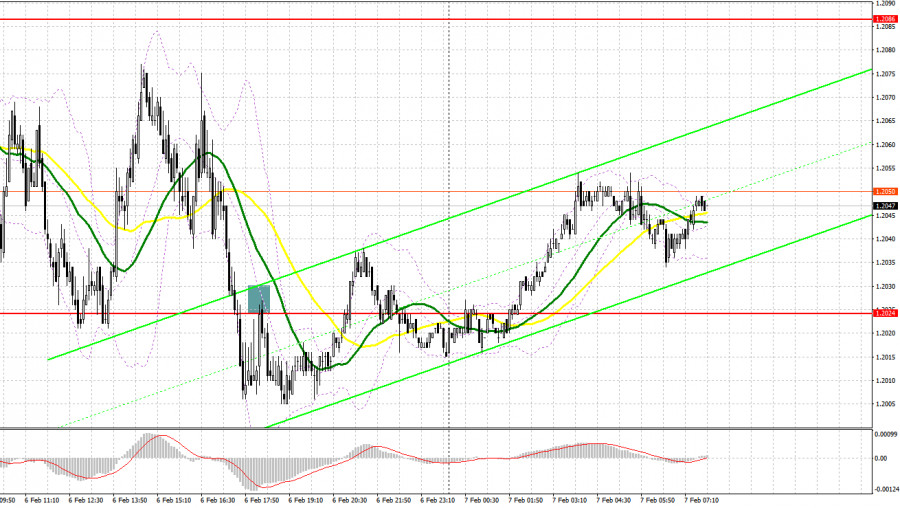

Yesterday, traders received just one signal to enter the market. Let us take a look at the 5-minute chart to find out what happened. A breakout and a reverse test of the support level of 1.2024 led to a sell signal only in the middle of the US trade. However, the pair did not show a noticeable drop. It slid just by 20 pips and pressure on the pound sterling weakened.

Conditions for opening long positions on GBP/USD:

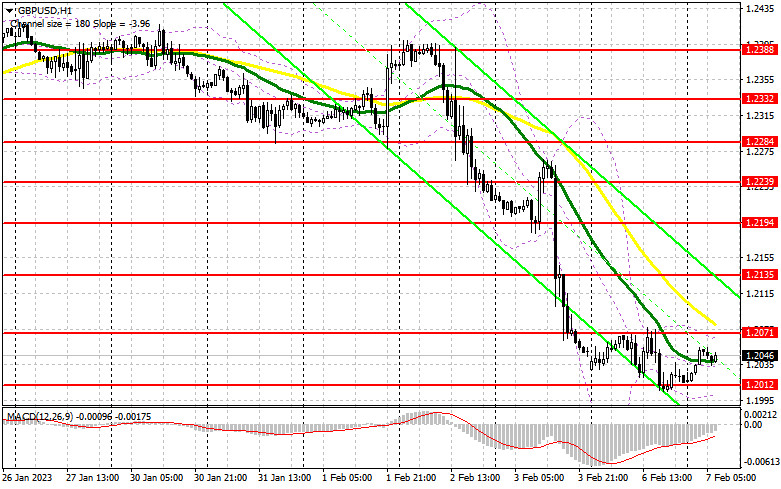

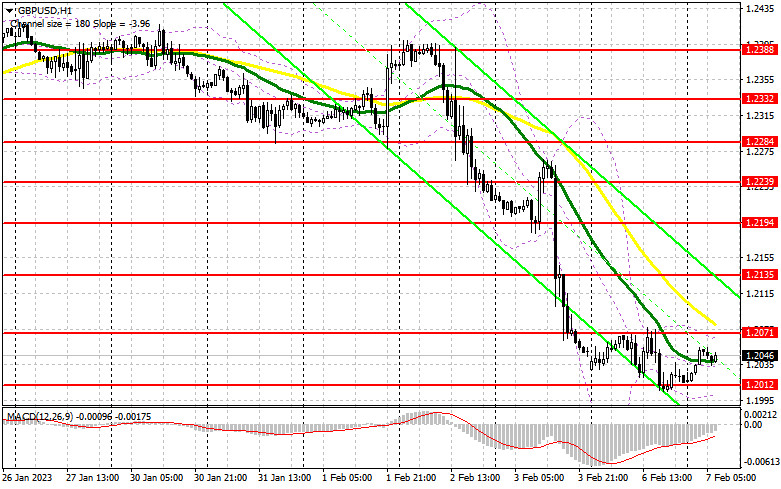

Today, the pound sterling may continue falling. To avoid this, bulls should push the price above the sideways channel. However, the data that will be disclosed today is unlikely to allow bulls to fulfill their plans. That is why a lot depends on the BoE. Thus, the US is expected to disclose the Halifax house price index report. However, traders are likely to focus on the speech that will be delivered by BOE Deputy Governor for Markets & Banking Sir David Ramsden. Although he will hardly say anything new, the volatility will rise. If the pair declines, bulls will become active only after a false breakout of 1.2012, a new support level formed yesterday. It also acts as a lower limit of the range. In this case, the pair may move towards 1.2071, where there are MAs that are capping the upward potential of the pair. If the pair settles and upwardly tests this level, I will bet on a sharp rise to the high of 1.2135. However, this scenario is hardly possible since last week, Andrew Bailey said that the regulator might switch to a looser stance. If the price climbs above the mentioned level, it will have a chance to increase to 1.2194. However, this will hardly happen without political factors. If bulls fail to protect 1.2012, pressure on the pound/dollar pair will rise, thus causing a new downtrend. Traders should remain cautious and open long positions near the next support level of 1.1952 after a false breakout. It is also possible to go long just after a bounce off 1.1881, expecting an increase of 30-35 pips intraday.

Conditions for opening short positions on GBP/USD:

Bears are controlling the market and now, they need to break 1.2012. Judging by the situation, bulls and bears will struggle for the upper limit of the sideways channel located at 1.2071. Bears should take it under control. Only a false breakout of this level will give a good sell signal with the target at 1.2012. A breakout and an upward test of this area will seriously affect buyers' plans to recoup losses. This will intensify bears' positions, thus forming a sell signal with the target at 1.1952. A test of this level will point to a new downward trend. The farthest target is located at 1.1881. However, the price will hit it only in case of strong data from the US. It is better to lock in profits at this level. If the pound/dollar pair increases and bears fail to protect 1.2071, bulls will become stronger. In this case, only a false breakout near the next resistance level of 1.2135 will give a sell signal. If bears fail to be active there, it will be better to sell from the high of 1.2194, expecting a drop of 30-35 pips.

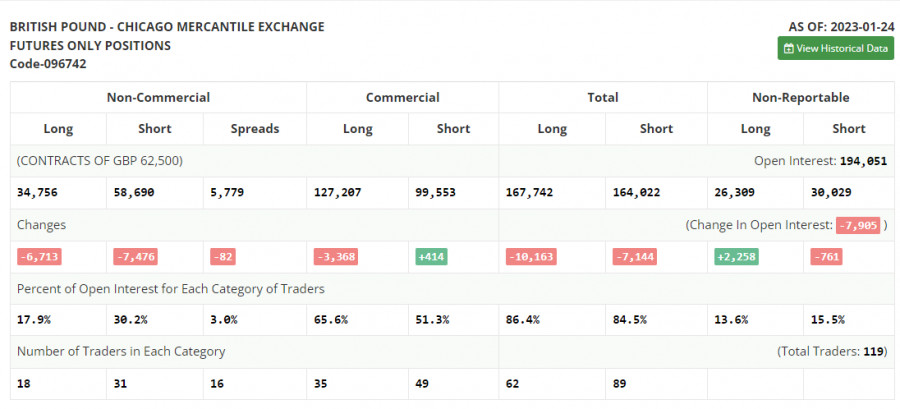

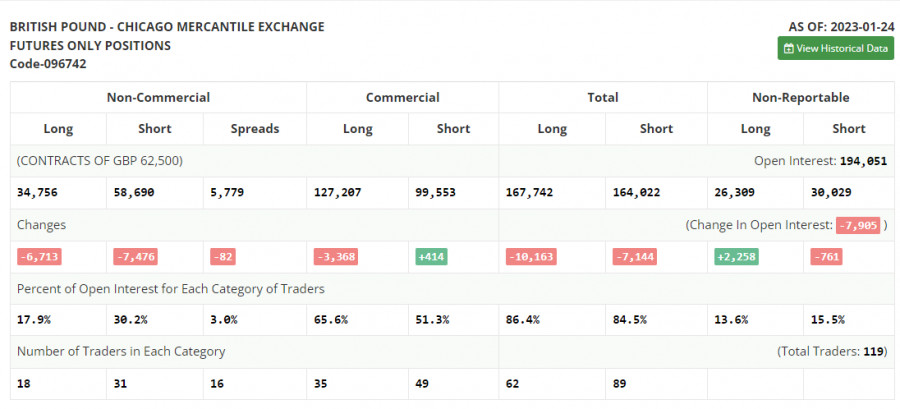

COT report

According to the COT report from January 24, the number of both long and short positions dropped. However, the current decline was quite acceptable. The fact is that the UK government is coming across tough times. It is struggling with strikes and demands to raise wages and at the same time, it is trying to achieve a steady decline in inflation. However, this is of less importance at the moment since traders are waiting for the meetings of the Fed and the BoE. The Fed is expected to switch to a less hawkish stance, whereas the BoE may remain aggressive. This may have a positive effect on the pound sterling. That is why I will bet on its further rise. The recent COT report unveiled that the number of short non-commercial positions decreased by 7,476 to 58,690, while the number of long non-commercial positions decreased by 6,713 to 34,756. As a result, the negative value of the non-commercial net position dropped to -23,934 from -24,697 a week earlier. Such minor changes will hardly affect the market situation. Thus, we will continue to closely monitor the economic indicators for the UK and the decision of the Bank of England. The weekly closing price rose to 1.2350 against 1.2290.

Signals of indicators:

Moving Averages

Trading is performed below 30- and 50-day moving averages, which points to a further decline in the pair.

Note: The author considers the period and prices of moving averages on the one-hour chart which differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

If the pair increases, the resistance level will be formed by the upper limit of the indicator located at 1.2071. In case of a decline, the lower limit of the indicator located at 1.2010 will act as support.

Description of indicators

- Moving average (a moving average determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (a moving average determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total number of long positions opened by non-commercial traders.

- Short non-commercial positions are the total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.