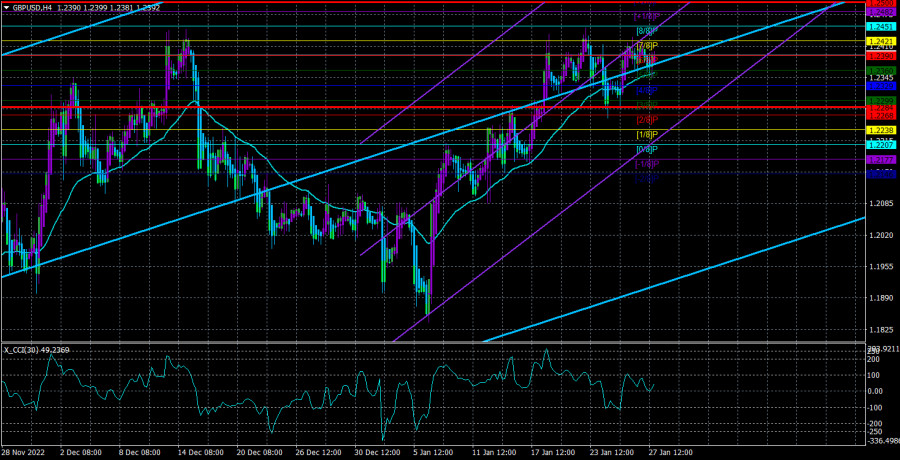

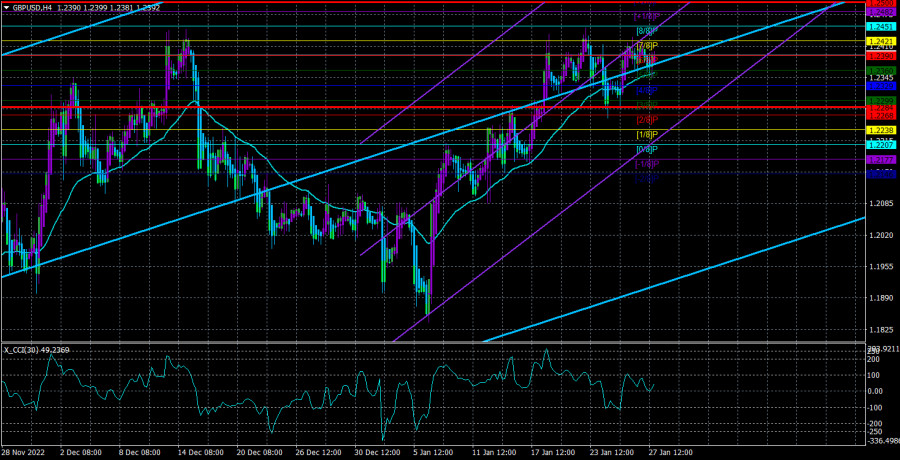

On Friday, the GBP/USD currency pair remained very close to its regional peak of 1.2451. The price made two unsuccessful attempts to break through this barrier. Following the initial bounce, there was a decent correction, which was followed by a somewhat drawn-out return to the starting positions. It should be determined soon if the pair will advance further or if a new bout of global downward correction will start. We support the second alternative because we have long argued that the euro and the pound are expanding excessively and are not consistent with the macroeconomic and structural foundations. Additionally, there will be so many various reports, events, and news items next week that the market will not be able to trade with moderate volatility. We can infer that the "rate factor" has already been determined because the pound has been rising in recent weeks, and it did not base its decision on macroeconomic articles. Now, if the Bank of England does not come as a surprise and does not pause the tightening of monetary policy once more, the market will have already adjusted for all the adjustments. The pound might just fall like a stone if the BA decides to reduce the rate of increase (which is useless in terms of battling inflation).

But let's not speculate on what will occur the following week. We must recognize that the market is currently "bullish," but that the price is unable to surpass either the level of 1.2451 or the moving average. As a result, the two were caught in a sort of "triangle." Although the overall essential background is as boring as possible, it will inevitably abandon it the following week. However, we continue to rely on active trading and the idea that the pair will choose its next course of action during the next few weeks. Right, I'm already getting quite tired of nonsensical and pointless growth.

What should I anticipate and pay attention to?

The following week will be routine in the UK. There will be a meeting of the Bank of England, at which the rate should be raised by 0.5%, and the final values of the business activity indices for January will be revealed. Two of the nine members of the monetary committee voted in favor of keeping the rate the same at the previous meeting. Forecasts indicate that at the February meeting, 2 will vote in support of immutability and 7, in favor of a 0.5% rise. The likelihood is highest in this case. And the market has already calculated it and taken it into account. Additionally, a collapse of the pound is probable if BA raises the rate less. The pound may also decline if the number of officials who support tightening drops from 7 to 5 or 6 since this would greatly raise the likelihood that rate hikes would be slowed down at the upcoming meetings. We even venture to argue that practically any outcome of the BA conference should cause the British pound to decline, but we'll have to wait and see.

Even more significant events will take place in the USA. The ISM index for the manufacturing and services sectors, the ADP report on the labor market, NonFarm Payrolls, unemployment rate, wages, applications for unemployment benefits, and Markit business activity indices will all be released in addition to the Fed's official meeting, the outcomes of which will be disclosed on Wednesday evening. As we can see, there won't be a lack of stories the next week. Of course, Non-Farm Payrolls and the ISM indexes deserve special attention. Nobody anticipates the Fed to make any shocks, as we've already stated. Wednesday night's market is anticipated to experience jarring moves in both directions before settling down. The only exception is if the Fed increases the rate by less than 0.25 percent, but this is currently not a possibility. According to our assessment, macroeconomics and the "foundation" may not offer the dollar much support. We do not anticipate outstanding results from other reports, and nonfarm rates are expected to slow down a little again and the unemployment rate will increase a little. The pair should move in the opposite way from where it has been moving in recent weeks, though, assuming the central banks do not make any unexpected moves. In that case, their decisions will have been made.

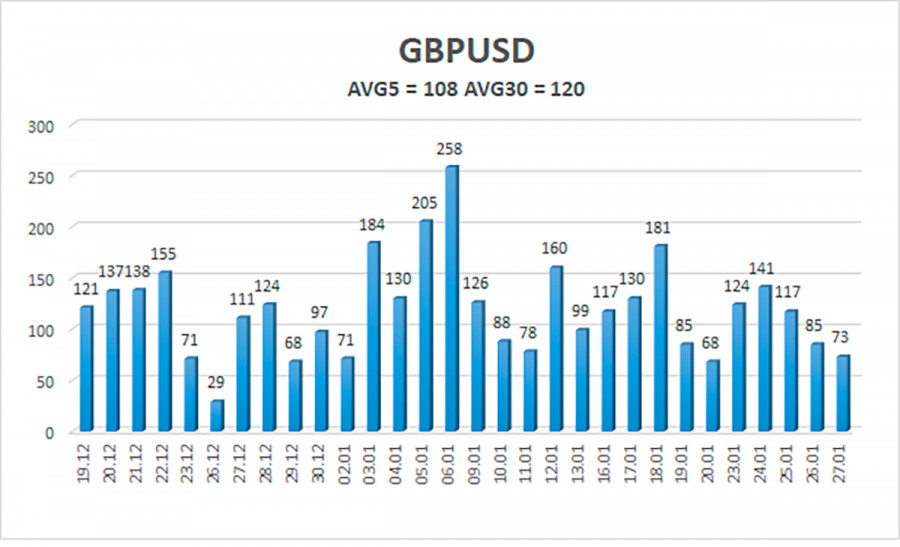

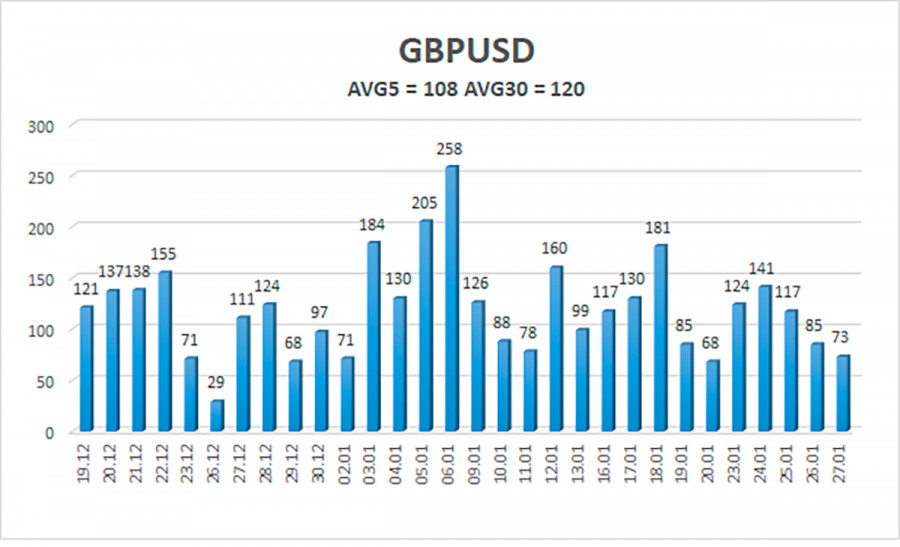

Over the previous five trading days, the GBP/USD pair has experienced an average volatility of 108 points. This number is the "average" for the dollar/pound exchange rate. Therefore, we anticipate movement on Monday, January 30 will be contained within the channel and constrained by the levels of 1.2284 and 1.2500. A new round of downward movement is indicated by the Heiken Ashi indicator turning downward.

Nearest levels of support

S1 – 1.2390

S2 – 1.2329

S3 – 1.2268

Nearest levels of resistance

R1 – 1.2451

R2 – 1.2512

R3 – 1.2573

Trading Suggestions:

In the 4-hour timeframe, the GBP/USD pair is still above the moving average. Therefore, until the Heiken Ashi turns down, it is possible to hold long positions with goals of 1.2451 and 1.2500. If the price is locked below the moving average line, short trades can be opened with targets of 1.2284 and 1.2268.

Explanations for the illustrations:

Channels for linear regression - allow us to identify the present trend. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.