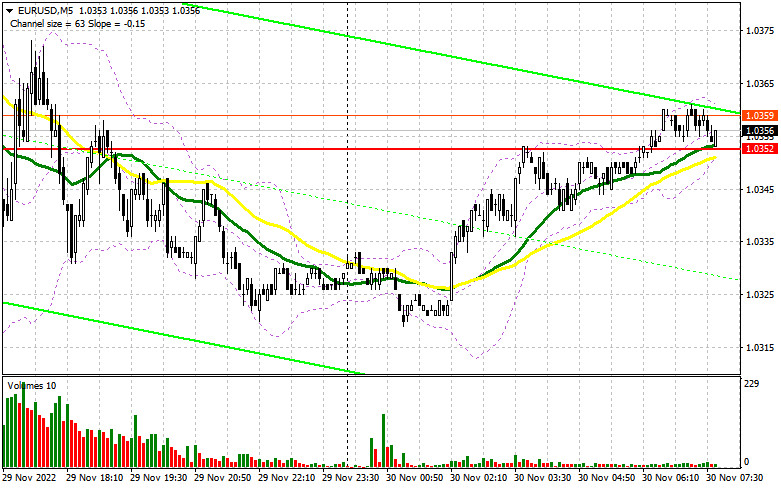

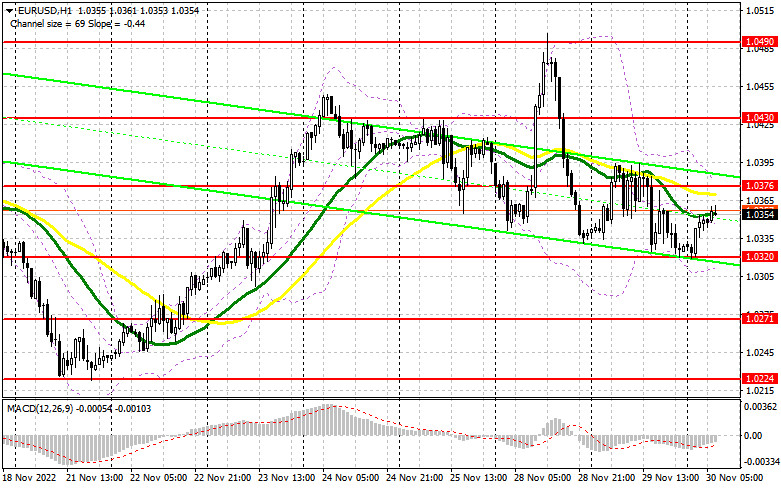

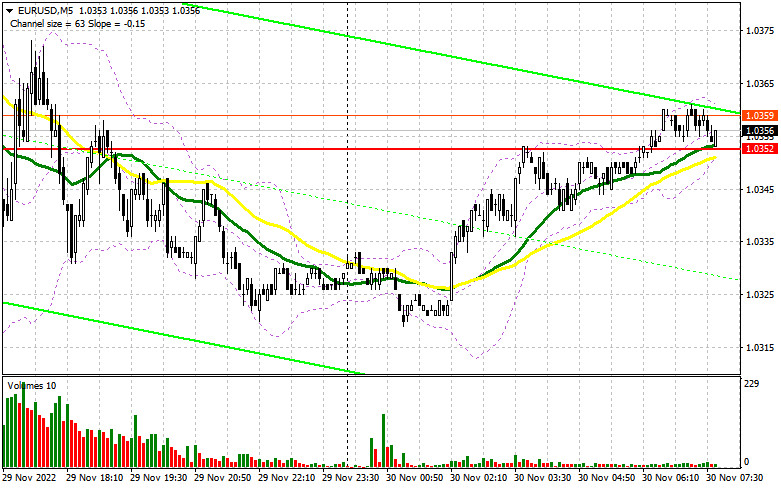

Yesterday, a sole entry signal was made. Let's take a look at the 5-minute chart to get a picture of what happened. In the previous review, we focused on the mark of 1.0377 where we considered entering the market. Growth and a false breakout through this level in the first half of the day produced a sell signal. However, the price did not fall sharply. Following the pair's 20-pip rise, the bulls regained control over the market, and the closed trade brought no losses. In the second half of the day, no signals were generated.

When to go long on EUR/USD:

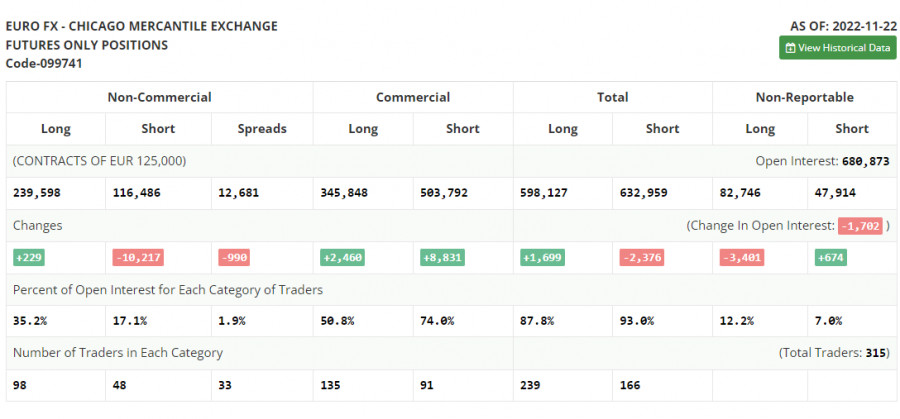

Before talking about prospects for EUR/USD, let's discuss what has happened in the futures market and analyze how the Commitments of Traders have changed. The COT report from November 22 logged an increase in long positions and a plunge in short ones. Statements made by senior Fed bankers allowed the EUR buyers to make their presence felt in the market, as traders once again believed in the Committee pivot. In the near future, important statistics on GDP and the American labor market will be delivered, which may put everything in place. Only inflation data for November will be lacking. An increase in unemployment could contribute to the weakening of the US dollar against risky assets, including the euro. Meanwhile, hawkish comments made by the Fed Chair could give another reason to go short because further rate hikes might push the US economy into a recession. According to the COT report, long non-commercial positions rose by 229 to 239,598 and short non-commercial positions plummeted by 10,217 to 116,486. The total non-commercial net positions grew to 123,112 from 112,666 a week ago. In other words, investors keep taking advantage of the situation and buying the undervalued euro even above the parity level. Traders are accumulating long positions, hoping for a resolution to the crisis and betting on a stronger euro in the long term. The weekly closing price dropped to 1.0315 versus 1.0390.

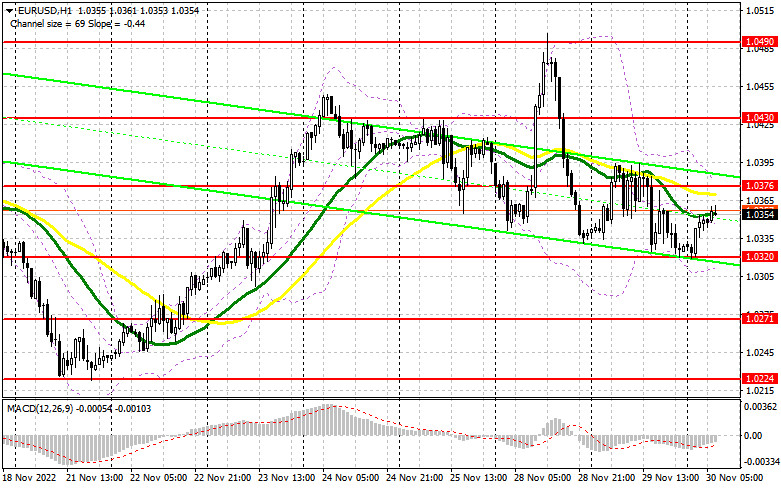

Today, many macro reports will be published in the eurozone countries. Yet, Germany's unemployment data deserves special attention. If the labor market shows a contraction, the greenback will come under pressure. Likewise, it is important to focus on the eurozone's CPI for November. Risk sentiment is likely to increase if CPI growth slows. It remains to be seen what report will affect the market more. In case of the pair's fall, a false breakout through 1.0320 will make a buy signal. Then, the uptrend may extend to the nearest resistance level of 1.0376, in line with bearish MAs. A breakout and a test of this range to the downside allow the pair to return to the 1.0430 high with the target at 1.0490. The most distant target is seen in the area of 1.0525 where a profit-taking stage may begin because the situation may drastically change. The price may go there only on dovish comments made by the Fed chair. If EUR/USD goes down when there is no bullish activity at 1.0320, the buyers will lose control over the market. A breakout through the 1.0271 support will make a buy signal. Also, it will be possible to buy EUR/USD on a bounce off the 1.0224 support, or even lower, in the area of the 1.0180 low, allowing a bullish correction of 30-35 pips intraday.

When to go short on EUR/USD:

The sellers hope for a significant bearish correction, which may extend in case of pessimistic macro results in the eurozone and a decrease in risk appetite. Therefore, EUR/USD may feel some pressure. Today, it would be wiser to go short after a false breakout through the 1.0376 resistance. If the price fails to settle there, the euro may drop to the area of yesterday's low of 1.0320. A breakout and consolidation below the mark along with its retest to the upside will make a sell signal and trigger a row of bullish stop orders, and the euro will fall to 1.0271 where a profit-taking stage may begin. The release of upbeat macro statistics in the US will push the pair beyond this level. If EUR/USD goes up during the European session when there is no bearish activity at 1.0376, we may expect the price to skyrocket. Then, it would be wiser to go short at 1.0430 after a false breakout only. Also, it will be possible to sell EUR/USD on a bounce off the 1.0490 high, or even higher, at 1.0525, allowing a bearish correction of 30-35 pips.

Indicator signals:

Moving averages

Trading is carried out below the 30-day and 50-day moving averages, reflecting a fall in the EUR value.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

The lower band at 1.0320 stands as support. Resistance is seen at 1.0376 in line with the upper band.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.