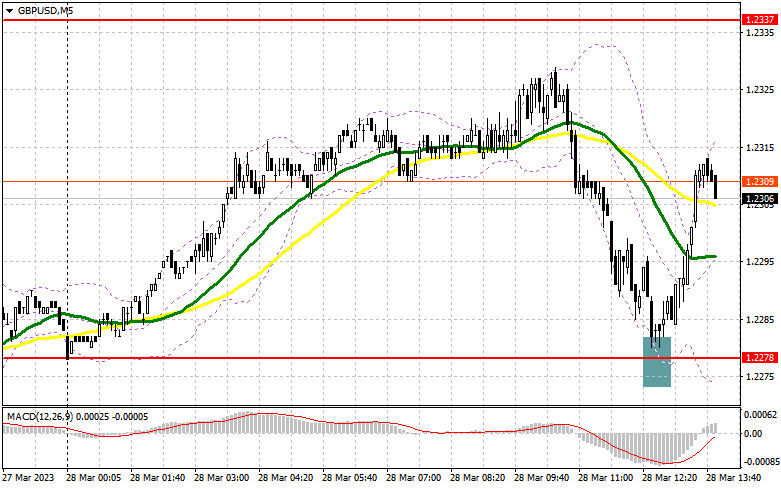

I focused on the level of 1.2278 when I made my morning forecast and suggested trading actions based on it. Let's take a look at the 5-minute chart to see what happened. It was possible to gain an entry point after the decrease in the area of 1.2278, but a few points were missing before the test of this level and the buy signal. The technical situation was left unchanged for the remainder of the day.

You require the following to open long positions on the GBP/USD:

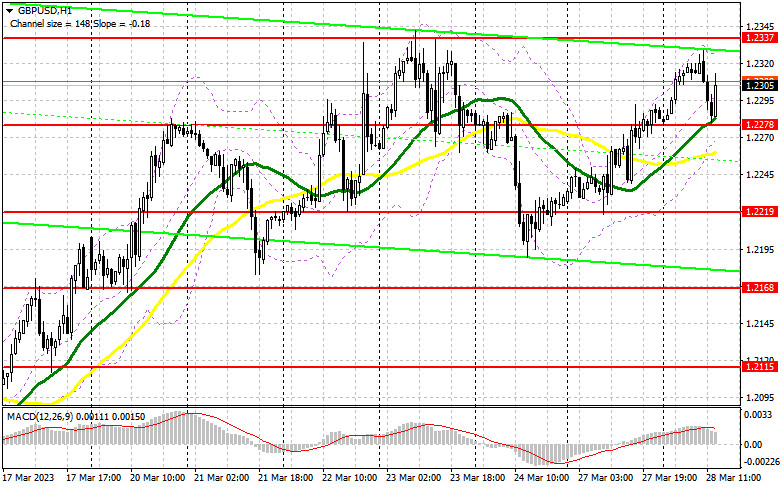

The speech of the Governor of the Bank of England, Andrew Bailey, did not support the pound, causing it to fall in the first half of the day. The focus is now on American consumer confidence data, which could suffer significantly as a result of the country's developing banking crisis, which almost had greater consequences. If the report comes in higher than expected, the pressure on the pound will undoubtedly increase again. In this scenario, one of the main objectives for the bulls will be to defend the support level of 1.2278, which we fell short of by a few points in the morning. The development of a false breakout, where the moving averages on the bulls' side pass, will allow the pair to return to 1.2337, and a breakout and test from the top down of this range would constitute an extra buy signal, resuming the bull market and pushing GBP/USD to 1.2388. It will be challenging for GBP/USD purchasers to predict the continuation of a new rally without this level. We can discuss an increase to 1.2450, where I will fix the profit if the exit occurs above this range. The area in the range of 1.2505, which will only be updated after limited data on the United States, will be the target that is the furthest away. The pound might be returned to the sellers' hands if GBP/USD declines and there are no buyers above 1.2278, a level that can already be taken back. If it does, I advise delaying long positions until 1.2219. I suggest only making purchases based on a false breakout. To correct 30-35 points within a day, it is possible to open long positions on the GBP/USD immediately for a rebound from 1.2168.

For opening short positions on the GBP/USD, you will need:

Strangely, the buyers did not demonstrate any activity and did not even approach the maximum monthly. Everything is currently in the hands of sellers, but I still advise you to proceed as if it were the morning: only the development of a false breakout at 1.2337 following strong US statistics constitutes a sell signal in anticipation of a further decline of the pair to the support level of 1.2278, for which I continue to anticipate an active confrontation. After the pair's increase from yesterday, a breakthrough and a reversal test from the bottom up of this range will provide an entry point for sale already with an update of the minimum of 1.2219. I'll set profits in the area of 1.2168 as a further target. The pound will come under pressure again if this level is updated, and a new bearish trend may develop as a result. The bull market will reappear with the possibility of GBP/USD growth and the absence of bears around 1.2337 in the afternoon, which is more possible given my expectations for bad consumer confidence numbers. This will cause a move of GBP/USD to the area of 1.2388. An entry point into short positions based on the decline of the pound is created by a false breakout at this level. If there isn't any activity there, I suggest selling GBP/USD at 1.2450 in the hopes that the pair would decline another 30-35 points over the day.

Both long and short positions decreased in the COT report (Commitment of Traders) for March 21. The Bank of England meeting in March went fairly smoothly. Given how poorly things are going with UK inflation, it made the entirely predictable decision to raise interest rates while maintaining the chance of future growth. The price rise persisted in February, based on the most recent data, necessitating more aggressive action on the part of the regulator about borrowing costs. Given that many anticipate a relaxing of the Federal Reserve System's control, the British pound has a strong probability of growing further. According to the most recent COT data, long non-commercial positions declined by 3,682 to a level of 28,652 while short non-commercial positions decreased by 498 to a level of 49,150. As a result, the non-commercial net position's negative value increased to -20,498 from -17,314 the previous week. In contrast to 1.2199, the weekly ending price increased to 1.2241.

Signals from indicators

Moving Averages

Trading is taking place above the 30 and 50-day moving averages, which suggests that the pound will continue to rise.

Note that the author's consideration of the period and costs of moving averages on the hourly chart H1 differs from the standard definition of the traditional daily moving averages on the daily chart D1.

Bands by Bollinger

The indicator's lower limit, which is located at 1.2270, will serve as support in the event of a decline.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.