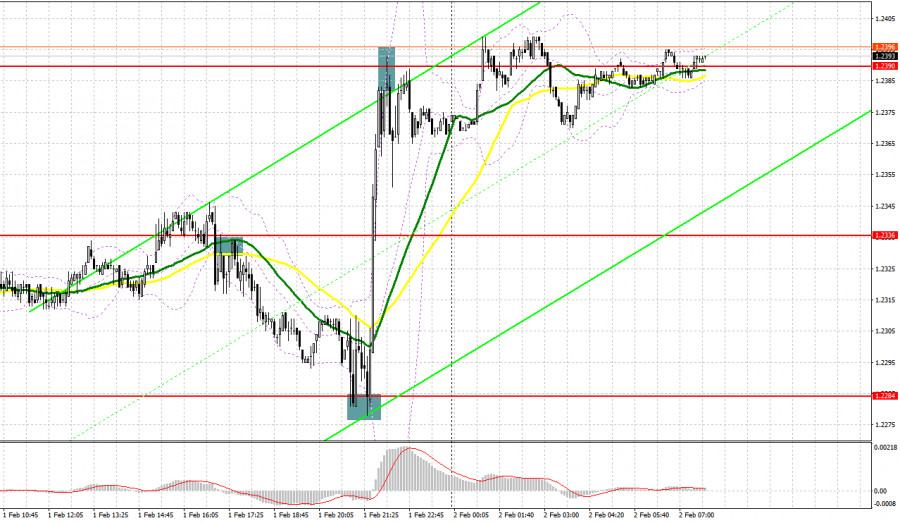

Yesterday, there were several excellent entry points. Now, let's look at the 5-minute chart and figure out what actually happened. In the morning, there were no signals. The pair failed to reach the target levels due to low volatility before the Fed and BoE meetings. In the afternoon, the bears regained control of 1.2336, which triggered an upward retest of this level. The pair started a correction. The pound sterling declined by more than 50 points even before the Fed meeting. After the Fed hiked the key rate by 25 basis points, a false breakout of 1.2284 created an excellent entry point into long positions. The pair soared by 100 pips.

When to open long positions on GBP/USD:

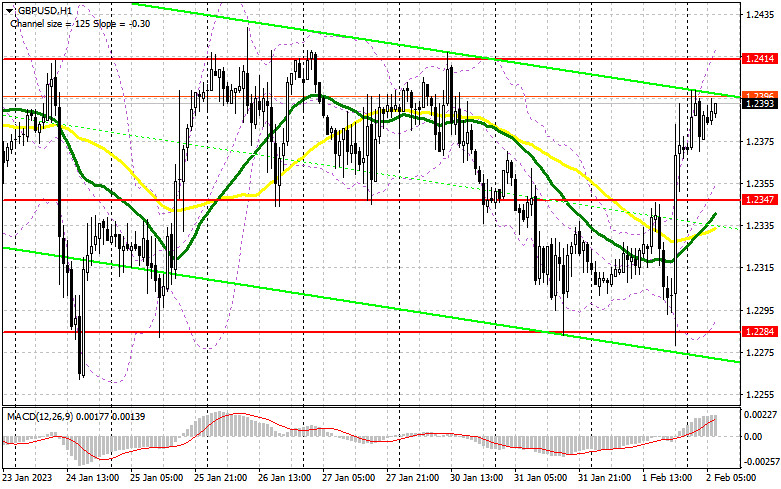

Today is a rather crucial day for the pound sterling. Bulls need to assert strength so that the price will be able to break out of the sideways channel. If so, it may reach the January highs. If they fail, the pair is likely to remain at the same levels with the prospect of a larger downward correction. Now, traders are awaiting not only the BoE's key rate decision. Besides, they are sure that the regulator will raise the interest rate by 50 basis points. This is why investors will pay more attention to the speech of Governor Andrew Bailey. If the tone of his comments is hawkish, the pair break through 1.2414 and rise higher. If the Bank of England changes its rhetoric all of a sudden, the price is likely to plunge to 1.2347, which is the middle of the sideways channel. At this level, the moving averages are benefiting bulls. Only a false breakout of this level, similar to the one I have mentioned above, could trigger a second breakout of 1.2414. Trading is now carried out near this level. In case of consolidation and a downward retest of this level, a sharper rise of GBP/USD to the high of 1.2477 looks likely. If the pair climbs above this level, it may advance to 1.2538. It may happen only amid hawkish comments of BoE hawkish comments. At this level, I recommend locking in profits. If the bulls fail to push the pair to 1.2347, the pressure on GBP/USD will escalate. However, it will hardly undermine bullish bias. I advise you not to rush into purchases and open long positions only at the lower border of the sideways channel after a decline and a false breakout of 1.2284. You could buy GBP/USD at a bounce from 1.2237, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on GBP/USD:

The bears are going to wait for the Bank of England meeting. They need to protect 1.2414 - the upper border of the sideways channel, formed on January 26. The pair could start a correction if the BoE stresses it may soon end the tightening cycle. However, such a scenario looks unlikely, especially given the soaring inflation in the UK. In case of a rise in the morning, a false breakout of 1.2414 will give a sell signal with the prospect of a decline to 1.2347 - the middle of the sideways channel. A breakout and an upward retest of this level will facilitate the bearish trend. It will give a sell signal with a fall to 1.2284. The test of this level will indicate an attempt to start a downtrend. A more distant target will be the 1.2237 level where I recommend locking in profits. If GBP/USD advances and bears show no activity at 1.2414, the bulls will take control of the market. In this case, only a false breakout of the next resistance level of 1.3477 will give an entry point into short positions. If bears do not make attempts to push the pair lower, you could sell GBP/USD at a bounce from a high of 1.2538, keeping in mind a downward intraday correction of 30-35 pips.

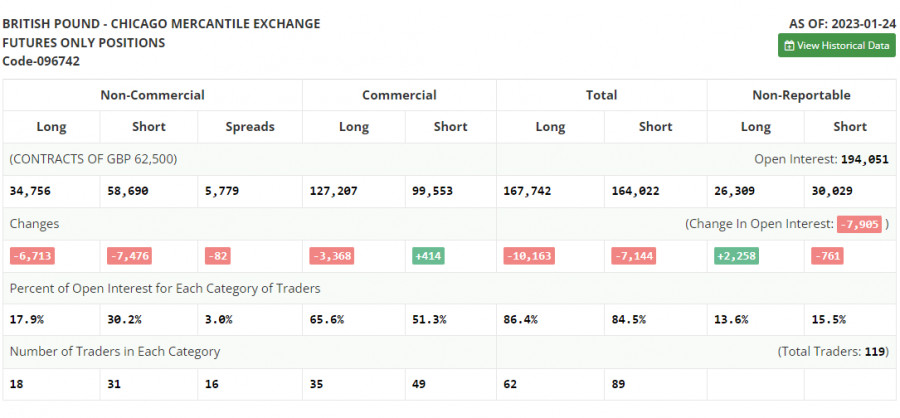

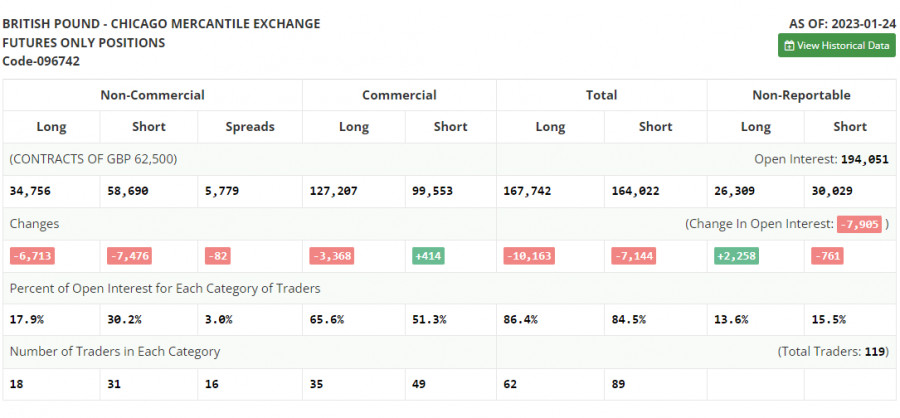

Commitments of Traders:

The COT report for January 24 logged a drop in both long and short positions. However, this drop was rather limited, especially given the problems the UK is going through now. The government has to deal with strikes for fair pay. Besides, inflation remains stubbornly high. Nevertheless, the US Fed and the Bank of England meetings are in the limelight. The US regulator is likely to move to a less aggressive tightening. Meanwhile, the BoE seems to be committed to a hawkish stance. It could raise the interest rate by 0.5%. In this case, the pound sterling may advance unless something extraordinary happens. According to the latest COT report, short non-commercial positions decreased by 7,476 to 58,690, and long non-commercial positions fell by 6,713 to 34,756. As a result, the non-commercial net position came in at -23,934 versus -24,697 a week ago. As seen, these changes are insignificant. They will hardly impact market sentiment. For this reason, it is important to monitor macroeconomic reports in the UK and the BoE's rate decisions. The weekly closing price rose to 1.2350 from 1.2290.

Indicators' signals:

Trading is carried out above the 30 and 50 daily moving averages, which indicates a further rise.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If GBP/USD moves up, the indicator's upper border at 1.2414 will serve as resistance. In case of a decline, the indicator's lower border at 1.2290 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.