest support levels:

S1 – 1.1269

S2 – 1.1108

Nearest resistance levels:

R1 – 1.1230

R2 – 1.1292

R3 – 1.1353

Trading recommendations:

The EUR/USD pair resumed its downward movement. Thus, today, you should stay in sell orders with targets of 1.1169 and 1.1121 until the Heiken Ashi indicator turns up. Purchases of the pair should be considered if the price is fixed above the moving average, with targets of 1.1353 and 1.1414.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels a- target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.