The NonFarm Payrolls report did not disappoint. Almost all components of the report came out either in the green zone or at the forecasted level. This result made it possible for the bears to partially regain their positions. We can assume that if the US labor market key data had disappointed the dollar bulls (like the PCE core and ISM manufacturing index did earlier), the bulls would have taken a swing at the 6th figure, further developing and consolidating their success.

But as they say, not everything is a blessing in disguise. The report cooled down the bulls' enthusiasm for EUR/USD, and after that the price returned to the area of the 4th figure for some time. Looking ahead, the report will not allow the price to reach the parity level in the near future (or even to the support level of 1.0250). But now the 5th price level may seem like a tough nut for the bulls, similar to the 4th figure (which they were storming throughout November).

In general, there is only one thing that is certain: the Federal Reserve will decide the fate of EUR/USD at its December meeting (which will take place in less than two weeks). All other fundamental factors either play a secondary role or are considered through the prism of possible results of the forthcoming meeting of the members of the US central bank. The aforementioned PCE and ISM indices, the minutes of the November FOMC meeting, some statements of Fed Chairman Jerome Powell - all these fundamental factors were on a conditionally dovish scale. And the NonFarm acted as a kind of a counterweight, allowing the EUR/USD bears to remind themselves again. At least the report wasn't another form of trump card for the bulls, though the report itself can hardly be considered as strong.

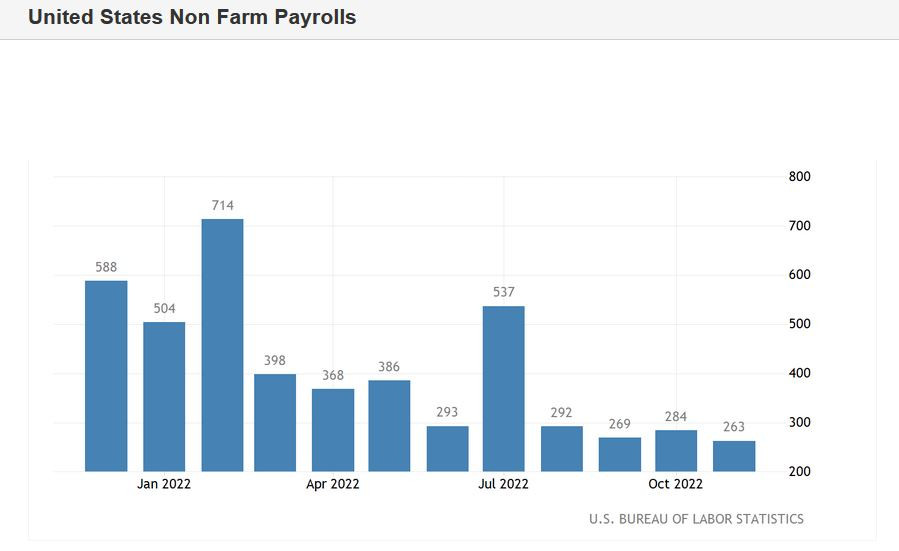

NonFarm Payrolls increased by 263,000 in November, the Bureau of Labor Statistics announced on Friday. This component was in the green zone, exceeding expectations of the majority of experts (the forecast was at the level of 200,000). It is also worth recalling that a rather weak report from the ADP agency (127,000) was published on Wednesday, which is considered to be a kind of "harbinger" of a weak Nonfarm. So the official result was positively received by the market. On the other hand, although this result exceeded analysts' expectations by showing positive signs in the US labor market, it was the weakest since April 2021.

As for the unemployment rate, it came out at 3.7%, the same as in November. Here we see stagnation after a slight increase from a multi-year low of 3.5%.

Another component of the release was a bit disappointing. The participation rate, or the proportion of working-age Americans who have a job or are looking for one, slipped to 62.1% from 62.2% in October. The decline is minimal, but the de facto indicator was in the red.

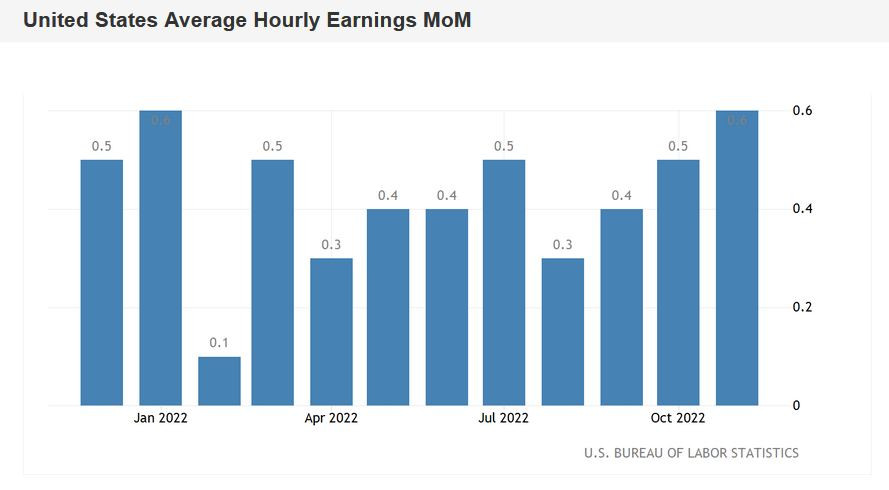

In my opinion, the dollar bulls were "saved" by the wage component, which really surprised with its breakthrough growth. The average hourly earnings indicator rose to 5.1% year-over-year, instead of the projected decline to 4.6%. The indicator had been declining for the past two months, but as we can see, it went back up in November. In monthly terms, the indicator also demonstrated a good result, rising to 0.6% (the strongest growth rate since January of this year).

So, on the one hand, the November Nonfarm data did not disappoint, especially given the alarming signals from the ADP. On the other hand, many components still leave much to be desired (except perhaps the wage indicator).

The report was a "breath of fresh air" for dollar bulls, following a series of weak US releases. Besides, the notorious "Friday factor" also played its role - on the threshold of the weekend, traders rushed to lock in profits, thus extinguishing the upward momentum.

In my opinion, next week EUR/USD bulls will try to get a foothold within the 5h figure again. We have the FOMC blackout period (Fed staff generally do not speak publicly between a week prior to the Saturday preceding a FOMC meeting), so traders of the dollar pairs will be left "on their own", being left alone with the macroeconomic reports (in particular, the day before the announcement of the results of the Fed meeting in December the data on the US inflation growth in November will be published). I assume that in the mid-term, the pair will trade within the range of 1.0400-1.0590, alternately pushing up the limits of this range. A similar situation we saw in November, only now the traders moved one floor higher.

From a technical point of view, the pair is between the middle and upper lines of the Bollinger Bands indicator on the daily chart, and also above all Ichimoku indicator lines (including the Kumo cloud). The support level is located at 1.0400, which corresponds to the Tenkan-sen line. The main price barrier is the target of 1.0590 (the upper line of the Bollinger Bands on the D1 timeframe).