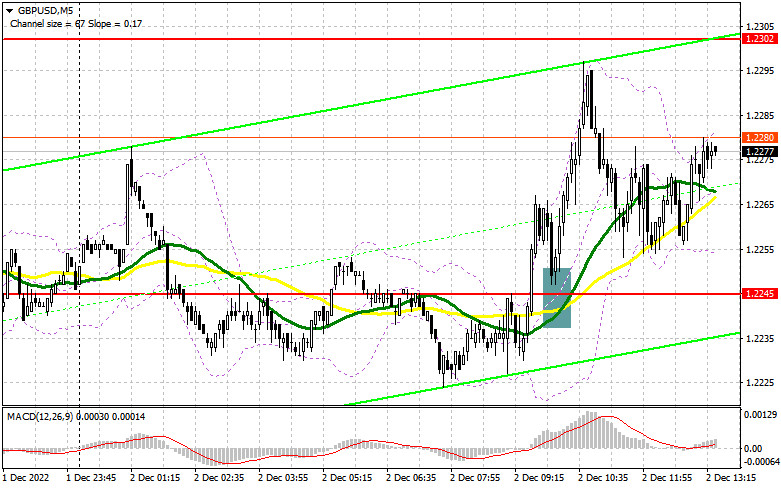

In my previous analytical review, I drew your attention to the level of 1.2245 and recommended entering the market from it. Let's have a look at the 5-minute chart and analyze the situation there. The pair broke through and made a top-down test of 1.2245, which created an entry point into long positions. Thus, the British pound jumped by more than 50 pips. In the afternoon, the technical picture has not changed. In addition, we may expect the price to hit new monthly highs.

Long positions on GBP/USD:

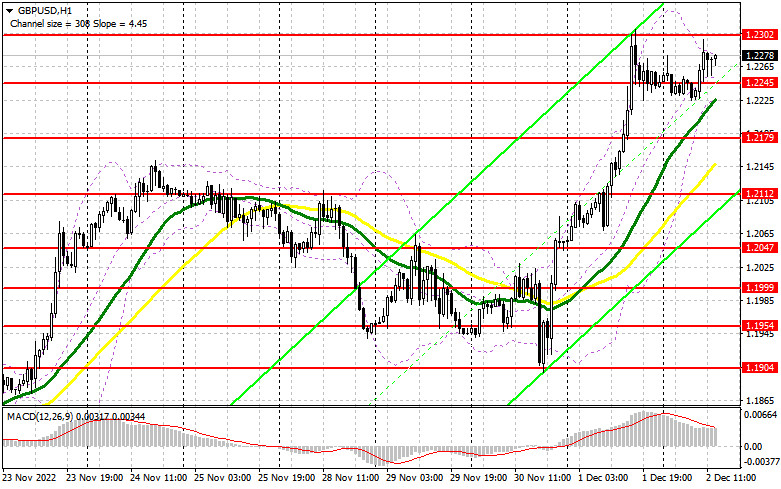

The market expects important unemployment claims and non-farm payroll reports today. A sharp drop in new jobs in the US is expected to grow by only 200,000 in November from 260,000 in October year-on-year. The US dollar may drop and the British pound is likely to soar, pushing the pair to a new monthly high. Even if the data beat economists' forecasts, the pair's downward move will be short-lived. Should the pressure on GBP return, it would be better to act according to this morning's scenario: a false breakout at 1.2245, which offers support, creates a signal to open long positions with the target at 1.2302. Notably, the price failed to reach this level today. A breakthrough and a downside test of this level are likely to support bulls, giving a buy signal with the target at 1.2347. The next target is located at a new monthly high of 1.2393, where traders may consider locking in profits. However, this level may be reached if we see weak statistics on the US labor market. If bulls fail to reach 1.2452, the pressure on the pair may return and we can profit-taking at the end of the week. If this happens, it would be better to buy the British pound only near the support of 1.2179, where the moving averages are passing and supporting bulls. It is better to open long positions on a rebound from 1.2112 or lower near 1.2047, allowing an intraday correction of 30-35 pips.

Short positions on GBP/USD:

For the most part, bears are not active in the market. Only strong US labor market statistics may help bring back the pressure on the British pound, making a deep correction at the end of the week. At the same time, bulls should defend 1.2302, as this level is highly likely to be pierced after the releases. Only a false breakout at this level may create a good entry point into short positions with the target at 1.2245. The price may pierce 1.2245 after we see strong US statistics and FOMC member Charles Evans's speech. A downward test of 1.2245 may give a sell signal, counting on a decline to 1.2179, where bears are likely to face difficulties. The next target is located in the area of 1.2112, where traders may take profits. If the pair moves down from 1.2302, which is likely to happen, bulls will continue to push the British pound higher, trying to reach the area of 1.2347. A false breakout there may give an entry point into short positions. If we see no activity there either, it is better to sell GBP on a pullback from 1.2393, allowing an intraday correction of 30-35 pips.

The COT report for November 22 logged a decrease in both short and long positions. The decline in the UK economy continues to signal the looming recession, which the Bank of England does not yet have much intention to fight. Firstly, it has to deal with high inflation. As shown the latest data shows, inflation continues to grow. Against this backdrop, it is not surprising why traders prefer to stay away from the market, neither buying nor selling the pound. This week, the Federal Reserve Chairman will share his views on the future of US monetary policy. If his statements do not match market expectations, the pressure on the British pound may come back immediately, triggering a large sell-off in the pair later this month and early next month. The latest COT report showed that long non-commercial positions declined by 3,782 to 30,917, while short non-commercial positions declined by 674 to 66,859, pushing the negative non-commercial net position to -35,942, versus -32,834 a week earlier. The weekly closing price rose to 1.1892, against 1.1885.

Indicator signals:

Moving Averages

Trading above the 30- and 50-day moving averages indicates a bull market.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

In case of a decline, the lower band of the indicator at 1.2230 will offer support.

Description of indicators:

- A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

- A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

- MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

- Bollinger Bands: 20-day period;

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

- Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

- Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

- The non-commercial net position is the difference between short and long positions of non-commercial traders.