On Thursday, the GBP/USD currency pair maintained its upward trend. If we consider the daytime, which is the period of greatest activity, the US dollar increased for little more than 15 minutes. A comprehensive set of macroeconomic indicators that were released at the start of the American trading session may have an impact on the movement of the pound/dollar pair. The real estate market, unemployment benefit applications, the fourth quarter GDP, and orders for long-term goods are the four relatively significant reports that were released. Forecasts were outperformed by all four reports. The dollar was able to gain 20 to 30 points during this period. And that is all you need to know about how statistics and the "foundation" affect the market. We have often called traders' attention to the fact that practically all data received is interpreted either favorably for the pound (or euro) or is simply ignored by traders. If they don't buy it, although there are very precise justifications for doing so, how can the US dollar demonstrate growth?

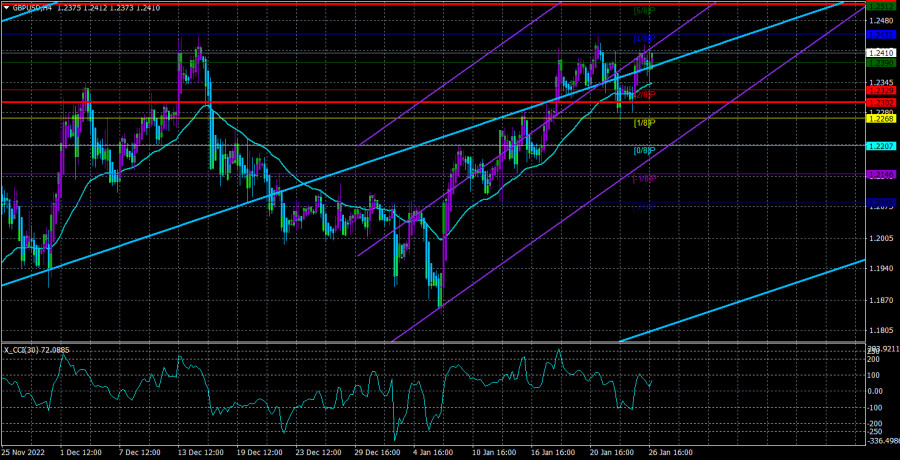

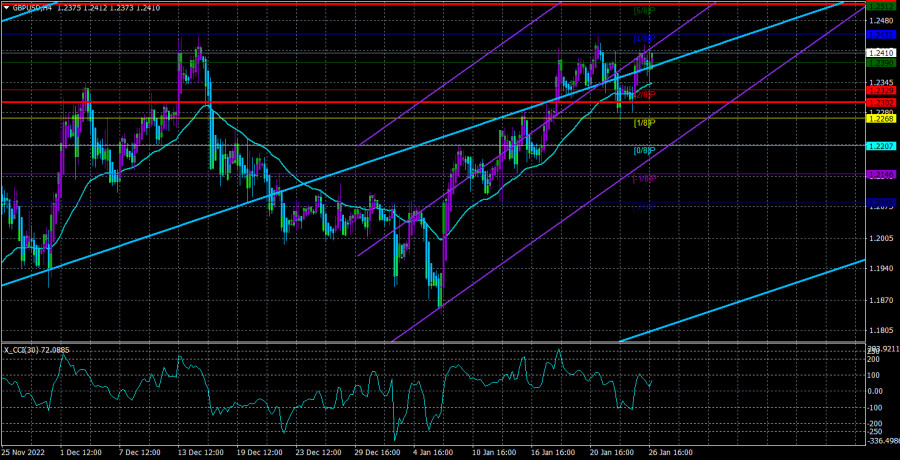

It turns out that the betting element still forces traders to exclusively trade for gains and that all macroeconomic facts are completely irrelevant. Technically, the pair hasn't fallen below the moving average, and all of the indicators are still pointing upward. Not a single sales indicator exists. Macroeconomics is macroeconomics, the "foundation" is the "foundation," the pair is moving north, and it would be sinful for things not to work out. The consolidation of the price below the moving average will be the first indication of a potential trend reversal, but when will it occur? Furthermore, even if this signal materializes, there is no guarantee that the pair will start making a substantial downward correction, as it has in the past. In general, the dollar has "nothing to catch" in such a market environment.

Commerzbank declares the end of the dollar.

It would not be unnecessary in the current circumstance to seek the advice of more specialists. For instance, Commerzbank analysts stated yesterday (before the release of the GDP report) that data on economic growth in the United States is unlikely to alter the market's perception of the dollar because they always offer a "past view," not a forward-looking perspective. But according to the bank, "leading signs" include company activity indices, information on long-term orders, and unemployment benefit applications. As you can see, these reports did not in any way help the US dollar and also came out in the "green" zone. So, we deviate from Commerzbank analysts. They are attempting to draw a connection between the currency and the US economy at the moment, but there is none. Traders currently control the dollar exchange rate and just disregard all statistics. Even when the right conditions are in place, the dollar doesn't increase.

At this point, all that is left to do is wait for either the Fed or the Bank of England to meet next week. Since market players are currently mainly focused on rates, there is hope that the BA will decide to cut down the pace of tightening monetary policy to 0.25%. This might have a highly negative effect on the pound sterling. We would suggest that the likelihood of a decrease in the pace of increase is limited because inflation is at an all-time high in the UK (possibly 30 or 40%). However, given the likelihood of a severe recession and the eight rate increases made last year, the regulator might operate more cautiously going forward. It turns out that the Bank of England's airplane is the only thing that gives the US dollar any hope. Whatever the outcome, we will see a decrease in both major pairings because the market may have time by the middle of the next week to anticipate future adjustments in the monetary policies of the Fed and the BA. There is just one technical explanation for the current decline: the price is still unable to surpass its previous local peak or the level of 1.2451. This could indicate the development of a "double top" pattern, which occasionally results in a fall.

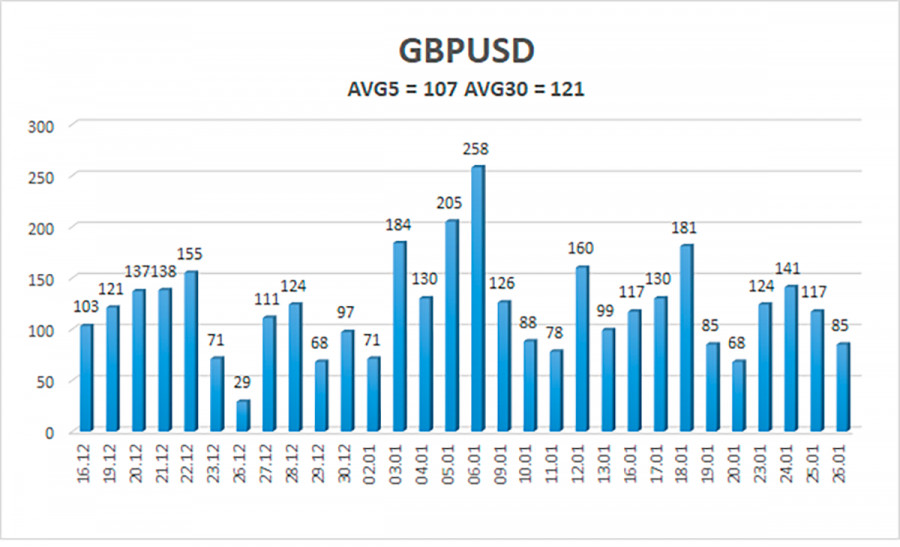

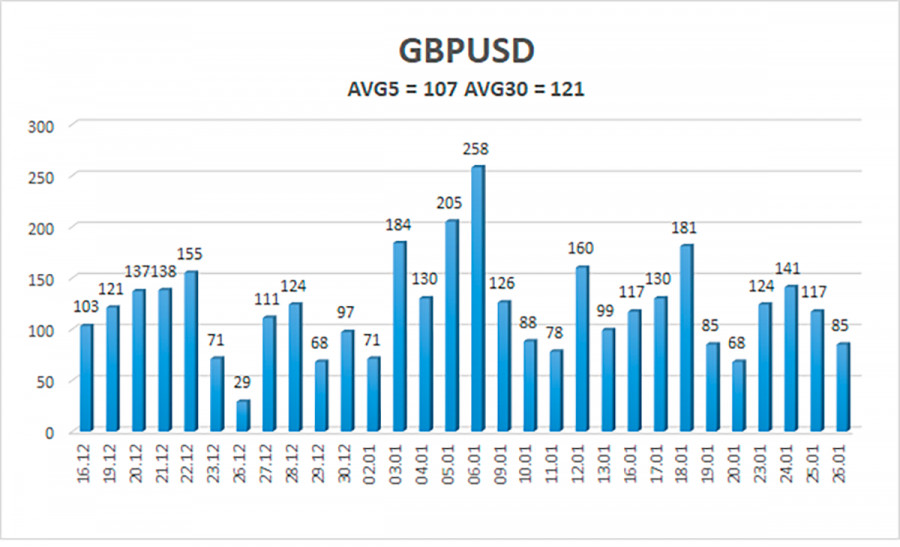

Over the previous five trading days, the GBP/USD pair has experienced an average volatility of 107 points. This number is the "average" for the dollar/pound exchange rate. Thus, we anticipate movement inside the channel on Friday, January 27, with movement being constrained by levels of 1.2302 and 1.2516. A new round of downward movement is indicated by the Heiken Ashi indicator turning downward.

Nearest levels of support

S1 – 1.2390

S2 – 1.2329

S3 – 1.2268

Nearest levels of resistance

R1 – 1.2451

R2 – 1.2512

R3 – 1.2573

Trading Suggestions:

In the 4-hour timeframe, the GBP/USD pair is still above the moving average. So long as the Heiken Ashi doesn't reverse, it is now possible to hold long positions with targets of 1.2451 and 1.2512. If the price is locked below the moving average line, short trades can be opened with targets of 1.2268 and 1.2207.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.