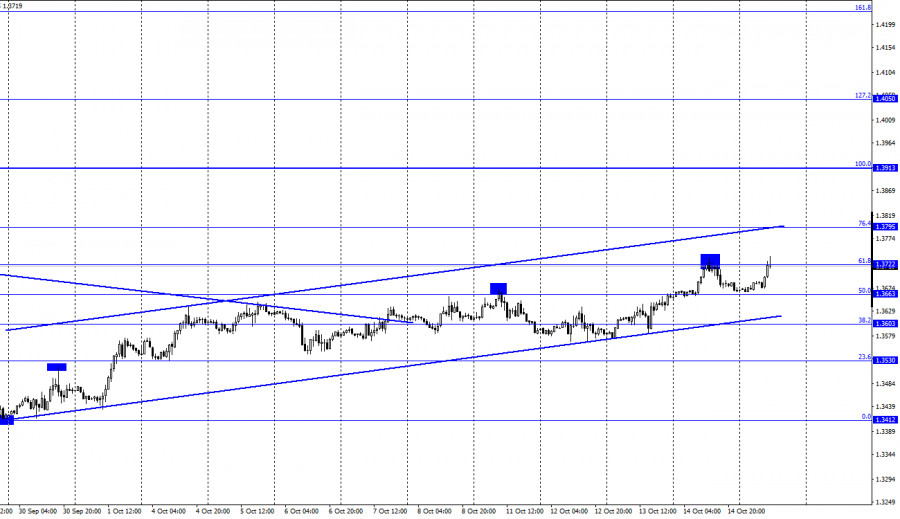

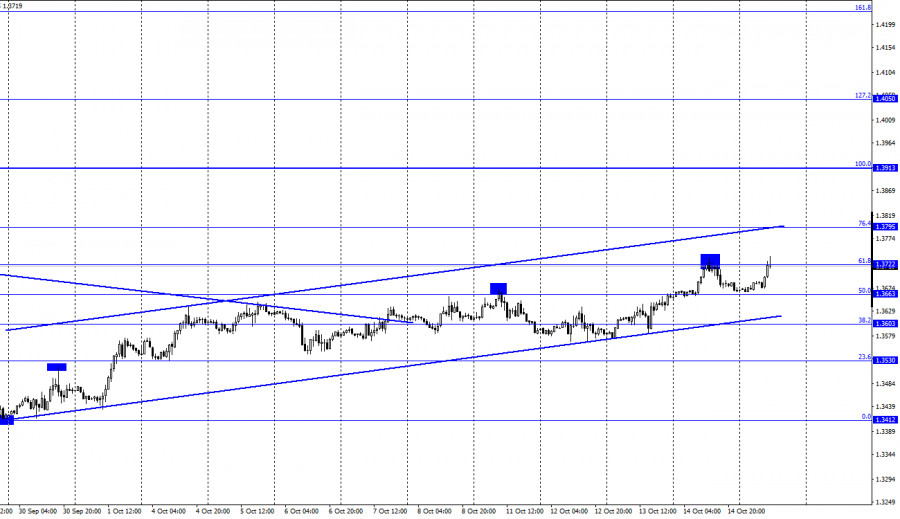

GBP/USD – 1H.

According to the hourly chart, the GBP/USD pair performed a rebound from the corrective level of 61.8% (1.3722), a slight drop, and resumed growth, returning to the level of 61.8%. Thus, fixing the pair's rate above this level will favor continuing the growth process towards the next Fibo level of 76.4% (1.3795). The second rebound of quotes from the level of 61.8% will favor the US currency and a new fall in the direction of the level of 1.3663 and the lower line of the ascending corridor, which still keeps the mood of traders "bullish." There was no information background in the UK yesterday, and the American background caused only a slight increase in the dollar. However, this is already in the past. Silvana Tenreyro, one of the Bank of England board members, also gave an interview yesterday. She said that raising the interest rate to counteract the growth of inflation would be the wrong decision. From Tenreyro's point of view, high inflation is temporary and is caused by rising prices for semiconductors and energy carriers.

Thus, the Bank of England is not going to react to the accelerating price growth. However, this is not surprising since you need to complete the incentive program, which amounts to 895 billion pounds in the UK. At the last three meetings of the Bank of England, at least one of the nine committee members voted in favor of reducing the volume of this program. There were already two of them at the last meeting. However, this is still far from the five votes necessary for a decision to be made on winding down. Thus, all central banks approach the issue of curtailing stimulus programs very slowly and are afraid to make a hasty decision. In such a situation, the ECB and the Bank of England will most likely focus on the Fed. And the Fed has not yet made any decision on QE. And it is not a fact that it will accept it in November – at the next meeting.

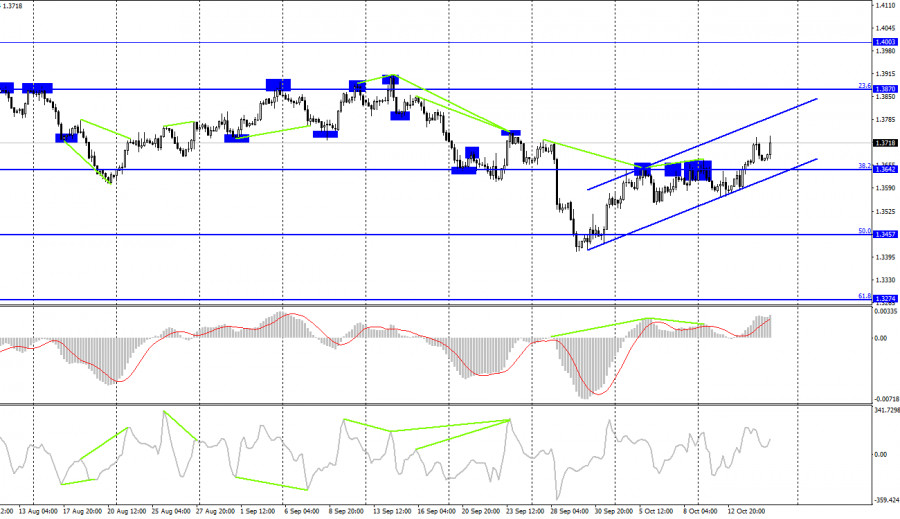

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair closed above the corrective level of 38.2% (1.3642) on the fifth or sixth attempt. Thus, the growth process can be continued towards the next Fibo level of 23.6% (1.3870). In the near future, I do not expect signals for a reversal in favor of the US currency on the 4-hour chart. There were enough of them formed in the last week, but the bears still could not resume the fall.

News calendar for the USA and the UK:

US - change in retail trade volume (12:30 UTC).

US - consumer sentiment index from the University of Michigan (12:30 UTC).

On Friday, nothing interesting is contained in the calendar of economic events in the UK. In America, the information background will be quite weak, although if the data of the reports can surprise traders, then a reaction may follow them.

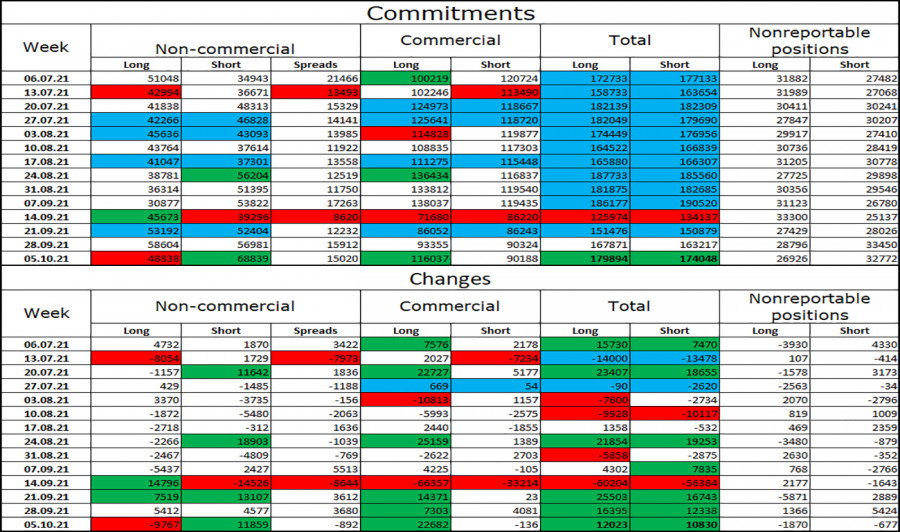

COT (Commitments of Traders) report:

The latest COT report from October 5 on the pound showed that the mood of the major players had become much more "bearish." In the reporting week, speculators closed 9,767 long contracts and opened 11,859 short contracts. Thus, the "bearish" mood has become stronger by about 20 thousand contracts. And now, the number of short contracts concentrated in the hands of speculators exceeds the number of long contracts by one and a half times. It already indicates a relatively strong "bearish" mood. Thus, we can expect a resumption of the fall of the British dollar in the near future. The level of 1.3642 can become an insurmountable obstacle for bull traders.

GBP/USD forecast and recommendations to traders:

I recommend buying the British when closing above the level of 61.8% (1.3722) on the hourly chart with a target of 1.3795. I recommend opening sales if there is closure under the ascending corridor on the hourly chart with a target of 1.3530.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.