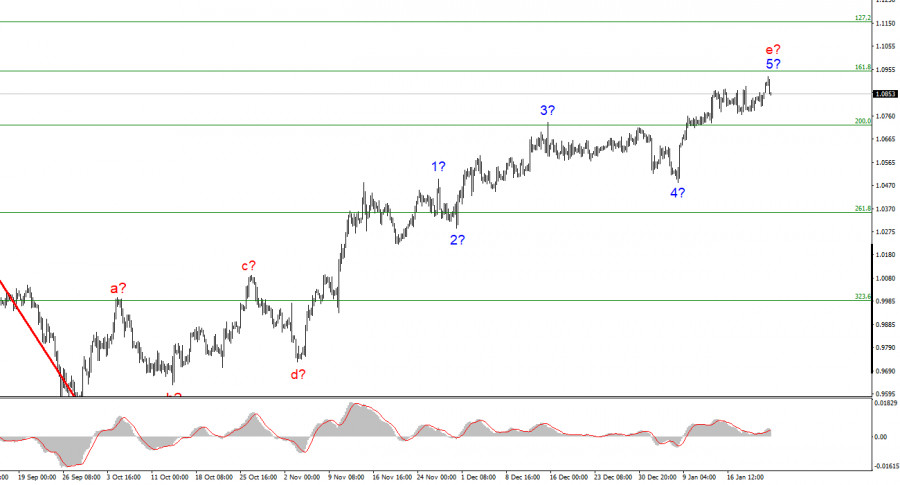

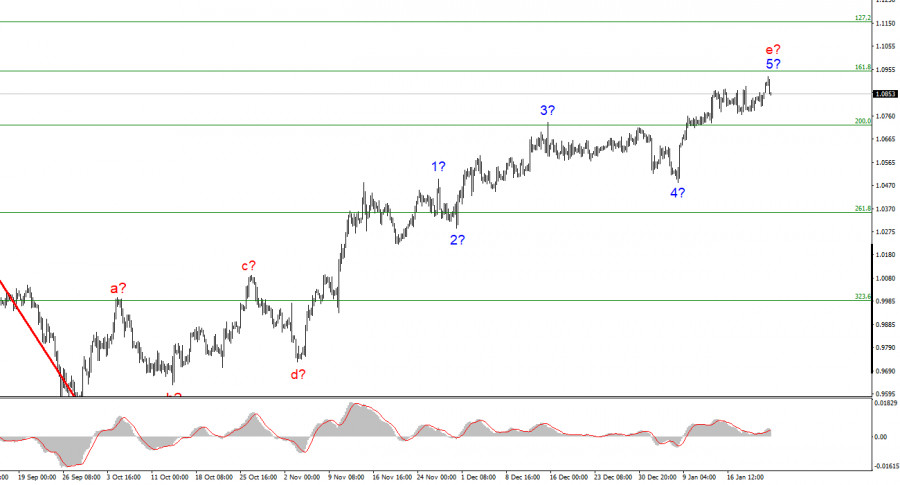

The wave marking on the euro/dollar instrument's 4-hour chart is still quite compelling and getting more intricate, and the entire upward segment of the trend is still quite convoluted. Although its length is better suited for the pulse portion, it has developed a noticeable correction and a highly expanded aspect. The waves a-b-c-d-e have been combined into a complicated corrective structure, with wave e having a form that is far more complex than the other waves. Since the peak of wave e is substantially higher than the peak of wave C, if the wave markings are accurate, construction on this structure may be nearly finished. I'm still planning for a decline in the instrument because we are predicted to build at least three waves down in this scenario. The demand for the euro currency was increasing again in the first week of 2023, and the instrument was only able to deviate somewhat from its prior highs during this time. A new attempt to surpass 1.0721, which according to Fibonacci amounts to 200.0%, was successful, allowing the wave e to take on an even longer form. Unfortunately, there is another delay in starting to build the trend correction part.

The ECB considers the current price level to be excessive.

On Monday, the euro/dollar instrument experienced a rise of 70 basis points followed by a fall of the same value. Another quote deviation from previously attained peaks has occurred, though it could be the same microwave as all previous waste. On Monday, there was no news context, but last week, when ECB President Christine Lagarde spoke multiple times, there was a wealth of it. She has speeches scheduled for today and at the end of the week, and I don't believe her rhetoric will shift or be expanded upon. The main topic of Lagarde's speech was the likelihood of future interest rate increases. Lagarde contends that the present inflation rate is extremely high and unfavorable to the ECB. To return inflation to 2% in the near future, Lagarde said, "We will hike the rate as much as it takes to reach a restrictive level."

Even these words, in my opinion, didn't say anything new. The markets have long been aware of all of this. However, there is more faith in the regulator's "hawkish" stance when Lagarde occasionally reiterates these sentiments. Perhaps because of this reality, despite the seeming lack of news context, demand for the European currency is rising. Only another speech by Lagarde was interesting last Friday, but the instrument once again rose. I anticipate that the European currency will increase up until the ECB meeting based on everything stated above. Furthermore, I believe that the market will have already fully accounted for the rate increase of 50 basis points and that the decrease in quotes that will start the following week should finally lead to the development of a trend-correcting section. Wave e has already developed an unwieldy shape.

Conclusions in general

I conclude that the upward trend section's building is about finished based on the analysis. As a result, given that the MACD is indicating a "down" trend, it is now viable to contemplate sales with targets close to the predicted Fibonacci level of 0.9994 (323.6%). The potential for complicating and extending the upward portion of the trend remains quite strong, as does the likelihood of this happening. The market will be ready to finish the wave e when a bid to break through the 1.0950 level fails.

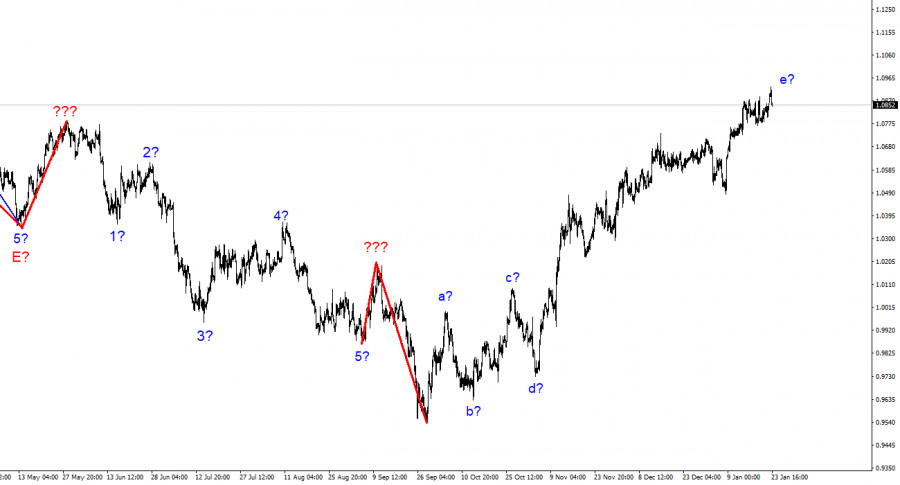

The wave marking of the descending trend segment notably becomes more intricate and lengthens at the higher wave scale. The a-b-c-d-e structure is most likely represented by the five upward waves we observed. After the construction of this portion is complete, work on the downward trend segment can start.